Assessing Valvoline (VVV) Valuation After Recent Share Price Momentum And Growth Expectations

Why Valvoline (VVV) is on investors’ radar

Valvoline (VVV) has caught investor attention after a stretch of solid recent returns, with the stock up over the past week, month, and past 3 months, alongside reported double digit annual revenue and net income growth.

See our latest analysis for Valvoline.

The recent move to a US$37.99 share price, alongside a 30 day share price return of 17.91% and year to date share price return of 31.59%, contrasts with a 1 year total shareholder return decline of 5.26%. This suggests that momentum has picked up only more recently compared with longer term results.

If Valvoline’s recent rebound has you considering where else the market is finding potential, it could be a good time to scan 24 power grid technology and infrastructure stocks for other opportunities tied to essential infrastructure themes.

With the share price at about an 8.6% discount to the average analyst target yet trading at a premium to one intrinsic value estimate, you have to ask: is Valvoline still mispriced, or is the market already baking in future growth?

Most Popular Narrative: 6.3% Undervalued

Against Valvoline’s last close at $37.99, the most followed narrative points to a fair value of about $40.53, built on detailed revenue, margin, and valuation assumptions.

Expansion of premium services (full synthetic oil changes, NOCR, fleet management, and digital/loyalty programs) is improving the service and product mix, resulting in higher average ticket sizes and gross margins, which is a direct catalyst for enhanced earnings growth.

Curious what kind of revenue growth, margin path, and future earnings multiple were needed to reach that fair value? The full narrative lays out a precise set of forecasts and valuation assumptions that go well beyond recent share price moves.

Result: Fair Value of $40.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on traditional oil change demand remaining stable and on acquisitions such as Breeze Autocare not putting unexpected pressure on margins and earnings.

Find out about the key risks to this Valvoline narrative.

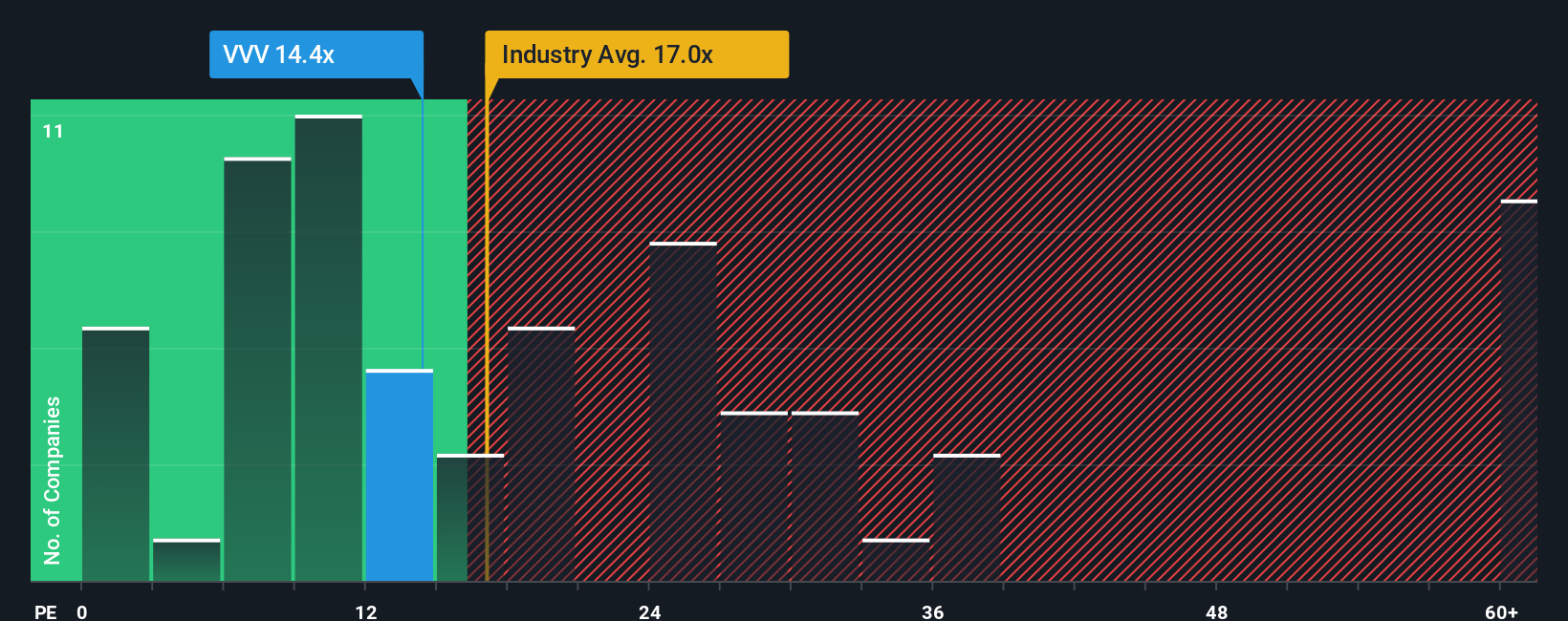

Another View: Multiples Paint a Very Different Picture

The most followed narrative leans on fundamentals and future earnings to argue Valvoline looks about 6.3% undervalued around $37.99. However, on a simple P/E check, the story flips. At 54.5x, the share price is far above the US Specialty Retail industry at 20.7x and peers at 11x, and even sits well above an estimated fair ratio of 35.1x. That kind of premium can signal confidence in the growth story, or it can mean expectations are already loaded into the price. Which side of that trade do you think you are on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valvoline Narrative

If you look at this and think you would weigh the numbers differently, you can test that view and build your own narrative in a few minutes, Do it your way.

A great starting point for your Valvoline research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Valvoline has you thinking bigger about your portfolio, do not stop here. The next opportunity you act on could be the one that really moves the needle.

- Target quality at a discount by scanning our list of 51 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect them yet.

- Strengthen your income stream by reviewing 14 dividend fortresses that focus on higher yields backed by more robust balance sheets.

- Protect your downside by checking 83 resilient stocks with low risk scores built around companies with more resilient risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com