A Look At Vishay Intertechnology (VSH) Valuation As Profitability Returns And Demand Strengthens

Vishay Intertechnology (VSH) is back in the black, with fourth quarter 2025 results showing a return to profitability and higher year over year sales, supported by broad demand and guidance for higher revenue next quarter.

See our latest analysis for Vishay Intertechnology.

The earnings rebound and product launches in power inductors and sulfur resistant resistors have come alongside strong share price momentum, with a 30 day share price return of 25.56% and a 90 day share price return of 48.24%, even though the 3 year total shareholder return is slightly negative at 0.50%.

If this move in Vishay has you thinking about where electrification and power demand could head next, take a look at our list of 24 power grid technology and infrastructure stocks as a starting point for further ideas.

With the share price up sharply, trading above a trimmed US$17.50 analyst target and screening as expensive on some intrinsic measures, is Vishay still mispriced after its earnings turnround, or are investors already paying up for future growth?

Most Popular Narrative: 15.4% Overvalued

At $20.19, Vishay Intertechnology is trading above the most widely followed fair value estimate of $17.50, which is built on explicit revenue, margin and valuation assumptions.

The net profit margin assumption was reduced from 21.51% to 7.91%, marking a significant pullback in long run profitability assumptions despite the higher fair value estimate. The future P/E multiple was increased from 3.25x to 9.95x, signaling a meaningfully higher assumed valuation multiple on the company’s earnings power.

Curious how lower long term margins can still support a higher value? The narrative leans on reshaped revenue growth and a richer future earnings multiple. Want to see how those pieces fit together and what they imply for earnings power over time? Read the full narrative for the complete picture behind that $17.50 figure.

Result: Fair Value of $17.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still questions around cash flow strain from heavy capacity spending and reliance on legacy products, which could pressure margins and challenge the fair value case.

Find out about the key risks to this Vishay Intertechnology narrative.

Another View: Multiples Paint a Different Picture

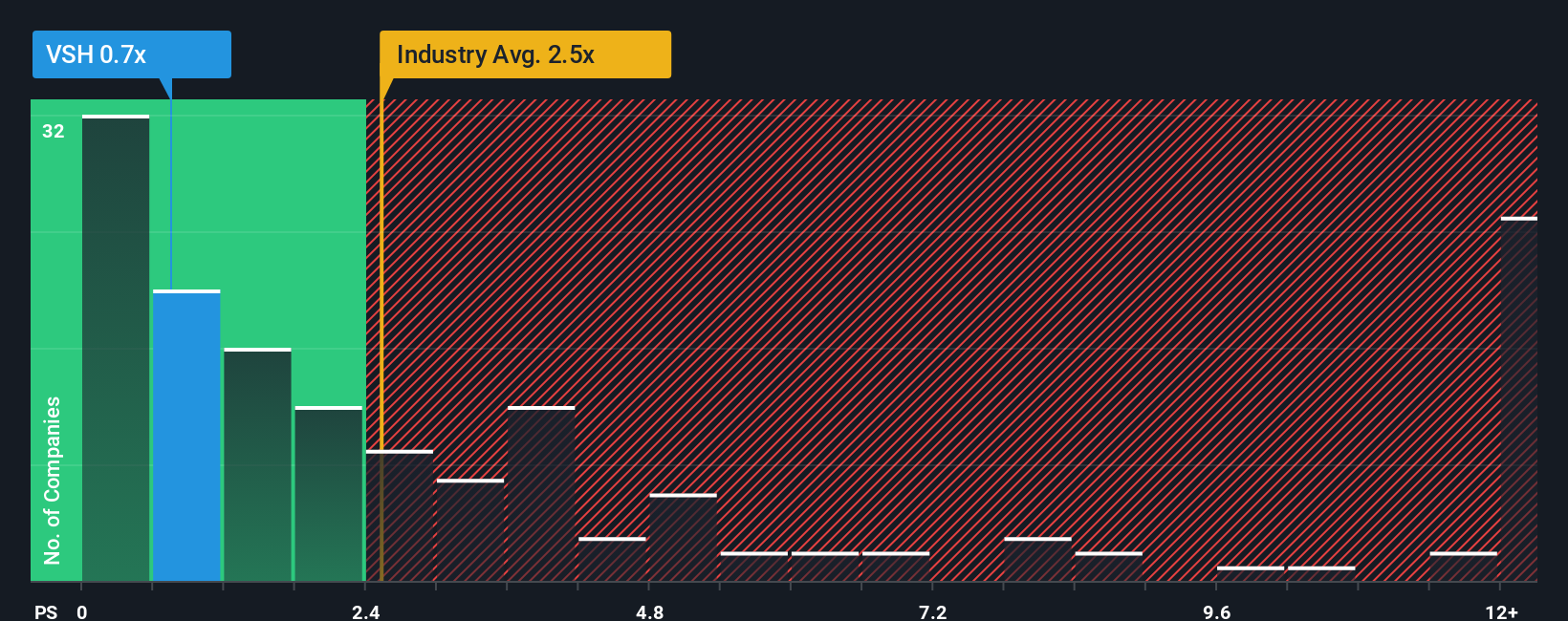

While the narrative model suggests Vishay Intertechnology is overvalued at $20.19 versus a $17.50 fair value, its P/S ratio tells a different story. At 0.9x, it sits below the 1.1x fair ratio our work points to, and well below the US Electronic industry at 2.9x and peer average at 3.2x. That gap suggests the market could still be pricing in plenty of caution, so is the upside or the downside being misread here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vishay Intertechnology Narrative

If you see the story differently or just like to test the numbers yourself, you can rebuild the assumptions, adjust the levers and Do it your way in under 3 minutes.

A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Vishay has sharpened your thinking, do not stop here. Use the screener to hunt for other opportunities that match how you like to invest.

- Target dependable income by checking out 13 dividend fortresses that could help anchor your portfolio with steady cash flows.

- Seek a margin of safety by scanning 51 high quality undervalued stocks that pair solid fundamentals with prices that our models flag as below fair value.

- Spot the quiet achievers by running through our screener containing 24 high quality undiscovered gems that the market may not be paying close attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com