Old Second Bancorp Buyback Signals Confidence In Undervalued Shares

- Old Second Bancorp (NasdaqGS:OSBC) has authorized a new share repurchase program of up to $43.9 million.

- The buyback authorization extends through 2026.

- The program adds another capital return tool alongside existing balance sheet and lending activities.

Old Second Bancorp, the holding company for Old Second National Bank, operates as a regional banking provider focused on lending, deposits, and other financial services. For investors, a new repurchase authorization of this size can be an important signal about how management views the current share price and overall capital position. It also comes at a time when banks are paying close attention to capital levels, funding costs, and regulatory expectations.

Going forward, two points may be important to monitor: whether Old Second Bancorp uses the full $43.9 million capacity and the timeframe over which any repurchases occur. The pace and price of any future repurchases, along with management commentary on capital priorities, will influence how significant this program is for existing and prospective shareholders.

Stay updated on the most important news stories for Old Second Bancorp by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Old Second Bancorp.

Quick Assessment

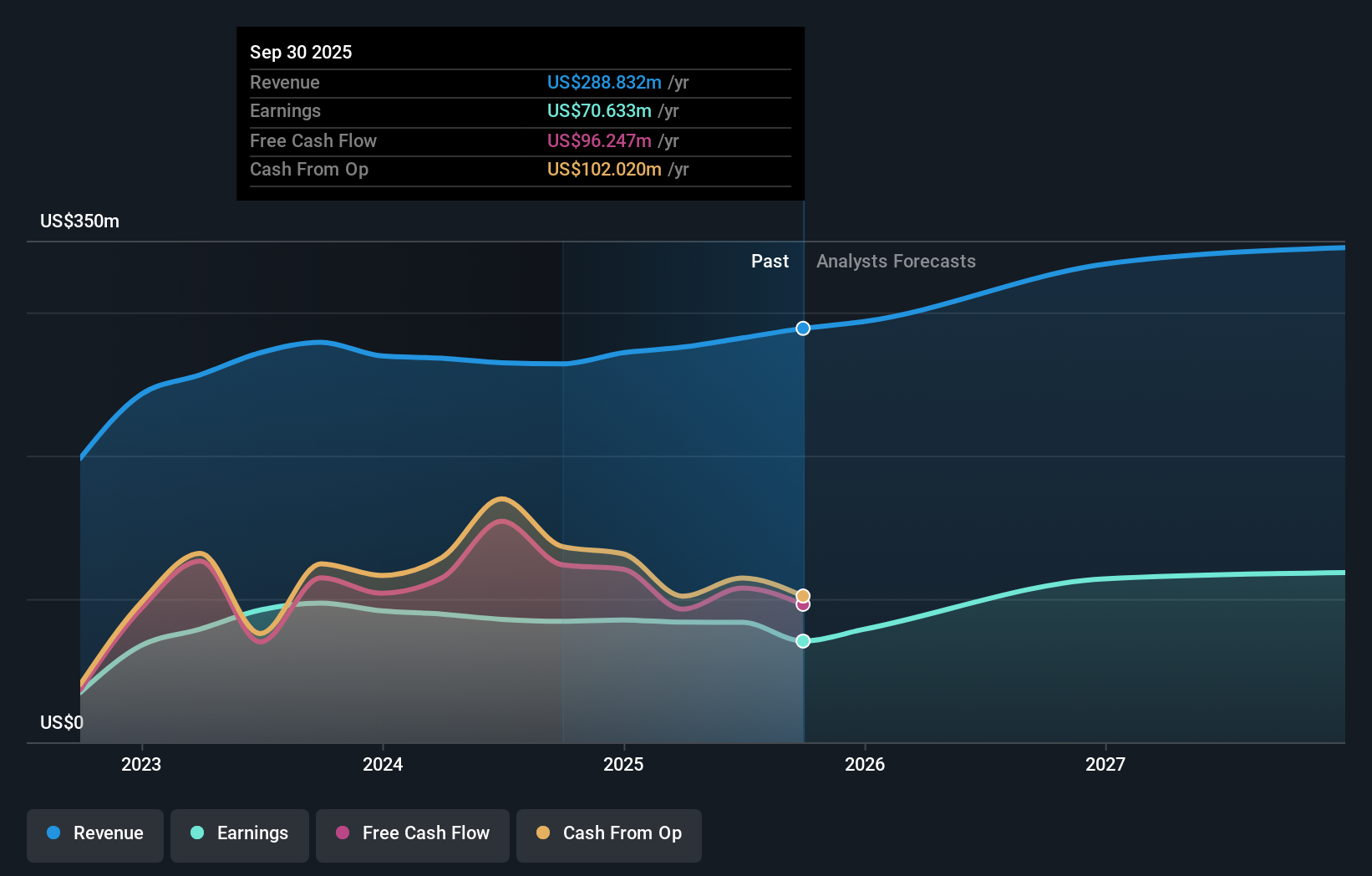

- ✅ Price vs Analyst Target: At US$20.40, the share price is about 14% below the US$23.80 analyst target, with the high end of estimates at US$26.00.

- ✅ Simply Wall St Valuation: Simply Wall St currently views Old Second Bancorp as undervalued, trading around 56.3% below its estimated fair value.

- ✅ Recent Momentum: The 30 day return of roughly 3.4% points to positive short term momentum into this buyback news.

There is only one way to know the right time to buy, sell or hold Old Second Bancorp. Head to Simply Wall St's company report for the latest analysis of Old Second Bancorp's Fair Value.

Key Considerations

- 📊 A US$43.9m repurchase authorization can reduce the share count over time, which may lift earnings per share if profits hold up.

- 📊 Watch how actively management uses the program at current P/E levels versus the 11.8x industry average and how that lines up with stated capital priorities.

- ⚠️ Shareholders have been diluted over the past year, so monitoring whether buybacks simply offset past issuance or go further will be important.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Old Second Bancorp analysis. Alternatively, you can check out the community page for Old Second Bancorp to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com