Is Enova International (ENVA) Still Attractively Valued After Its 3x Three-Year Share Price Surge?

- If you are wondering whether Enova International is still reasonably priced after its strong run, this article will help you size up what you are actually paying for today.

- The stock last closed at US$148.44, and while it has seen a 7.1% decline over the past week and a 5.8% decline over the past month, the 1 year return of 34.0% and roughly 3x return over 3 years have kept it firmly on many investors' watchlists.

- Recent coverage has focused on Enova International's role as a diversified financial services provider and the way its share price performance has compared with peers. This helps frame how sentiment has shifted around its business model and risk profile, which is important when you weigh whether the current price reflects cautious expectations or ongoing confidence in the company.

- On our valuation checks, Enova International currently scores 3 out of 6. We will look at what different valuation methods say about that score and then finish with a way of assessing value that goes beyond the usual ratios.

Approach 1: Enova International Excess Returns Analysis

The Excess Returns model asks a simple question: is Enova International earning enough on shareholders’ equity, after its cost of equity, to justify its current price? It looks at how much profit the company generates on each dollar of book value and compares that to what investors require as a return.

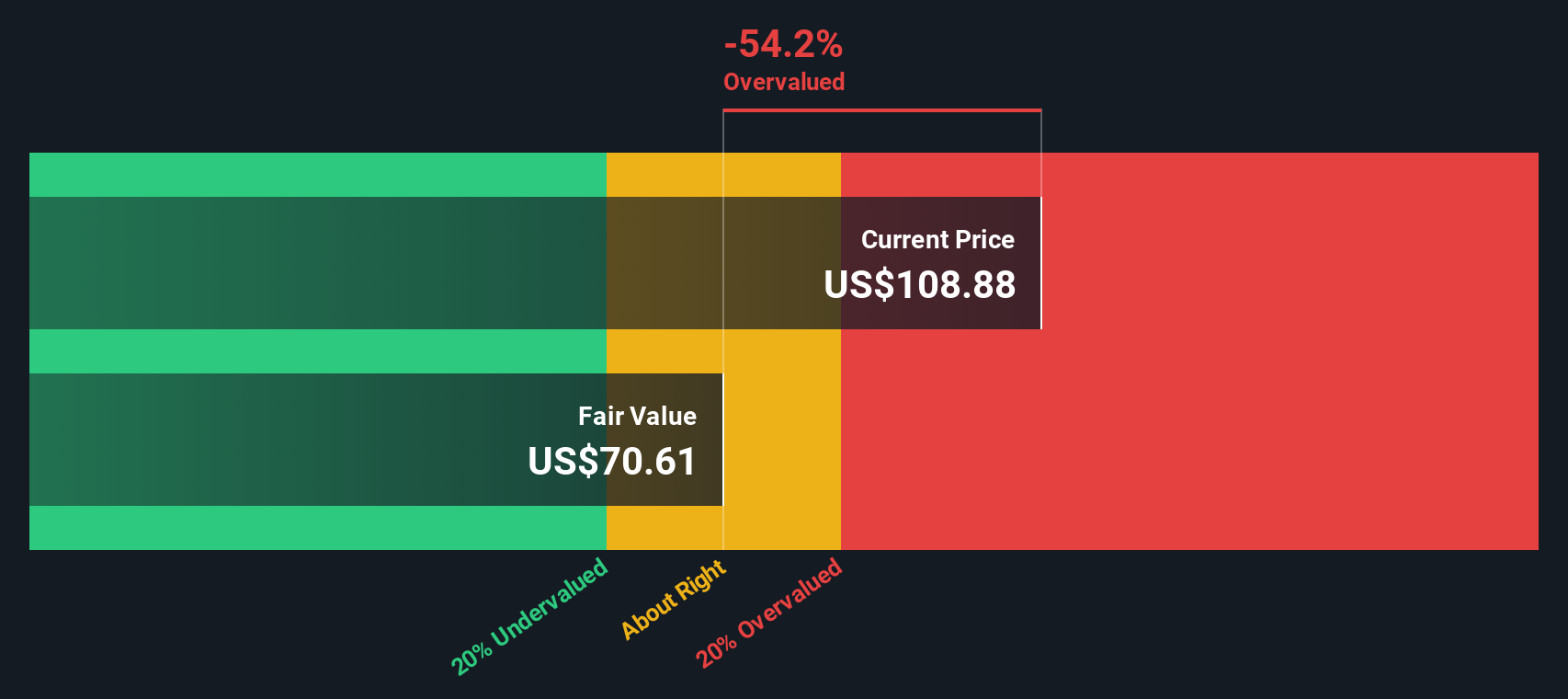

For Enova International, the model uses a Book Value of US$54.08 per share and a Stable EPS of US$7.30 per share, based on the median return on equity from the past 5 years. The implied Average Return on Equity is 16.87%, while the Cost of Equity is US$4.49 per share. That leaves an Excess Return of US$2.81 per share, using a Stable Book Value of US$43.31 per share, again based on the past 5 year median.

Feeding these assumptions into the Excess Returns framework gives an estimated intrinsic value of US$83.62 per share. Compared with the recent share price of US$148.44, the model suggests Enova International is 77.5% overvalued on this basis.

Result: OVERVALUED

Our Excess Returns analysis suggests Enova International may be overvalued by 77.5%. Discover 55 high quality undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Enova International Price vs Earnings

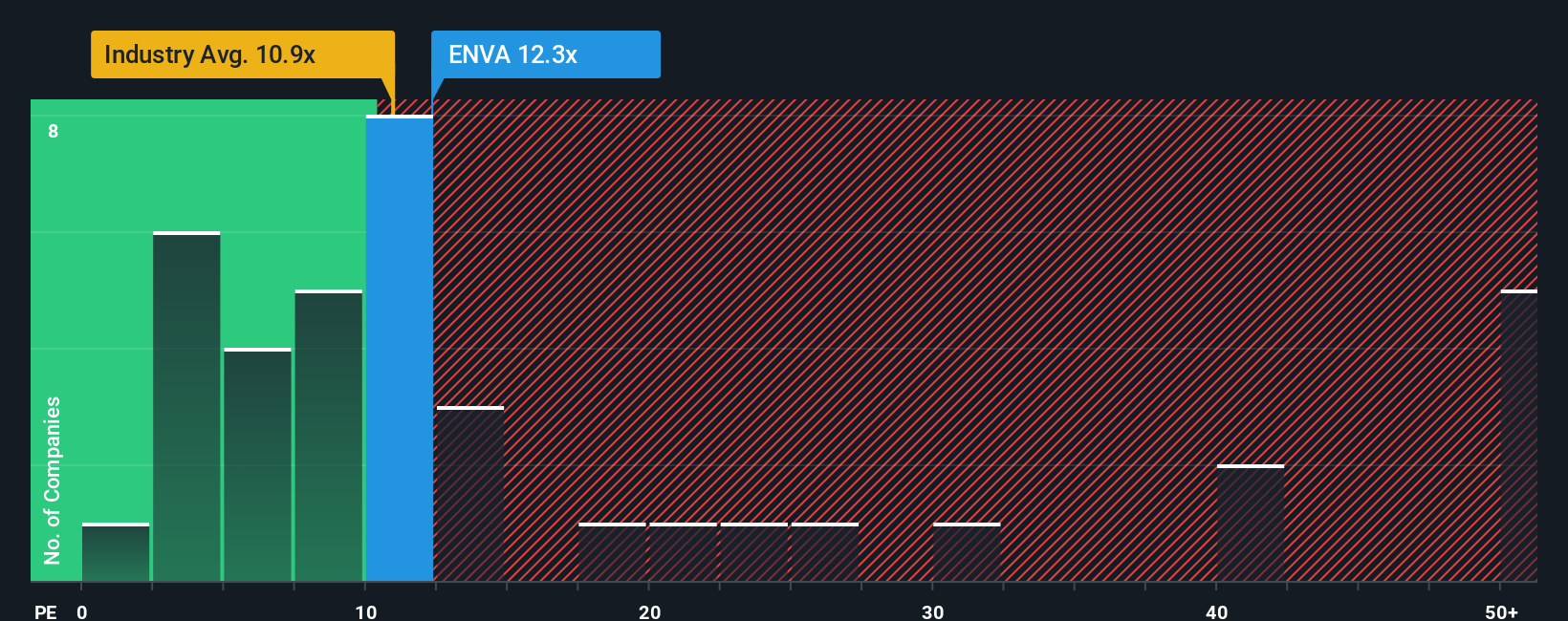

For profitable companies like Enova International, the P/E ratio is a straightforward way to think about value, because it links what you pay for each share to the earnings that business is currently generating.

What counts as a “normal” or “fair” P/E usually reflects two things: how quickly earnings are expected to grow and how risky those earnings are. Higher growth and lower perceived risk can justify a higher P/E, while slower growth or higher risk often mean a lower P/E is more appropriate.

Enova International currently trades on a P/E of 11.90x. That sits above the Consumer Finance industry average of 8.16x, but below the peer group average of 19.73x. To go a step further, Simply Wall St uses a proprietary “Fair Ratio” for the P/E, which for Enova International is 16.98x. This Fair Ratio attempts to adjust for company specific factors such as earnings growth, risk profile, profit margins, industry and market cap, rather than relying only on broad peer or industry comparisons.

Comparing the current P/E of 11.90x with the Fair Ratio of 16.98x suggests Enova International trades below the level implied by these fundamentals.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Enova International Narrative

Earlier we mentioned that there is an even better way to understand valuation. Narratives on Simply Wall St let you put a clear story behind the numbers by linking your view of Enova International’s business to a specific forecast for revenue, earnings and margins, then to a fair value that you can compare with the current share price. All of this happens within an easy tool on the Community page that updates as new news or earnings arrive. One investor might build a Narrative that lines up with the higher fair value of about US$193.71 per share, while another might anchor closer to the lowest analyst target of US$111.00. By seeing these different stories side by side, you can judge where your own expectations sit and whether the current price feels closer to an opportunity or a reason to be cautious.

Do you think there's more to the story for Enova International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com