Why United Rentals (URI) Is Up 10.6% After Major Buyback, Dividend Hike And Board Addition

- United Rentals, Inc. recently reported fourth-quarter and full-year 2025 results, issued 2026 revenue guidance of US$16.8–US$17.3 billion, raised its quarterly dividend by 10% to US$1.97 per share, and authorized a new US$5.00 billion share repurchase program, while later appointing Alexander Taussig to its board, bringing the total to 11 directors.

- Together, the large buyback authorization, dividend increase, and addition of a venture capital board partner highlight management’s current focus on capital returns and evolving governance.

- We’ll now examine how the new US$5.00 billion repurchase program may influence United Rentals’ existing investment narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

United Rentals Investment Narrative Recap

To own United Rentals, you need to believe that large project activity and its one‑stop rental model can support steady equipment demand, even as margins face pressure from higher costs and heavy CapEx. The new US$5.00 billion buyback and 10% dividend increase do not meaningfully change the near term reliance on big projects as the key catalyst, nor the risk that elevated investment and debt could strain free cash flow if conditions weaken.

Of the recent announcements, the expanded US$5.00 billion repurchase program is most relevant, because it sits directly alongside United Rentals’ sizeable CapEx needs and high debt. For investors watching free cash flow and balance sheet risk, this raises important questions about how much room the company has to keep funding fleet renewal, Specialty expansion and capital returns if project activity slows or margins come under more pressure.

Yet, while capital returns are rising, investors should be aware that the company’s high CapEx and debt levels leave less room if project demand or margins suddenly soften...

Read the full narrative on United Rentals (it's free!)

United Rentals’ narrative projects $18.8 billion revenue and $3.5 billion earnings by 2028.

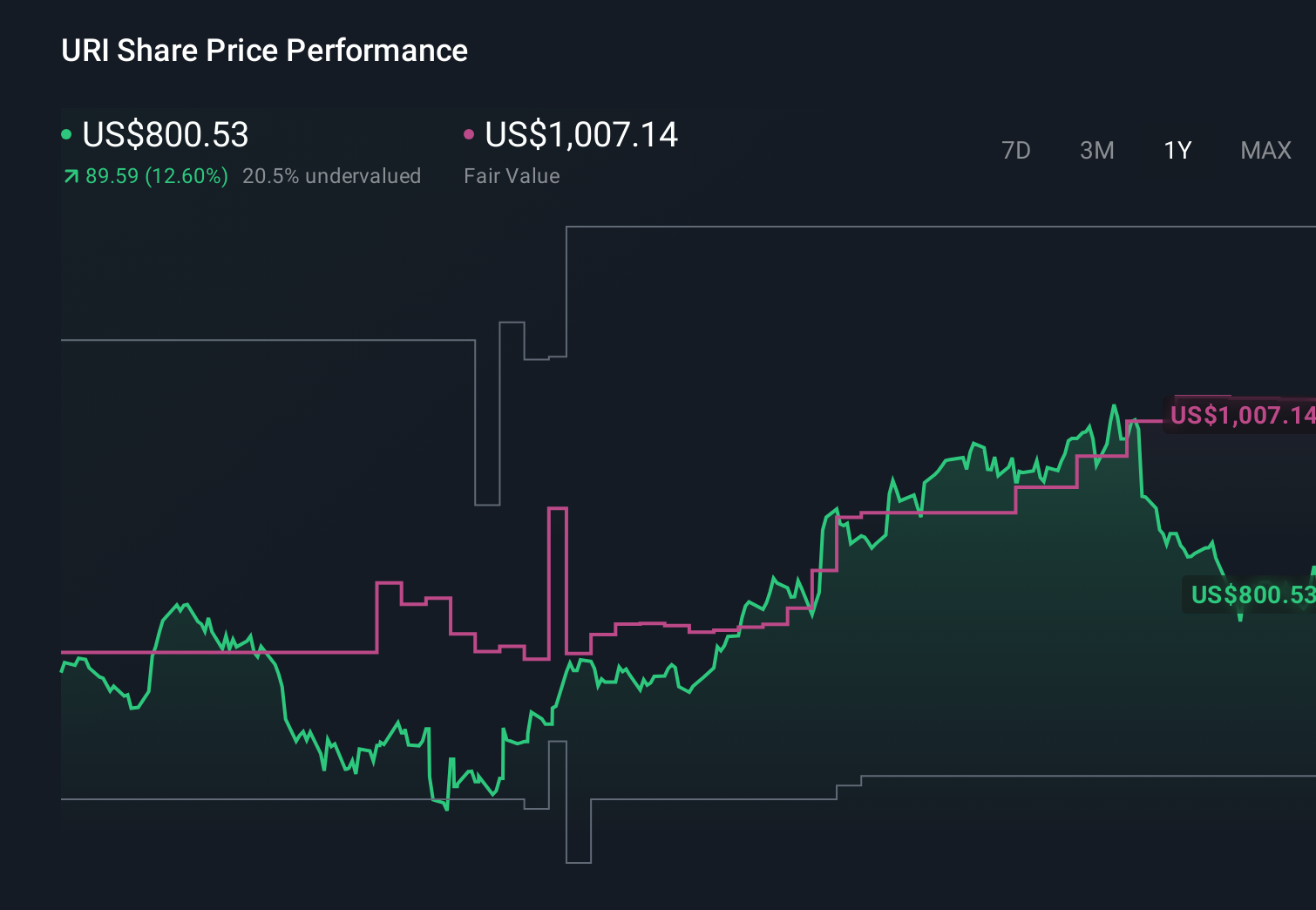

Uncover how United Rentals' forecasts yield a $1008 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Before this news, the most optimistic analysts expected revenue near US$20.8 billion and earnings around US$3.7 billion, so compared with the baseline focus on project risk and CapEx pressure, you are looking at a far more upbeat story that could shift meaningfully as this new buyback and board change are fully reflected.

Explore 5 other fair value estimates on United Rentals - why the stock might be worth as much as 23% more than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with 27 elite penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find 51 companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com