A Look At BrightView Holdings (BV) Valuation After Snow Removal Surge And Expanded Buyback

Why BrightView’s latest update matters for shareholders

BrightView Holdings (BV) recently reported quarterly results showing a larger net loss, reaffirmed its 2026 revenue outlook of US$2.670b to US$2.730b, and completed a share buyback that retired 2.32% of its stock.

See our latest analysis for BrightView Holdings.

BrightView’s 1-day share price return of 3.35% and 90-day share price return of 11.83% suggest momentum has been firming around the reaffirmed 2026 revenue outlook, even though the 1-year total shareholder return decline of 5.12% contrasts with a very large 3-year total shareholder return gain.

If BrightView’s mix of services and buybacks has your attention, it could be a good moment to broaden your search and review 23 top founder-led companies.

With BrightView trading at US$13.90, a sizeable intrinsic value gap and a discount to the average analyst price target raise a key question for you: is this a genuine mispricing, or is the market already factoring in future growth?

Most Popular Narrative: 25.2% Overvalued

Compared to the narrative fair value estimate of $11.10, BrightView’s last close at $13.90 prices in a richer outlook than that model implies, setting up a clear tension between price and projections.

The widespread shift toward drought-resistant landscaping and artificial turf as water scarcity and climate change intensify is expected to structurally reduce demand for BrightView's core traditional landscaping services, which poses a risk to long-term recurring revenue and top line growth.

Want to see what kind of earnings rebuild would be needed to justify today’s price, using a discount rate under 9% and tighter margin assumptions? The narrative also leans on modest revenue growth and a future profit multiple below the broader industry. If you are curious how those ingredients come together to land on that $11.10 figure, the full story is worth a look.

Result: Fair Value of $11.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if BrightView keeps lifting margins through cost savings and turns its development backlog into recurring contracts, that could challenge this more cautious narrative.

Find out about the key risks to this BrightView Holdings narrative.

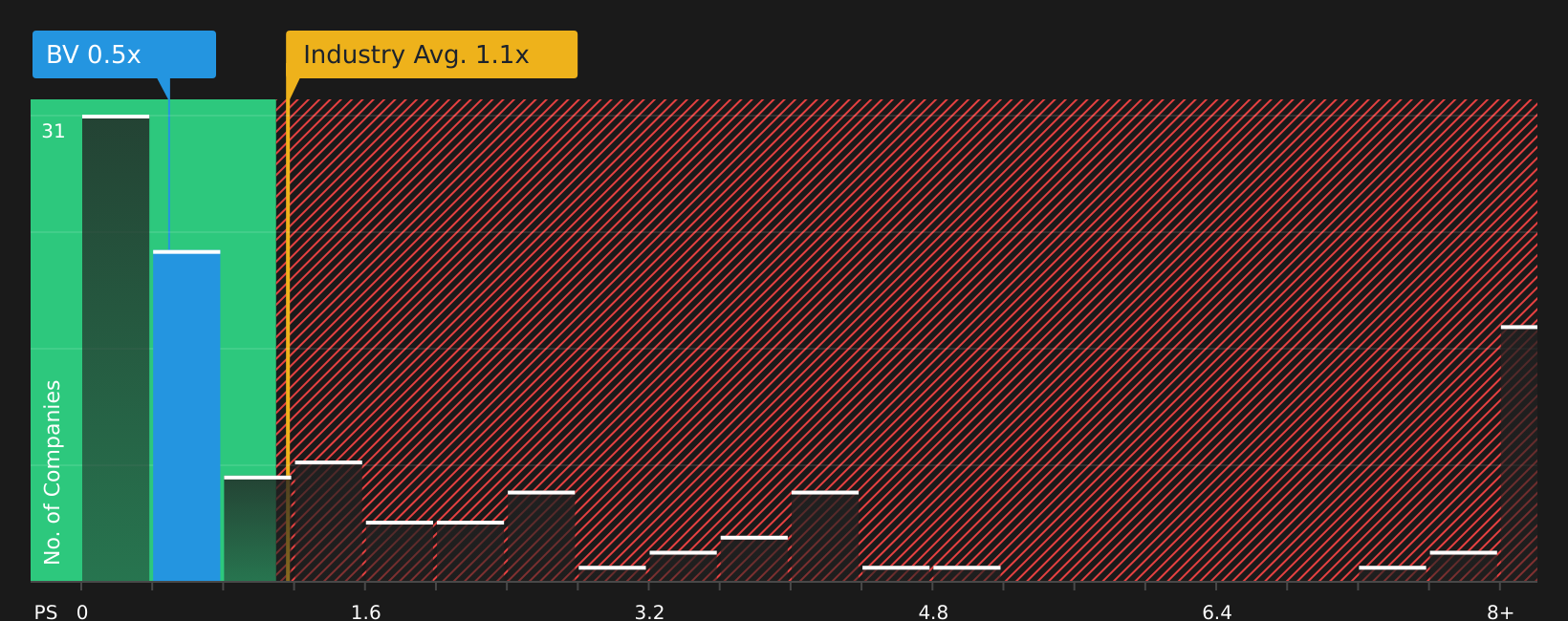

Another View: Multiples Send a Different Signal

That $11.10 narrative fair value suggests BrightView appears overvalued, yet the market is pricing it at a P/S of 0.5x, compared with a fair ratio of 0.7x, peers at 1.7x, and the US Commercial Services industry at 1.2x. If the market moves closer to that fair ratio, today’s discount could be interpreted differently. Which signal do you think deserves more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightView Holdings Narrative

If parts of this story do not sit right with you, or you prefer to work directly with the numbers yourself, you can build a view that reflects your own assumptions in just a few minutes by starting with Do it your way.

A great starting point for your BrightView Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BrightView has sharpened your focus, do not stop here; using a few targeted stock lists now could help you spot opportunities before they feel obvious.

- Target value opportunities by checking companies that screen as potentially mispriced with 51 high quality undervalued stocks grounded in cash flows and balance sheet quality.

- Prioritize resilience first and see which businesses stand out in our 83 resilient stocks with low risk scores so you can focus on names with fewer red flags.

- Hunt for earlier stage potential by scanning our screener containing 24 high quality undiscovered gems before the wider market pays closer attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com