Undervalued Small Caps With Insider Action To Watch In February 2026

As February 2026 begins, the U.S. stock market is experiencing a robust start with major indices like the Dow Jones and S&P 500 showing significant gains, reflecting a positive sentiment despite recent economic uncertainties such as delayed jobs reports due to government shutdowns. In this dynamic environment, small-cap stocks often present unique opportunities for investors looking to capitalize on insider actions and potential undervaluation within the broader market context.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First United | 9.8x | 2.9x | 46.08% | ★★★★★☆ |

| Vestis | NA | 0.4x | 39.92% | ★★★★★☆ |

| German American Bancorp | 14.3x | 4.7x | 45.08% | ★★★☆☆☆ |

| MVB Financial | 11.2x | 2.2x | 18.02% | ★★★☆☆☆ |

| Bank of the James Financial Group | 10.1x | 1.9x | 49.65% | ★★★☆☆☆ |

| New Peoples Bankshares | 9.8x | 2.3x | 39.22% | ★★★☆☆☆ |

| Monro | NA | 0.6x | 27.46% | ★★★☆☆☆ |

| Angel Oak Mortgage REIT | 12.7x | 6.4x | 38.75% | ★★★☆☆☆ |

| FutureFuel | NA | 1.2x | 44.25% | ★★★☆☆☆ |

| Hallador Energy | NA | 2.0x | -22.04% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Lucky Strike Entertainment (LUCK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lucky Strike Entertainment operates in the bowling entertainment industry with a focus on providing leisure and recreational activities, and it has a market cap of $1.75 billion.

Operations: Lucky Strike Entertainment's primary revenue comes from its Bowling Entertainment Business, generating $1.24 billion. The company experienced fluctuations in gross profit margin, with a notable increase to 42.02% in July 2023 before settling at 35.51% by December 2025. Operating expenses are significant, including general and administrative costs that reached $148.40 million by the end of December 2025.

PE: -10.9x

Lucky Strike Entertainment, a company with dynamic growth potential, has been focusing on expanding its entertainment venues, recently opening a new location in Aliso Viejo. Despite reporting a net loss of US$12.66 million for Q2 2026, the company anticipates revenue growth between 5% and 9% for the fiscal year. Insider confidence is evident as they completed significant share repurchases worth US$467.86 million since February 2022. With Peter Murray's appointment as Head of Media, Lucky Strike aims to transform its venues into immersive sports and entertainment hubs, potentially enhancing future prospects in experiential entertainment markets.

Oxford Industries (OXM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Industries is a lifestyle apparel company known for its brands such as Tommy Bahama and Lilly Pulitzer, with a market capitalization of $1.80 billion.

Operations: Oxford Industries generates revenue primarily from its Tommy Bahama, Lilly Pulitzer, Johnny Was, and Emerging Brands segments. The company has experienced fluctuations in its net income margin, which reached a high of 13.09% during the period ending July 2022 but later declined to -0.20% by November 2025. Operating expenses consistently account for a significant portion of costs, with general and administrative expenses being the largest component within this category.

PE: -204.6x

Oxford Industries, a small-cap company, recently faced challenges with a net loss of US$63.68 million in Q3 2025 and impairment charges of US$61 million. Despite this, insider confidence is evident as Robert Trauber purchased 10,000 shares for approximately US$414K. The company projects Q4 sales between US$365M and US$385M and maintains its quarterly dividend of $0.69 per share. With earnings forecasted to grow significantly, the stock presents an intriguing opportunity amidst current setbacks.

Veris Residential (VRE)

Simply Wall St Value Rating: ★★★☆☆☆

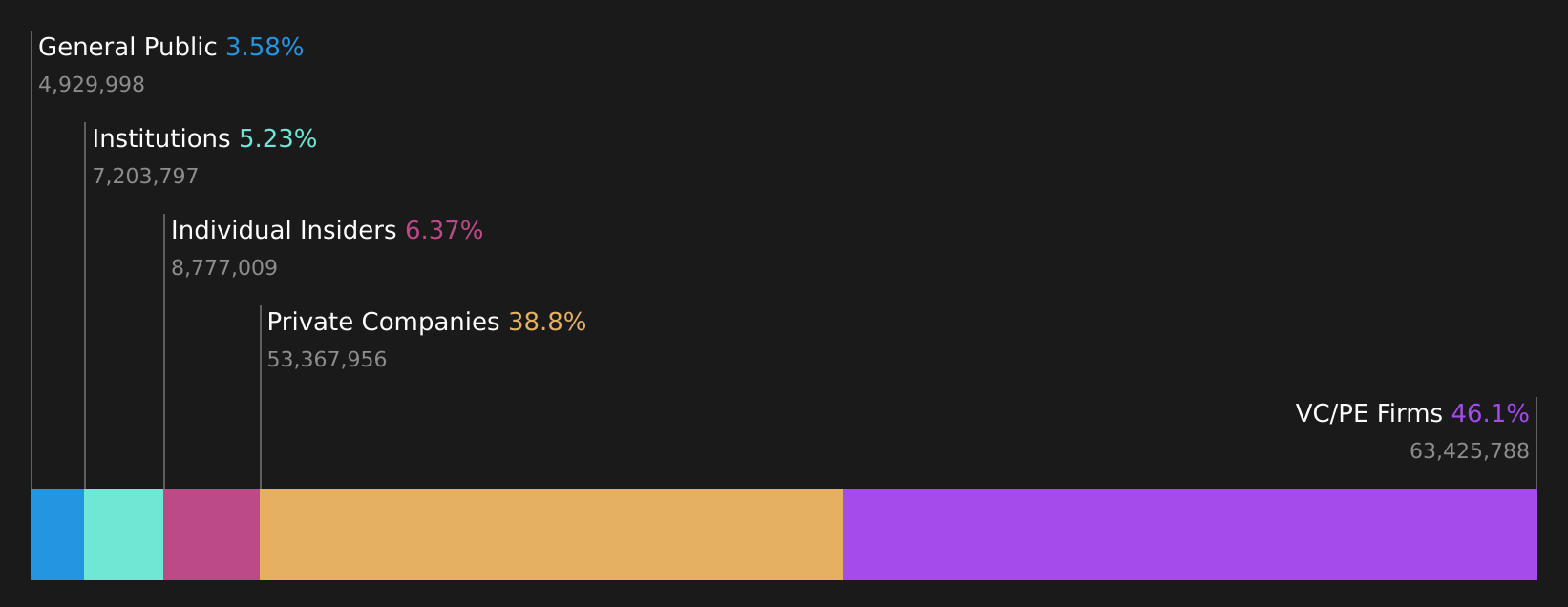

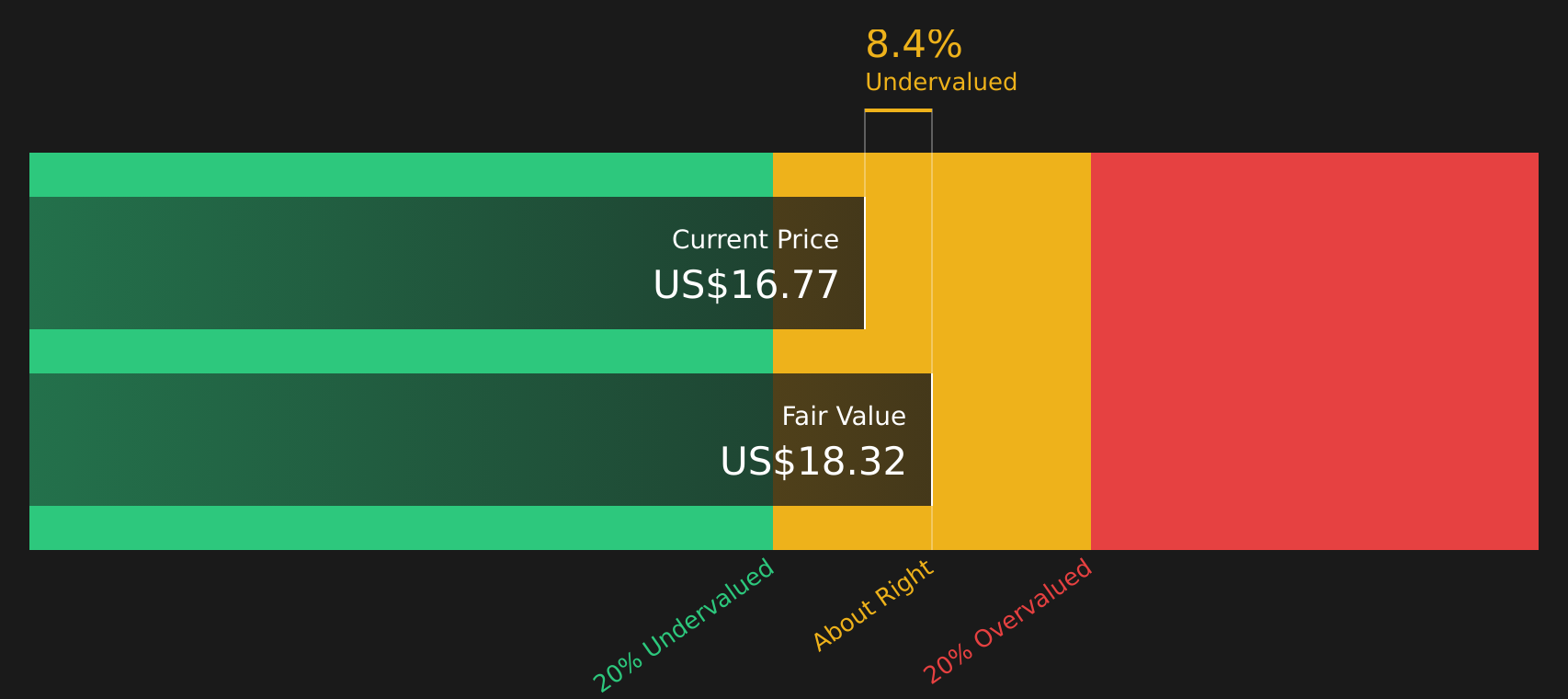

Overview: Veris Residential focuses on the ownership, operation, and development of its multifamily real estate portfolio and has a market cap of approximately $1.73 billion.

Operations: The company's revenue primarily comes from its multifamily real estate portfolio, with a recent gross profit margin of 60.51%. Operating expenses and non-operating expenses have varied over time, impacting net income margins significantly.

PE: 26.1x

Veris Residential, a small cap player in the U.S., is drawing attention with insider confidence shown through recent share purchases over the past six months. Despite having higher risk funding due to reliance on external borrowing, this company showcases potential as an undervalued investment. However, with earnings expected to decline by 52% annually over three years and interest payments not well-covered by earnings, investors should weigh these factors when considering future prospects.

- Unlock comprehensive insights into our analysis of Veris Residential stock in this valuation report.

Gain insights into Veris Residential's past trends and performance with our Past report.

Seize The Opportunity

- Reveal the 65 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com