A Look At Stanley Black & Decker (SWK) Valuation After Soft Q4 Results And Supply Chain Reset

Stanley Black & Decker (SWK) is back in focus after fourth quarter results came in below analyst expectations, with softer retail demand and price sensitive consumers weighing on revenue and organic growth.

See our latest analysis for Stanley Black & Decker.

The weak fourth quarter follows a sharp rebound in the share price. The 90 day share price return is 34.32% and the year to date gain is 18.39%. The 1 year total shareholder return of 11.08% contrasts with a 5 year total shareholder return of a 37.37% loss. This suggests that recent momentum has picked up after a tougher multi year period as investors react to earnings progress and leadership changes such as the appointment of a new General Counsel.

If this earnings update has you rethinking where growth could come from next, it can be useful to scan beyond industrial names and check out 22 top founder-led companies as a fresh source of ideas.

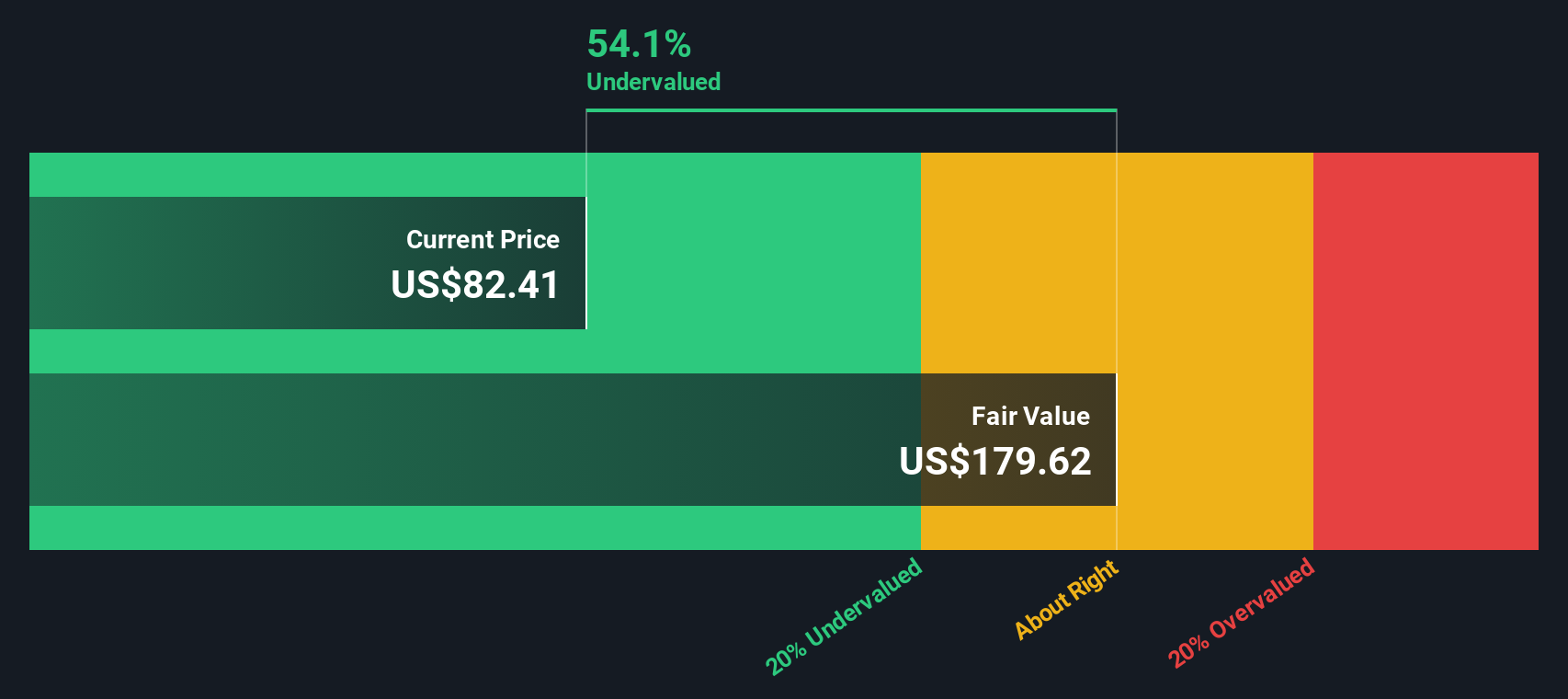

With the stock now close to its consensus price target and a 17% intrinsic discount indicated, the key question is whether recent gains still leave room for mispricing or if the market is already baking in the next leg of growth.

Most Popular Narrative: 6% Overvalued

The most followed narrative puts Stanley Black & Decker's fair value at about $85.44, which sits below the latest close of $90.53, and leans heavily on long run margin repair and cash flow discipline.

The multi-year supply chain transformation nearing its final phase is delivering substantial recurring cost reductions, improved operational flexibility, and resilience to trade/tariff shocks; management expects these initiatives to drive gross margin back to 35%+ by late 2026, supporting sustained improvements in net margins and earnings.

Read the complete narrative. Read the complete narrative.

Want to see how much of that future margin rebuild, earnings ramp, and re rated profit multiple is already baked into the $85 fair value line? The full story sits inside the narrative's revenue path, margin targets, and required return that all have to work together for this pricing to hold up.

Result: Fair Value of $85.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that flat to weaker DIY and Outdoor demand, along with heavy reliance on big box retailers, could pressure both revenue and margins.

Find out about the key risks to this Stanley Black & Decker narrative.

Another View: Cash Flows Paint a Different Picture

While the popular narrative tags Stanley Black & Decker as about 6% overvalued at $85.44, our DCF model points the other way, with a fair value estimate of $109.13 per share and a 17% discount at the current $90.53 price. So which story earns your trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stanley Black & Decker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stanley Black & Decker Narrative

If you look at these assumptions and think you would tweak the inputs or story, you can stress test the numbers yourself and Do it your way in just a few minutes.

A great starting point for your Stanley Black & Decker research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Stanley Black & Decker is on your radar, it is worth widening your lens and lining up a few contrasting ideas from different corners of the market.

- Spot potential value plays early by checking companies that screen as 51 high quality undervalued stocks based on their fundamentals and current pricing.

- Focus on staying power by reviewing solid balance sheet and fundamentals stocks screener (45 results) and see which names pair financial strength with resilient business profiles.

- Add some higher yielding income ideas to your watchlist by scanning 13 dividend fortresses that might complement more growth focused positions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com