A Look At Bentley Systems (BSY) Valuation As SaaS Investors Rotate Back To Established Names

Analysts flagging oversold conditions across SaaS have pushed some investors back toward established names, and Bentley Systems (BSY) is feeling that shift as attention turns to its infrastructure focused software franchise.

See our latest analysis for Bentley Systems.

At a share price of US$34.10, Bentley Systems has seen a 6.5% 7 day share price return after a 30 day share price decline of 13.6% and a 90 day share price decline of 21%. Its 1 year total shareholder return sits at a 26.6% loss, pointing to short term momentum recovering after a tougher period for longer term holders as SaaS sentiment resets.

If this SaaS rebound has you thinking about where software demand could go next, it might be worth checking out our screener of 34 AI infrastructure stocks as another way to look for opportunity tied to digital infrastructure spending.

So, with Bentley Systems posting a 26.6% 1-year total shareholder return loss despite reporting higher revenue and net income, is the stock quietly offering value at this level, or is the market already fully reflecting its growth prospects in the current price?

Most Popular Narrative: 41.4% Undervalued

With Bentley Systems closing at $34.10 against a widely followed fair value estimate of $58.21, the narrative is framing a sizeable valuation gap that rests on long term infrastructure software demand and agentic AI adoption.

Sustained global investment in infrastructure driven by government initiatives in the US, UK, EU, and high growth regions like India and the Middle East continues to expand Bentley's addressable market, supporting durable double digit ARR and revenue growth. Large scale productivity challenges (such as the shortage of skilled engineers) are forcing the sector to accelerate digital transformation, elevating demand for Bentley's AI driven, cloud based, and digital twin solutions, which should drive both revenue expansion and higher margin product mix.

Curious what sits behind that confidence in long run revenue, margin, and earnings power, and how it translates into today’s fair value math? The narrative leans on specific growth rates, profitability shifts, and a future earnings multiple that does a lot of heavy lifting. If you want to see exactly which assumptions need to hold for that valuation gap to close, the full story lays those numbers out in black and white.

Result: Fair Value of $58.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still hinges on agentic AI bets paying off, and on competitors not squeezing pricing or share more than analysts currently factor in.

Find out about the key risks to this Bentley Systems narrative.

Another Angle On The Valuation

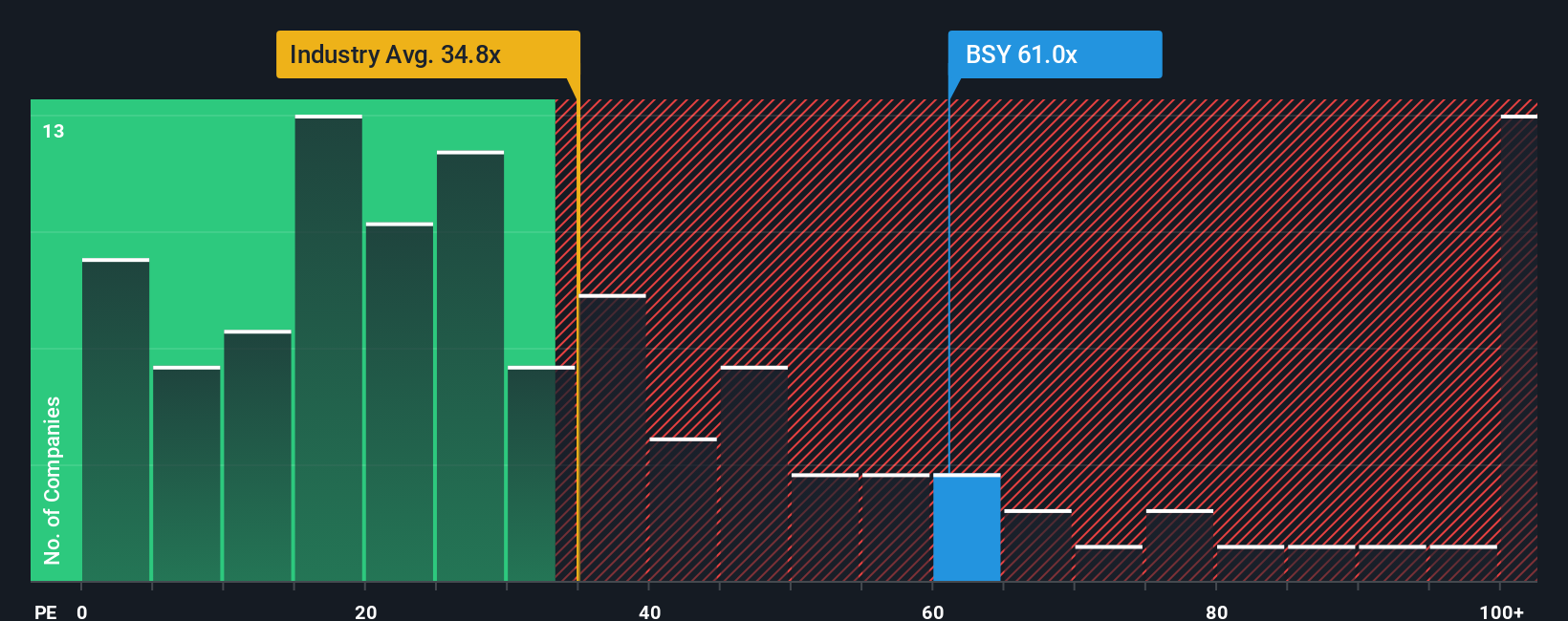

If the narrative fair value of $58.21 paints Bentley as undervalued, the earnings multiple tells a different story. At a P/E of 39.8x, the shares sit well above the US Software average of 27.1x and a fair ratio of 28.5x, which points to less room for error if growth or margins fall short. So is this a reset opportunity, or is the bar simply set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bentley Systems Narrative

If you are not fully on board with this storyline or simply prefer to test the numbers yourself, you can build a custom view in just a few minutes, then Do it your way.

A great starting point for your Bentley Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Bentley has sharpened your thinking, do not stop here. Broaden your watchlist with focused ideas that could suit very different investing goals.

- Target potential mispricing by reviewing our list of 55 high quality undervalued stocks that pair solid business fundamentals with prices that may not fully reflect their profiles.

- Strengthen your income stream by scanning 16 dividend fortresses that aim for higher yields while keeping an eye on durability.

- Dial down portfolio stress by considering 84 resilient stocks with low risk scores that score better on balance sheet strength and risk metrics than many broad market alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com