A Look At Definium Therapeutics (DFTX) Valuation After Roger Adsett Joins The Board

Board appointment puts governance in focus for Definium Therapeutics (DFTX)

Definium Therapeutics (DFTX) recently added experienced biopharmaceutical executive Roger Adsett to its Board of Directors, an event that puts governance, commercial expertise, and long term execution squarely on investors’ radar.

See our latest analysis for Definium Therapeutics.

At a share price of $17.37, Definium Therapeutics has posted a 25.51% 1 month share price return and a 43.08% 3 month share price return, while the 1 year total shareholder return of 110.93% and 3 year total shareholder return of about 3.3x indicate momentum over a longer horizon as investors reassess its growth and risk profile around events like the recent board appointment.

If this kind of board level change has your attention, it could be a moment to widen your watchlist with our screener of 27 healthcare AI stocks as potential next ideas.

With the stock at $17.37, a discount of about 17% to the US$31.85 analyst price target and a flagged intrinsic discount, you have to ask: is Definium still mispriced, or is the market already baking in future growth?

Price to book of 13.1x: Is it justified?

At $17.37, Definium Therapeutics is carrying a P/B ratio of 13.1x, which screens as expensive compared to both its industry and peer group.

The price to book ratio compares the market value of the equity to the company’s net assets on the balance sheet, and it is often used for early stage or unprofitable biopharma names where earnings are not a meaningful guide. A higher P/B usually suggests investors are willing to pay a premium over the accounting value of the business, often because they see potential in the pipeline or intangible assets that do not show up in book value.

For Definium, that premium is steep. The P/B of 13.1x sits well above the US pharmaceuticals industry average of 2.3x, and it is also higher than the peer average of 4.9x. That kind of gap suggests the market is assigning Definium a much richer valuation multiple than many of its sector peers, even though the company is currently unprofitable, reports no meaningful revenue and has seen losses increase over the past 5 years.

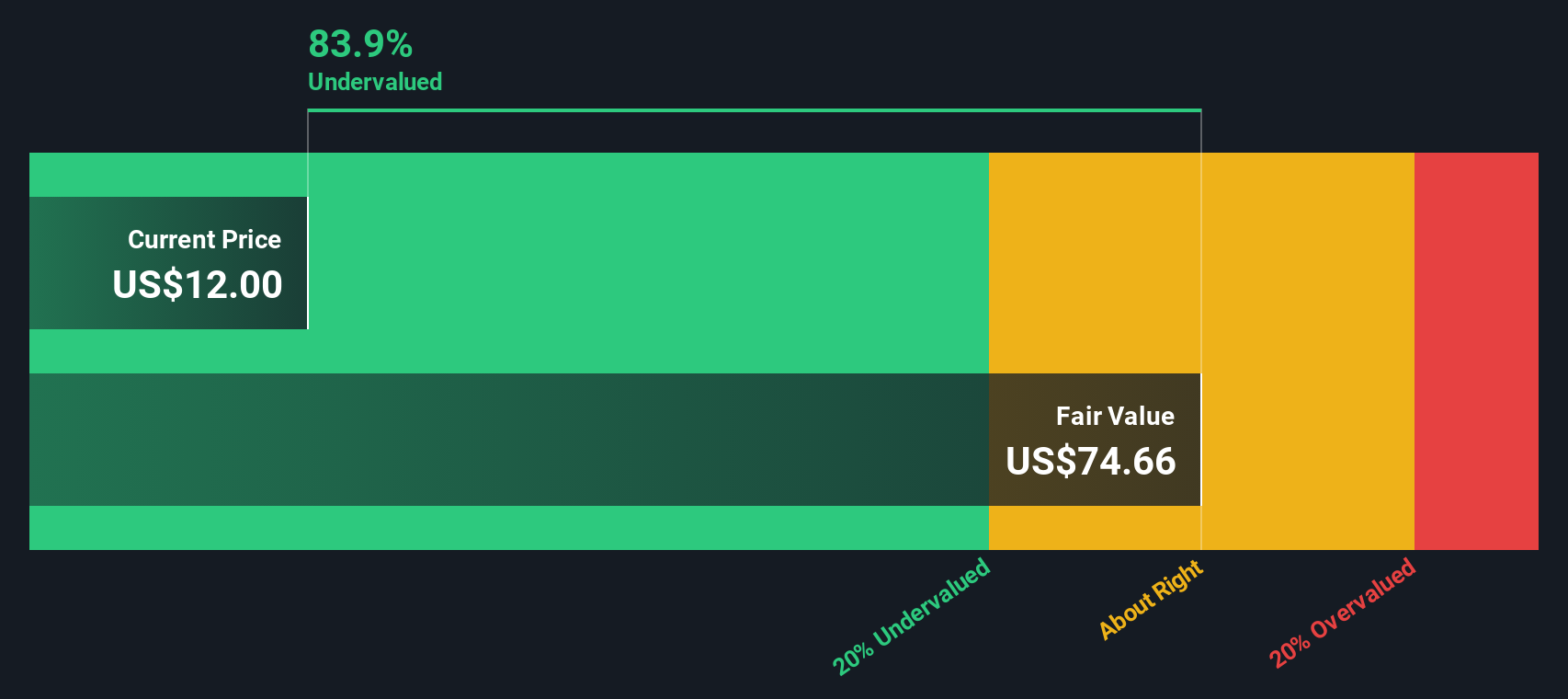

At the same time, Simply Wall St’s DFTX specific work flags that the shares are trading at 92.6% below its estimate of fair value and that the SWS DCF model implies a future cash flow value of $234.44 per share, far above the current $17.37 price. Those two lenses, a high P/B on one side and a discounted cash flow value more than 10x the current share price on the other, highlight how sensitive any valuation is to the assumptions investors make about future clinical progress, cash needs and eventual commercialisation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book ratio of 13.1x (OVERVALUED)

However, you still have to weigh a clinical stage, loss making business with no current revenue, as well as heavy reliance on successful MM120 and DT402 trial outcomes.

Find out about the key risks to this Definium Therapeutics narrative.

Another way to look at value

The P/B of 13.1x makes DFTX look expensive next to the US pharmaceuticals average of 2.3x and the peer average of 4.9x. Yet our DCF model suggests the shares trade 92.6% below an estimated future cash flow value of $234.44 per share. Which lens do you trust more for a clinical stage story like this?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Definium Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Definium Therapeutics Narrative

If you see the story differently or simply want to test your own assumptions against the data, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Definium Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Definium has sharpened your thinking, do not stop here. Broaden your opportunity set with a few focused stock lists built from clear, data driven criteria.

- Target potential mispricings by reviewing our list of 51 high quality undervalued stocks that combine solid fundamentals with prices that may not fully reflect their underlying strength.

- Strengthen your income stream by checking out 14 dividend fortresses, a collection of companies offering higher yields with an emphasis on consistency.

- Prioritise resilience by scanning 83 resilient stocks with low risk scores, where you will find businesses that score well on financial health and risk metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com