A Look At Exponent (EXPO) Valuation After Strong Q4 2025 Earnings And Dividend Increase

Exponent (EXPO) shares moved sharply after fourth quarter 2025 results topped expectations, management projected high single digit revenue growth and margin expansion for 2026, and the board approved a higher quarterly dividend.

See our latest analysis for Exponent.

At a share price of $78.34, Exponent has a 7 day share price return of 6.35% and a 90 day share price return of 10.42%. However, the 1 year total shareholder return of a 12.42% decline suggests recent momentum follows a weaker multi year stretch.

If this shift in sentiment has you looking beyond a single name, it could be a good moment to broaden your search and check out our 22 top founder-led companies as potential ideas to research next.

With the shares rebounding after a weak multi year stretch, solid Q4 results, fresh guidance for high single digit growth, and a higher dividend, is Exponent now trading below its underlying potential, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 8.4% Undervalued

Compared to the last close of $78.34, the most followed narrative pegs Exponent’s fair value at $85.50, using a detailed cash flow and earnings roadmap with a 7.21% discount rate.

The analysts have a consensus price target of $88.0 for Exponent based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0 and the most bearish reporting a price target of $76.0.

Want to see what is sitting behind that fair value gap and tight target range? The narrative leans heavily on steady revenue gains, resilient profit margins, and a premium future earnings multiple that assumes Exponent keeps earning its reputation on complex technical work.

Result: Fair Value of $85.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker utilization and pressure on margins, together with automation potentially cutting billable hours, could make it harder for Exponent to match this upbeat narrative.

Find out about the key risks to this Exponent narrative.

Another View: High P/E Raises a Different Question

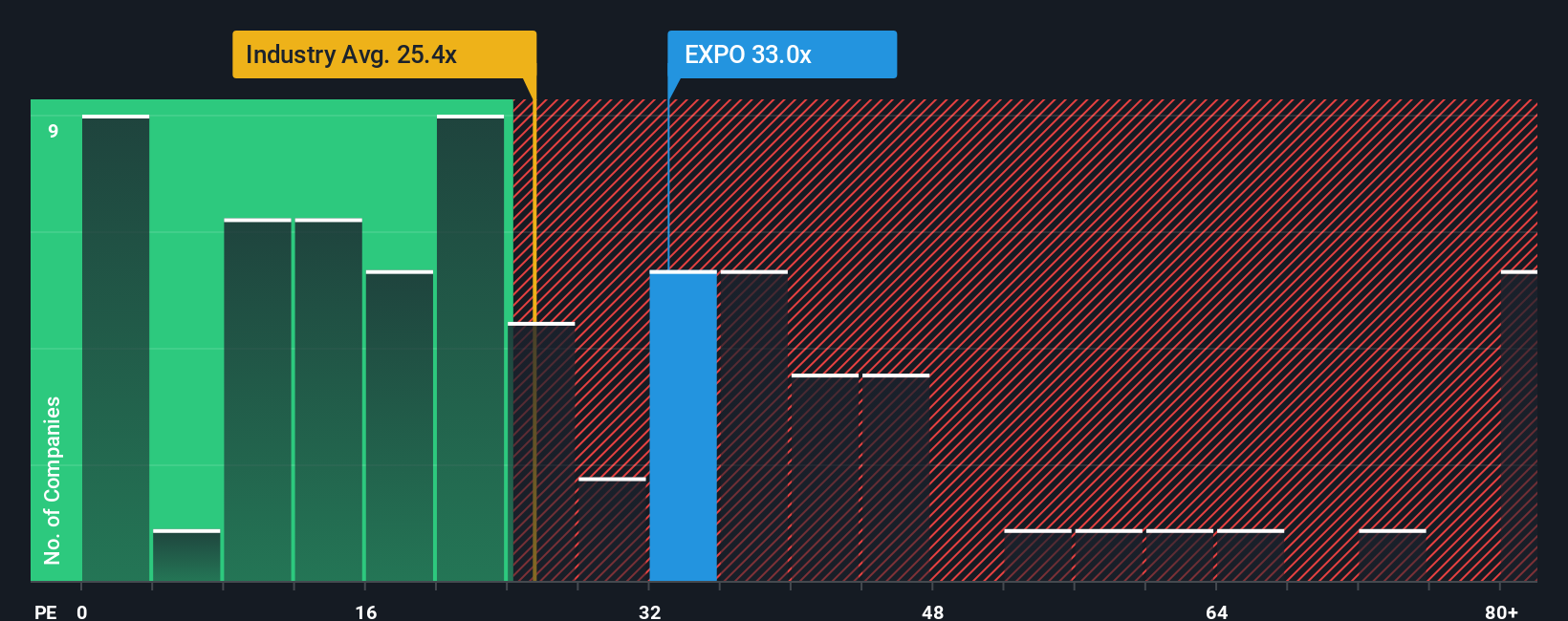

While the narrative and our model suggest Exponent trades around 30.9% below fair value, the current P/E of 36.9x tells a different story. That is far above the US Professional Services industry at 21.5x, peers at 17.1x, and a fair ratio of 22x.

In plain terms, the share price already embeds a lot of optimism relative to both peers and where the fair ratio suggests the P/E could move. Is this a quality premium that endures, or a valuation risk if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exponent Narrative

If you are not fully on board with these views or prefer to weigh the numbers yourself, you can shape your own thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exponent.

Looking for more investment ideas?

If Exponent has sparked your interest, do not stop here. Your next strong idea might sit just outside your current watchlist, waiting to be uncovered.

- Target value opportunities first by scanning our 52 high quality undervalued stocks which filters for quality businesses trading at what may be appealing prices.

- Prioritise resilience by checking the 82 resilient stocks with low risk scores which focuses on companies with steadier risk profiles for investors who care about capital preservation.

- Hunt for tomorrow’s potential standouts using the screener containing 24 high quality undiscovered gems which highlights less crowded names with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com