A Look At Mobileye Global (MBLY) Valuation After Mahindra Picks Its ADAS For Future Models

Mobileye Global (MBLY) just announced that Mahindra & Mahindra plans to use its SuperVision and Surround ADAS systems in at least six future vehicle models, with production targeted to start in 2027.

See our latest analysis for Mobileye Global.

Despite the Mahindra win and recent conference appearances, momentum in Mobileye Global’s share price return has been weak overall. A 7 day share price return of 7.8% contrasts with a 1 year total shareholder return decline of 42.4% and a 3 year total shareholder return decline of 79.5%, leaving the stock at US$9.63.

If this ADAS deal has you thinking more broadly about automation, it could be a good time to scan the wider opportunity set through our list of 30 robotics and automation stocks.

With the share price down sharply over 1 and 3 years but trading at a discount to analyst targets and intrinsic estimates, is Mobileye undervalued today or already reflecting all the future growth investors are hoping for?

Most Popular Narrative: 47.1% Undervalued

Mobileye Global’s most followed narrative puts fair value at about $18.20 per share, a long way above the last close at $9.63, which sets up a wide valuation gap for investors to interpret.

Bullish analysts point to ongoing wins in advanced driver assistance systems, including a large Surround ADAS award covering roughly 9 million vehicles starting in 2028, as support for the current valuation and for longer term growth potential.

Some see Mobileye as well positioned to benefit from increasing original equipment manufacturer outsourcing of premium Level 2+ features, with the potential for recurring software enabled revenue streams to support earnings quality over time. Read the complete narrative.

Curious what kind of revenue ramp and margin lift would need to sit behind that $18.20 fair value, and how much hinges on premium ADAS take up and software style income streams rather than hardware alone? The full narrative lays out those moving parts in detail, including how a higher long term earnings multiple is justified against that growth path.

Result: Fair Value of $18.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on global auto demand holding up, and tariffs or slower OEM decisions on SuperVision and Chauffeur could quickly undercut those fair value assumptions.

Find out about the key risks to this Mobileye Global narrative.

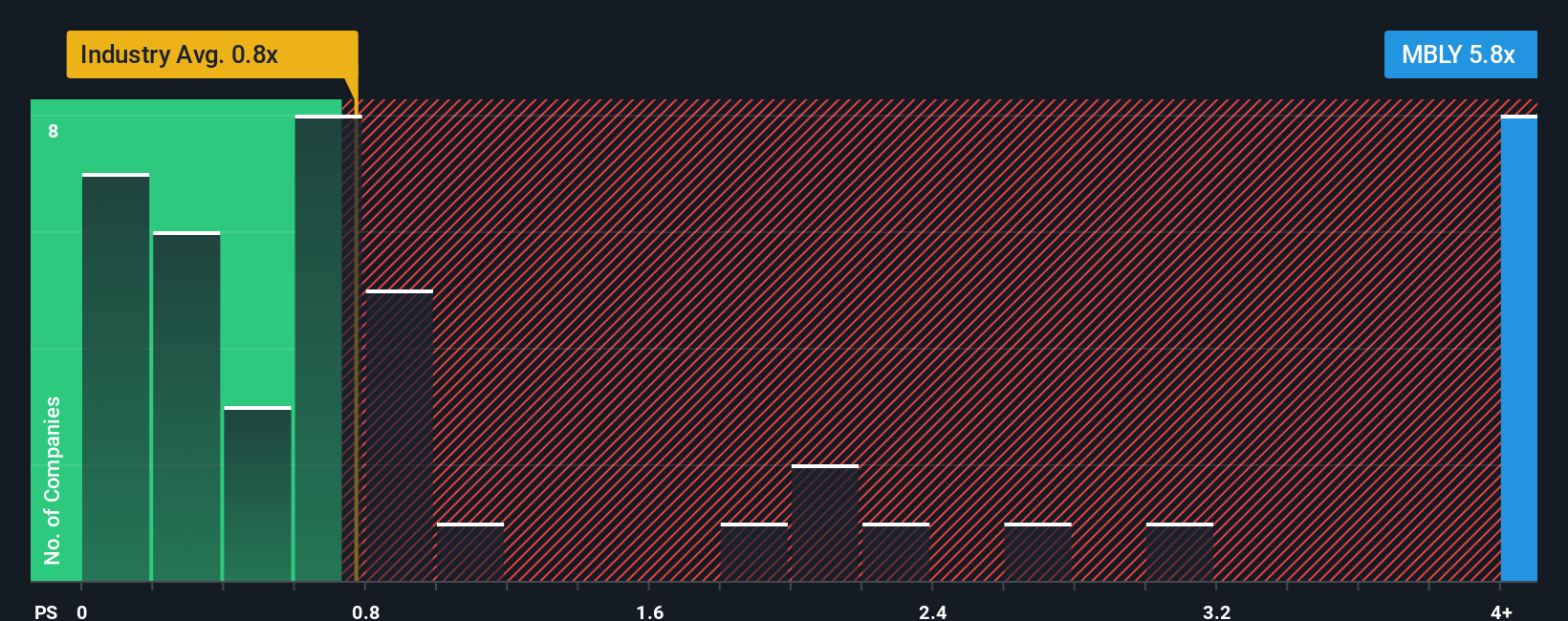

Another View: Multiples Flash A Different Signal

There is a catch. While the SWS DCF model flags Mobileye as trading about 39.3% below its estimated fair value of $15.86, the market is still pricing the stock at a P/S of 4.3x, compared with an industry average of 0.8x, peers at 1.1x and a fair ratio of 3.3x. That gap suggests you are paying a premium for growth expectations even if the cash flow math says the shares look cheap. The question is which signal you put more weight on.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you look at the numbers and reach a different conclusion, or simply want to test your own assumptions against the data, you can build a personalised Mobileye Global story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Ready to Find Your Next Idea?

If Mobileye has sharpened your thinking, do not stop here. Casting a wider net now could be what separates a solid portfolio from missed chances.

- Target quality at a discount by scanning our list of 52 high quality undervalued stocks that pair fundamentals with appealing pricing.

- Prioritise resilience with 85 resilient stocks with low risk scores that score well on stability, so you are not relying on just one story to hold up your portfolio.

- Hunt for underfollowed opportunities using our screener containing 24 high quality undiscovered gems, where strong numbers have not yet drawn widespread attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com