Is Wolverine World Wide (WWW) Pricing In Its Business Reshaping Efforts?

- If you are looking at Wolverine World Wide and asking yourself whether the current share price reflects its true worth, you are not alone.

- The stock recently closed at US$17.73, with returns of 2.0% decline over 7 days, 5.6% decline over 30 days, 2.6% decline year to date, 4.0% decline over 1 year, 23.3% gain over 3 years and 38.7% decline over 5 years, which can change how investors think about both risk and future potential.

- Recent news coverage has focused on Wolverine World Wide's efforts to reshape its business and brand portfolio, as well as market commentary on how footwear and apparel companies are handling changing consumer demand. Together, these updates give helpful context for why the share price has moved the way it has over different time frames.

- On our valuation checks, Wolverine World Wide scores 5 out of 6, giving it a value score of 5/6. Next we will walk through what that means using several common valuation approaches before finishing with a broader way to think about the company’s value.

Approach 1: Wolverine World Wide Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company could be worth by projecting its future cash flows and then discounting them back to today using a required return. It is essentially asking what those future dollars are worth in present terms.

For Wolverine World Wide, the model used is a 2 Stage Free Cash Flow to Equity approach. The company’s latest twelve month free cash flow is US$57.21 million. Analysts provide explicit forecasts out to 2027, with free cash flow for that year projected at US$135.24 million. Beyond that, Simply Wall St extrapolates further, with ten year projections running through 2035 based on those early year estimates.

When all those projected cash flows are discounted back and combined, the DCF model arrives at an estimated intrinsic value of US$30.45 per share. Compared with the recent share price of US$17.73, this implies the stock is about 41.8% undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wolverine World Wide is undervalued by 41.8%. Track this in your watchlist or portfolio, or discover 55 more high quality undervalued stocks.

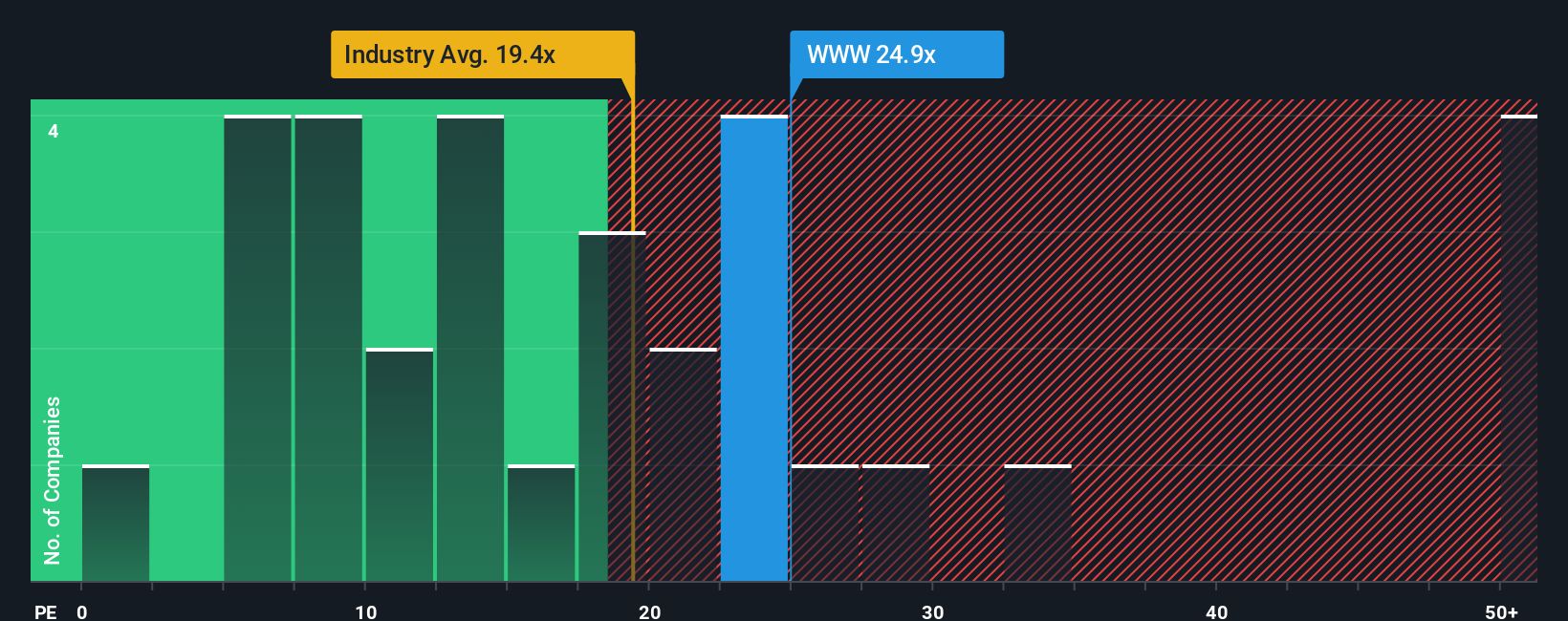

Approach 2: Wolverine World Wide Price vs Earnings

For profitable companies, the P/E ratio is a useful yardstick because it links what you are paying directly to the earnings the business is already generating. Investors usually accept a higher P/E when they expect stronger growth or see lower risk, and a lower P/E when growth expectations are more modest or risks feel higher.

Wolverine World Wide currently trades on a P/E of 16.7x. That sits below the Luxury industry average of about 18.9x and also below the peer group average of roughly 27.1x. This suggests the market is assigning a lower earnings multiple than many comparable companies.

Simply Wall St’s Fair Ratio for Wolverine World Wide is 17.0x. This is a proprietary estimate of what the P/E could be based on factors such as the company’s earnings growth profile, industry, profit margins, market cap and specific risks. Because it blends these company specific inputs, it can be more tailored than a simple comparison with broad industry or peer averages.

Comparing the Fair Ratio of 17.0x with the actual P/E of 16.7x, the gap is small, so the shares look ABOUT RIGHT on this metric.

Result: ABOUT RIGHT

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Wolverine World Wide Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St’s Community page you can use Narratives, where you and other investors connect Wolverine World Wide’s story to a set of assumptions about future revenue, earnings and margins. These assumptions then roll into a fair value that can be compared with today’s share price to help you judge whether it looks attractive, expensive or somewhere in between. These Narratives update automatically as new news or earnings arrive and span a range of views from more optimistic fair values around US$35.92 per share to more cautious ones near US$17.00 per share, all based on different interpretations of the same business.

For Wolverine World Wide however, we’ll make it really easy for you with previews of two leading Wolverine World Wide Narratives:

🐂 Wolverine World Wide Bull Case

Fair value in this bullish narrative: US$21.33 per share

Implied discount to that fair value at the last close of US$17.73: about 16.9% undervalued using this narrative’s fair value

Revenue growth assumption in this narrative: about 5.0% a year

- Analysts in this camp expect international expansion, digital channels and health and outdoor trends to support revenue and margins over time.

- They see portfolio clean up and supply chain work as important supports for gross margin resilience even with tariff and cost risks.

- In their view, if revenue, margins and earnings track the assumptions, the current price leaves room for upside relative to this fair value estimate.

🐻 Wolverine World Wide Bear Case

Fair value in this bearish narrative: US$17.00 per share

Implied premium to that fair value at the last close of US$17.73: about 4.1% overvalued using this narrative’s fair value

Revenue growth assumption in this narrative: about 4.9% a year

- This view puts more weight on slower progress in Work Group, reliance on wholesale and the impact of tariffs and cost inflation on earnings.

- It assumes only mid single digit revenue growth and more modest margin improvement, which keeps the fair value close to the current share price.

- To agree with this stance, you would need to be comfortable with lower earnings and a reduced P/E multiple compared to more optimistic analyst expectations.

Together, these two narratives frame the current debate around Wolverine World Wide. Your next step is to decide which set of assumptions feels closer to how you see the brands, channels and risks playing out over time, then test whether the current share price lines up with your own view of fair value.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Wolverine World Wide? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com