A Look At Veeco Instruments (VECO) Valuation After A Year Of Nearly 24% Returns

What Veeco Instruments' Recent Performance Tells Investors

Veeco Instruments (VECO) has drawn attention after a period where the share price was roughly flat over the past 3 months but showed a 24% total return over the past year.

See our latest analysis for Veeco Instruments.

In the short term, the share price return has been soft, with 7-day and 1-month share price returns of 3.2% and 7.85% declines, respectively. However, the 1-year total shareholder return of 23.92% points to momentum that has been building over a longer period.

If Veeco has you looking more closely at chip related names, it could be a good time to scan our list of 33 AI infrastructure stocks for further ideas.

With the share price roughly flat in recent months, a 24% 1 year return, and a price only about 5% below the US$32 analyst target, is Veeco still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 8.9% Undervalued

With Veeco Instruments last closing at $30.51 against a narrative fair value of $33.50, the most followed view sees some upside still on the table, backed by detailed assumptions about growth, margins and discount rates.

Veeco's guidance and narrative reflect optimism about growth drivers such as AI, advanced packaging, and 3D architectures. However, industry consolidation and increased bargaining power among large customers could put downward pressure on average selling prices and squeeze net and operating margins, particularly as competition intensifies both in legacy and emerging technologies.

Curious what sits behind that fair value gap? The narrative leans on steady revenue expansion, stable margins and a richer future earnings multiple. The exact mix might surprise you.

Result: Fair Value of $33.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story could change quickly if demand for new tools is slower than expected, or if concentrated customers pull back on orders and capital spending.

Find out about the key risks to this Veeco Instruments narrative.

Another Way to Look at Valuation

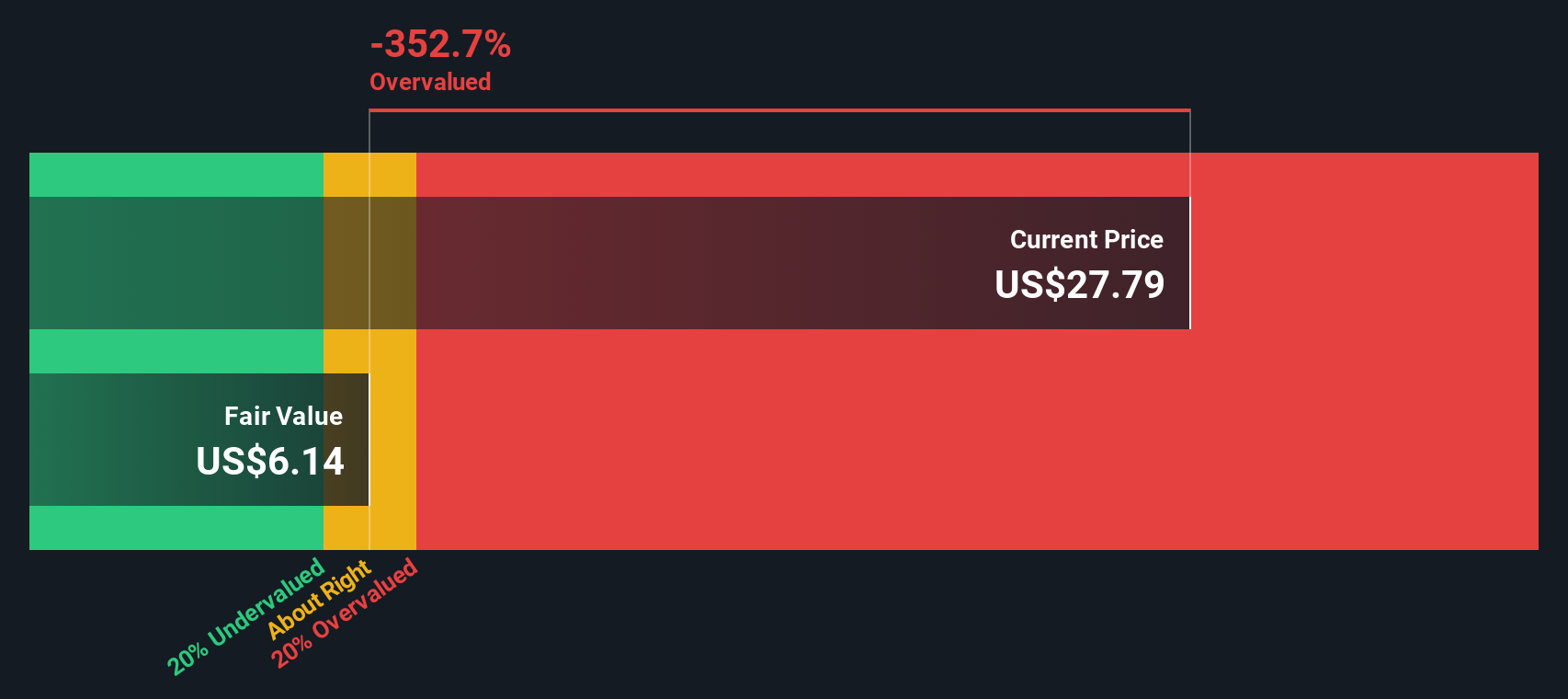

Our DCF model presents a very different picture compared with the narrative fair value. At $30.51, the share price sits well above our estimated future cash flow value of $12.64, which screens as overvalued using this method. It raises a simple question: which story do you trust more, the narrative or the cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veeco Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veeco Instruments Narrative

If this view does not quite match your perspective, or you prefer to work from your own numbers, you can build a custom thesis in minutes, starting with Do it your way.

A great starting point for your Veeco Instruments research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Veeco has sparked your interest, do not stop here. Use the Simply Wall St screener to surface fresh ideas that match your style before the crowd gets there.

- Target quality at a discount by scanning our list of 52 high quality undervalued stocks that pair robust fundamentals with prices that may not fully reflect their potential.

- Prioritise resilience with 82 resilient stocks with low risk scores, focusing on companies that score well on stability so short term swings are less likely to derail your plan.

- Spot opportunities others might overlook through our screener containing 24 high quality undiscovered gems and see which quieter names stand out on fundamentals before they attract wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com