A Look At Nexstar Media Group (NXST) Valuation After Strong Recent Shareholder Returns

Nexstar Media Group (NXST) has attracted fresh attention after recent share price moves, with the stock showing double digit total returns over the past year and past 3 months, prompting closer scrutiny from income and value focused investors.

See our latest analysis for Nexstar Media Group.

The share price has moved to US$240.45 after a 30.94% 90 day share price return, while the 1 year total shareholder return of 65.30% suggests strong momentum rather than a short term spike.

If this kind of move has you thinking about what else could be setting up for a strong run, take a look at our 22 top founder-led companies as a starting point for fresh ideas.

With Nexstar trading around US$240 and a value score of 5, plus an intrinsic value estimate that implies a sizable discount, the big question is whether you are looking at a genuine mispricing or a market already banking on future growth.

Most Popular Narrative: 3.7% Overvalued

At $240.45, Nexstar Media Group is trading slightly above the most widely followed fair value estimate of $231.89, which is built around detailed revenue, margin and earnings assumptions discounted at 8.53%.

The analysts have a consensus price target of $231.889 for Nexstar Media Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $250.0, and the most bearish reporting a price target of just $190.0.

Curious what justifies pricing Nexstar above a flat revenue outlook yet higher future margins and earnings per share, plus a richer P/E than today, all discounted back carefully? The full narrative lays out those moving parts and how they line up with that $231.89 fair value.

Result: Fair Value of $231.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh risks such as ongoing pay TV subscriber losses and high debt levels, which could pressure both revenue stability and financial flexibility.

Find out about the key risks to this Nexstar Media Group narrative.

Another View: Earnings Multiple Signals Room To Move

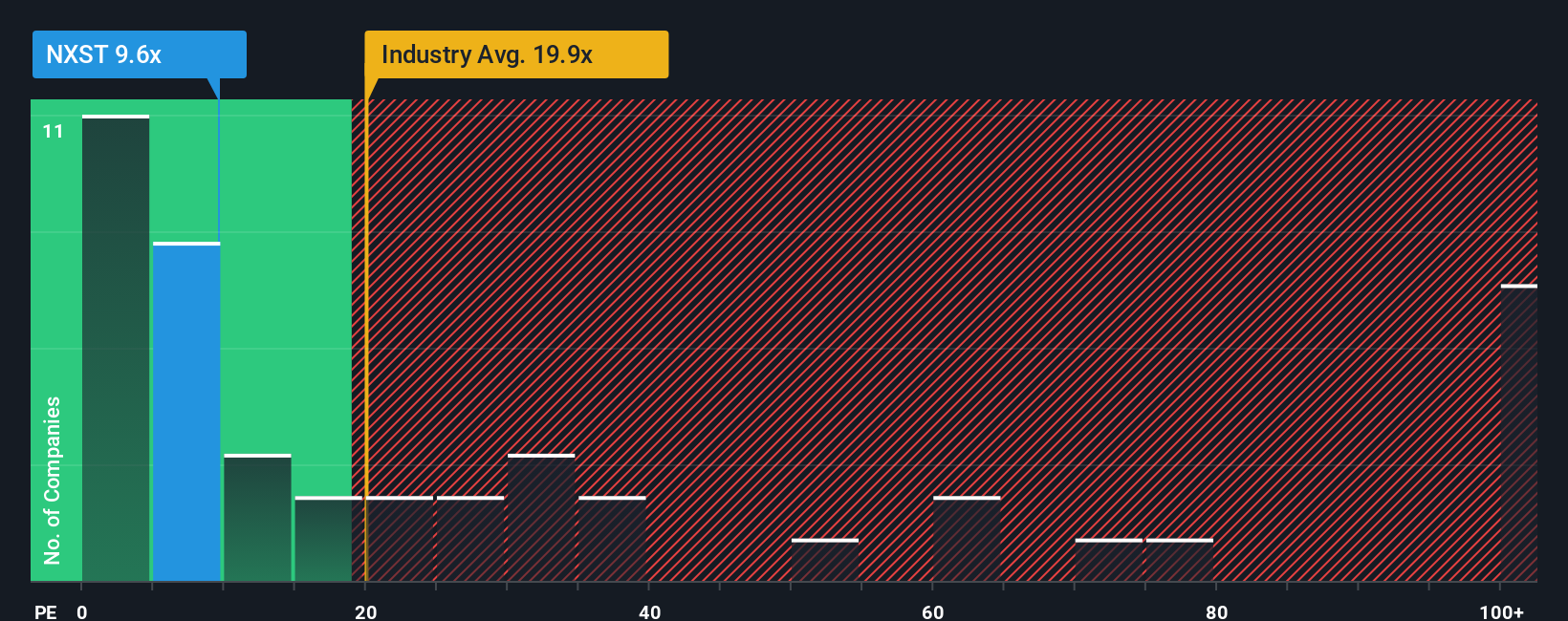

If you set the narrative fair value aside and just look at the P/E, Nexstar at 14.6x earnings screens cheaper than the US Media industry at 15.3x and peers at 25x, and below its own 19.7x fair ratio. That gap points to real valuation risk or opportunity, depending on how you see the business.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nexstar Media Group Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own view against the data, you can build a complete Nexstar thesis yourself in just a few minutes, starting with Do it your way.

A great starting point for your Nexstar Media Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Nexstar has sharpened your appetite for opportunity, do not stop here. Widen your search with focused stock lists built straight from hard numbers, not hype.

- Target reliable cash generators by reviewing companies in our 51 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them.

- Prioritise staying power and sturdy finances by scanning stocks in the solid balance sheet and fundamentals stocks screener (45 results) that meet strict balance sheet and fundamentals filters.

- Reduce surprises by assessing companies within the 85 resilient stocks with low risk scores where our scoring highlights businesses with more tempered overall risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com