February 2026's Promising Penny Stocks To Consider

As February 2026 begins, the U.S. stock market has seen a robust start, with major indexes like the Dow Jones Industrial Average and S&P 500 posting significant gains. This positive momentum reflects broader economic optimism and renewed investor confidence, despite ongoing geopolitical developments and economic policy shifts. In this context, penny stocks—often representing smaller or newer companies—continue to capture interest for their potential to offer growth opportunities at an affordable entry point. While the term "penny stocks" may seem outdated, these investments still hold relevance as they can provide investors with access to promising companies that demonstrate financial strength and resilience amidst evolving market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.71 | $587.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.85 | $669.08M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.7418 | $122.3M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.05 | $513.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Udemy (UDMY) | $4.73 | $677.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.60 | $974.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Nephros (NEPH) | $4.02 | $42.72M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.985 | $6.98M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.32 | $75.22M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Aclaris Therapeutics (ACRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aclaris Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing novel drug candidates for immune-inflammatory diseases in the United States, with a market cap of $399.79 million.

Operations: The company generates revenue through its Therapeutics segment, contributing $13.76 million, and its Contract Research segment, which accounts for $16.37 million.

Market Cap: $399.79M

Aclaris Therapeutics is a clinical-stage biopharmaceutical company with a market cap of US$399.79 million, focusing on immune-inflammatory diseases. Recent positive preclinical results for its ITK/JAK3 inhibitor ATI-2138 and promising interim Phase 1a trial results for its bispecific antibody ATI-052 underscore the potential of its pipeline. Despite being unprofitable, Aclaris has sufficient cash runway for over a year and no debt, providing financial stability. The experienced board and management team further bolster investor confidence, though the stock remains highly volatile with increased weekly volatility from 14% to 22% over the past year.

- Get an in-depth perspective on Aclaris Therapeutics' performance by reading our balance sheet health report here.

- Gain insights into Aclaris Therapeutics' future direction by reviewing our growth report.

Agora (API)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service globally, including in the United States and China, with a market cap of approximately $395.23 million.

Operations: The company generates revenue primarily from its Internet Telephone segment, which amounted to $137.36 million.

Market Cap: $395.23M

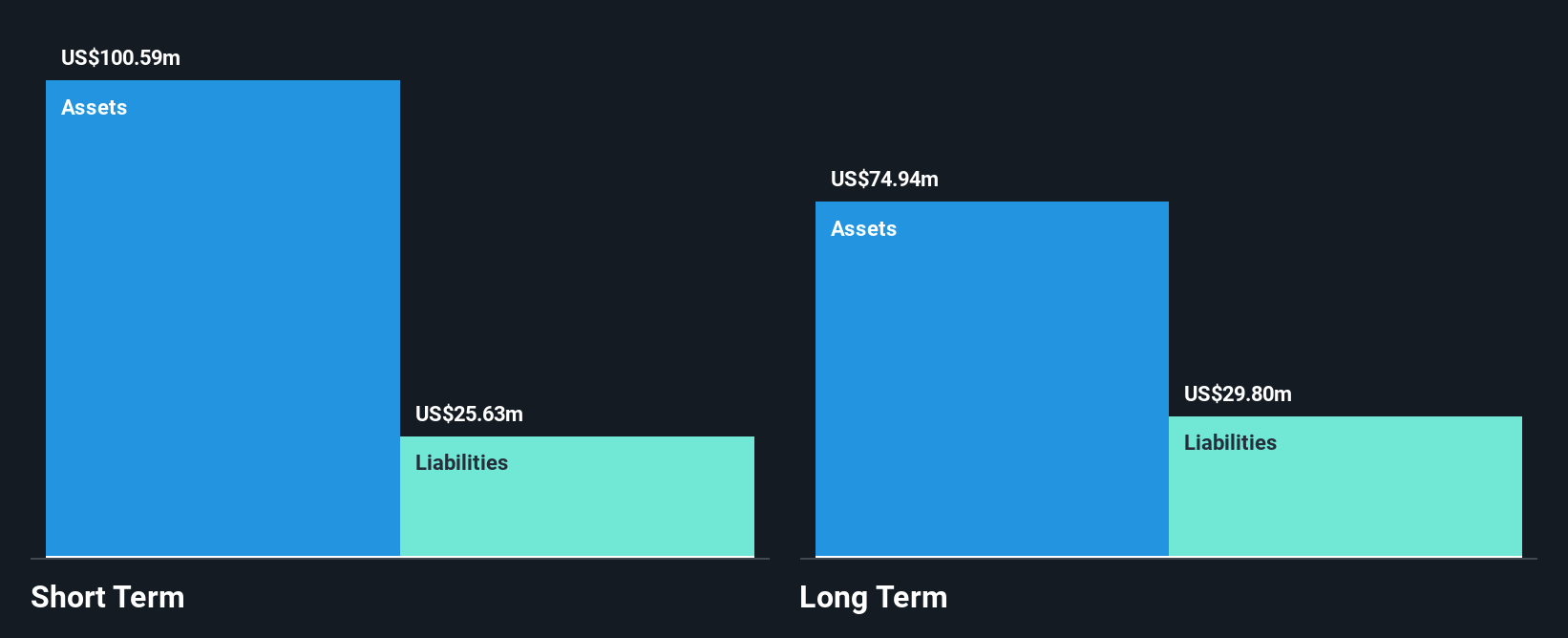

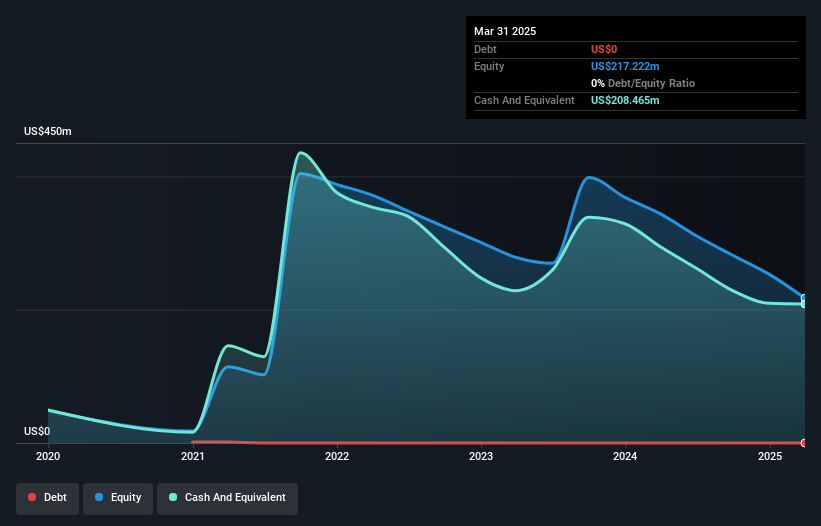

Agora, Inc., with a market cap of US$395.23 million, has shown financial resilience by becoming profitable this year and maintaining strong cash reserves that exceed its total debt. The company's short-term assets of US$210.7 million comfortably cover both its short and long-term liabilities. Recent client announcements highlight Agora's strategic integration with Agnes AI, enhancing real-time collaboration capabilities across Southeast Asia's fast-growing AI platform. Additionally, Agora has been active in share buybacks and provided optimistic earnings guidance for the fourth quarter of 2025, projecting revenue growth between 7.2% to 10.1%.

- Unlock comprehensive insights into our analysis of Agora stock in this financial health report.

- Explore Agora's analyst forecasts in our growth report.

Caribou Biosciences (CRBU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Caribou Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing genome-edited allogeneic cell therapies for hematologic malignancies and autoimmune diseases, with a market cap of approximately $146.74 million.

Operations: The company's revenue for its pipeline of allogeneic CAR-T and CAR-NK cell therapies is $9.30 million.

Market Cap: $146.74M

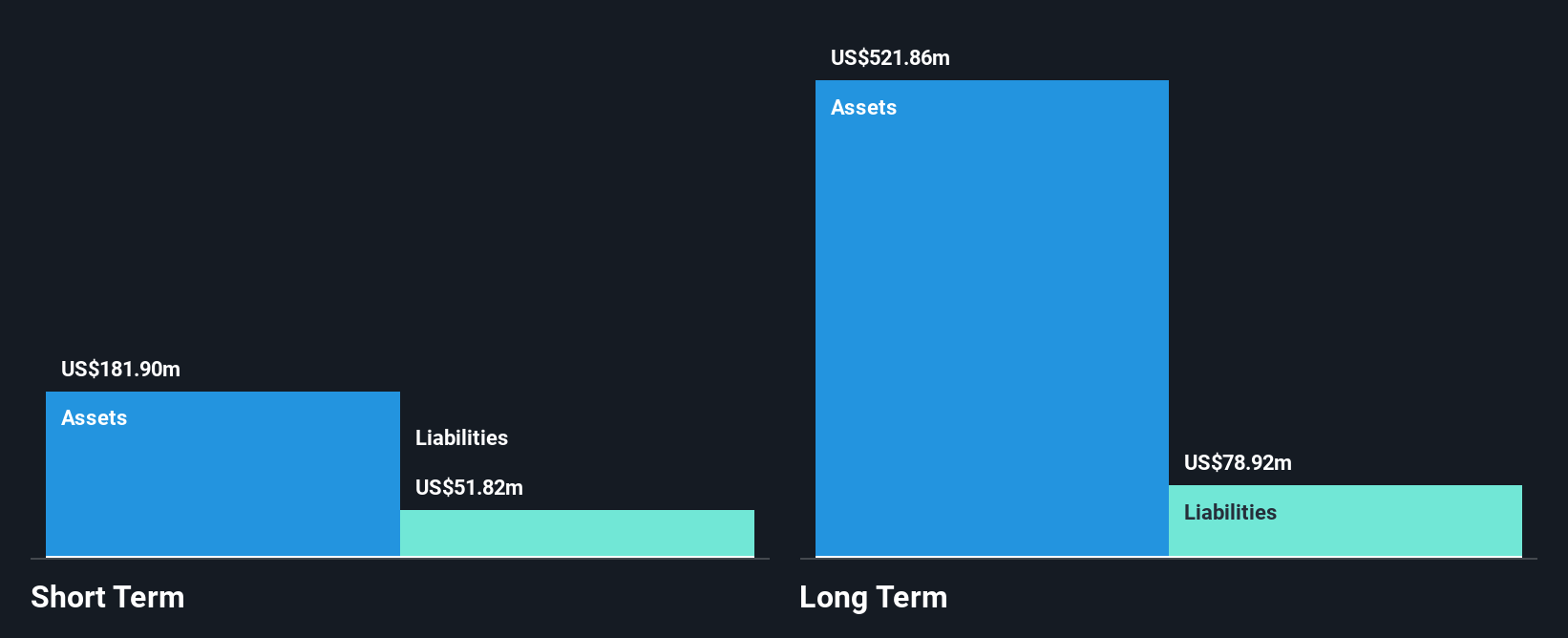

Caribou Biosciences, Inc., with a market cap of approximately US$146.74 million, remains a pre-revenue entity focused on developing genome-edited therapies. Despite being debt-free and having short-term assets of US$155.5 million that exceed its liabilities, the company faces challenges with less than one year of cash runway if free cash flow continues to reduce at historical rates. The management team and board are experienced, yet profitability is not expected in the near term as earnings are forecasted to decline by 3% annually over the next three years. Recent inclusion in the NASDAQ Biotechnology Index may boost visibility among investors.

- Take a closer look at Caribou Biosciences' potential here in our financial health report.

- Learn about Caribou Biosciences' future growth trajectory here.

Summing It All Up

- Click here to access our complete index of 340 US Penny Stocks.

- Interested In Other Possibilities? AI is about to change healthcare. These 105 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com