Liberty Energy Inc.'s (NYSE:LBRT) 27% Price Boost Is Out Of Tune With Earnings

Liberty Energy Inc. (NYSE:LBRT) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

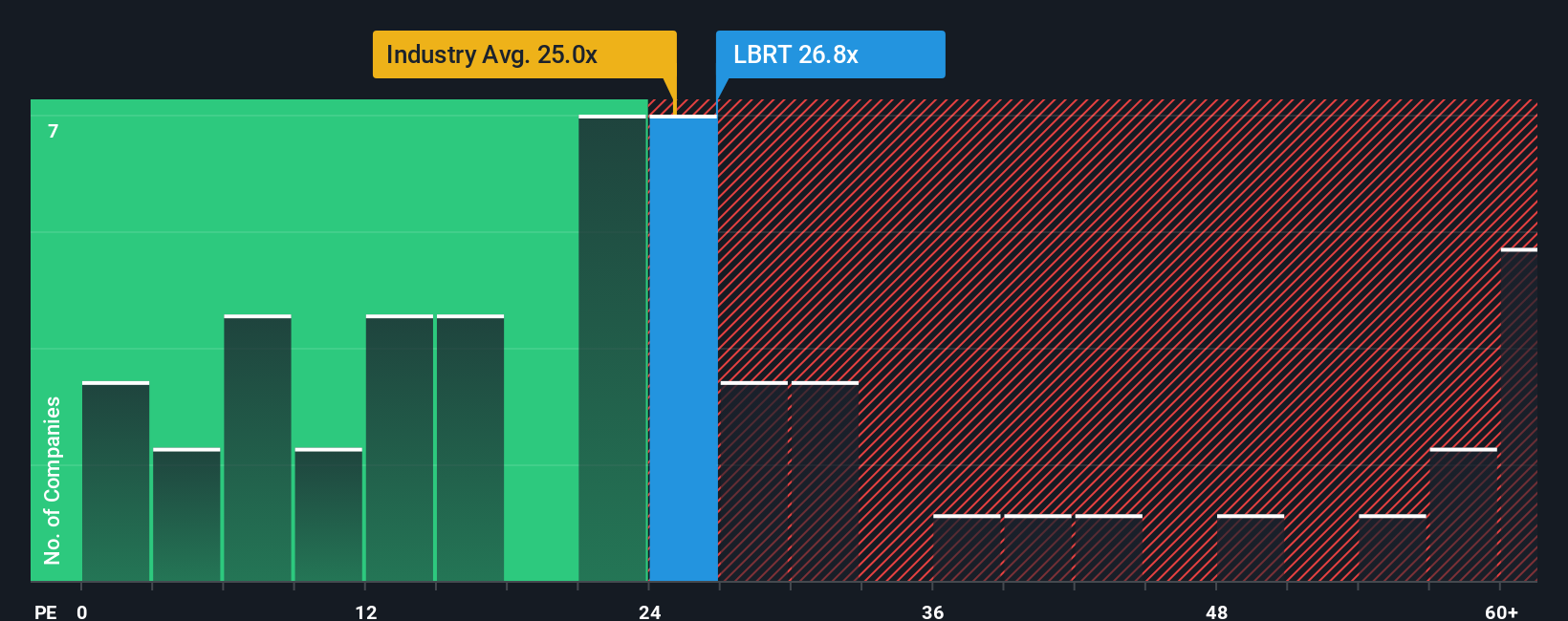

Since its price has surged higher, Liberty Energy may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 26.8x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Liberty Energy's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Liberty Energy

Is There Enough Growth For Liberty Energy?

Liberty Energy's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 58% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

The Key Takeaway

The large bounce in Liberty Energy's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

It is also worth noting that we have found 5 warning signs for Liberty Energy (1 is a bit concerning!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Liberty Energy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.