Jefferies Deepens SMBC Alliance As Valuation And Dividend Cover Diverge

- Jefferies Financial Group (NYSE:JEF) has nominated Yoshihiro Hyakutome of Sumitomo Mitsui Financial Group to its Board of Directors, replacing Toru Nakashima.

- The move is part of a broader effort to deepen the alliance between Jefferies and SMBC around Japan equities.

- The companies are working toward a Japan equities joint venture targeted to begin in January 2027.

- SMBC also plans to increase its economic stake in Jefferies, subject to regulatory approvals.

For you as an investor, this board change highlights how Jefferies is leaning further into its partnership model with a major Japanese financial institution. Jefferies is known for its investment banking and capital markets business, and closer ties with SMBC connect it more directly to client flows and corporate relationships in Japan.

Looking ahead, the planned joint venture and potential increase in SMBC’s stake point to a tighter alignment of interests between the two firms. The key question for investors is how this collaboration may influence Jefferies' role in cross border equity activity involving Japan once the joint venture is underway.

Stay updated on the most important news stories for Jefferies Financial Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Jefferies Financial Group.

We've flagged 1 risk for Jefferies Financial Group. See which could impact your investment.

Quick Assessment

- ✅ Price vs Analyst Target: At US$57.68 vs a consensus target of US$73.67, the share price sits about 22% below analyst expectations.

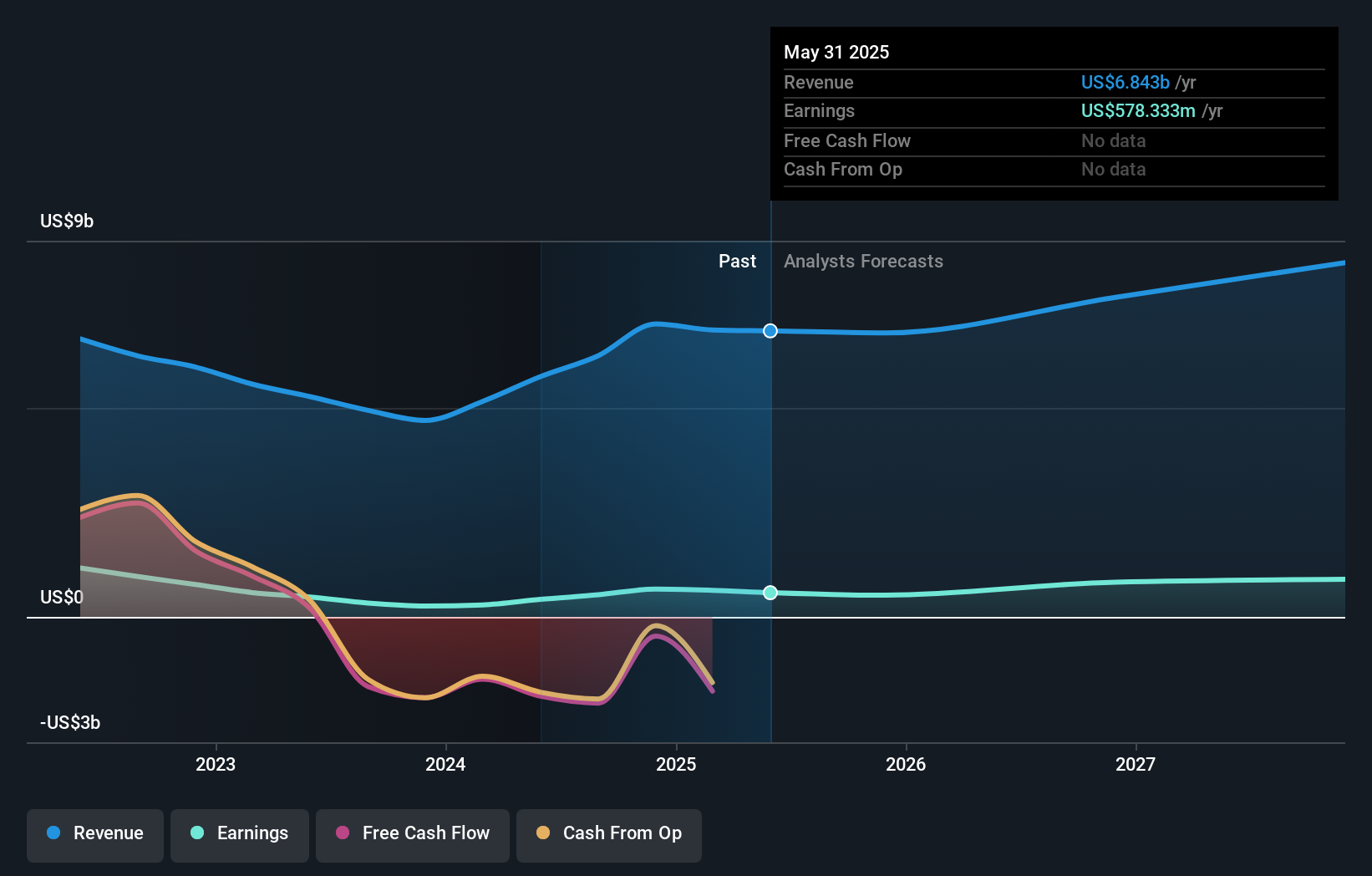

- ❌ Simply Wall St Valuation: Simply Wall St estimates the shares are trading around 13.5% above fair value.

- ❌ Recent Momentum: The 30 day return is roughly an 8.1% decline.

There is only one way to know the right time to buy, sell or hold Jefferies Financial Group. Head to Simply Wall St's company report for the latest analysis of Jefferies Financial Group's fair value.

Key Considerations

- 📊 The closer tie up with Sumitomo Mitsui and a planned Japan equities joint venture could deepen Jefferies' access to Japanese deal flow and clients.

- 📊 Watch how Japan related revenues, profitability in capital markets, and SMBC's economic stake progress as the partnership is built out.

- ⚠️ One current flag is that the 2.77% dividend is not well covered by free cash flows, which matters if the firm leans on equity partnerships rather than balance sheet flexibility.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Jefferies Financial Group analysis. Alternatively, you can visit the community page for Jefferies Financial Group to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com