A Look At Dorchester Minerals (DMLP) Valuation After Dividend Increase And Insider Buying

Dividend move and insider buying put Dorchester Minerals (DMLP) in focus

Dorchester Minerals (DMLP) has drawn fresh attention after lifting its quarterly dividend to $0.7557 per unit, alongside insider purchases by its director and CFO that may indicate confidence in the partnership’s outlook.

See our latest analysis for Dorchester Minerals.

Those dividend and insider buying headlines come after a period where the 30 day share price return of 8% and 90 day gain of 6.82% sit against a 1 year total shareholder return decline of 12.47%, even as the 5 year total shareholder return is very large.

If income and energy exposure are on your radar after this move, it might be worth widening the lens and checking out 21 elite gold producer stocks as another way to source commodity linked ideas.

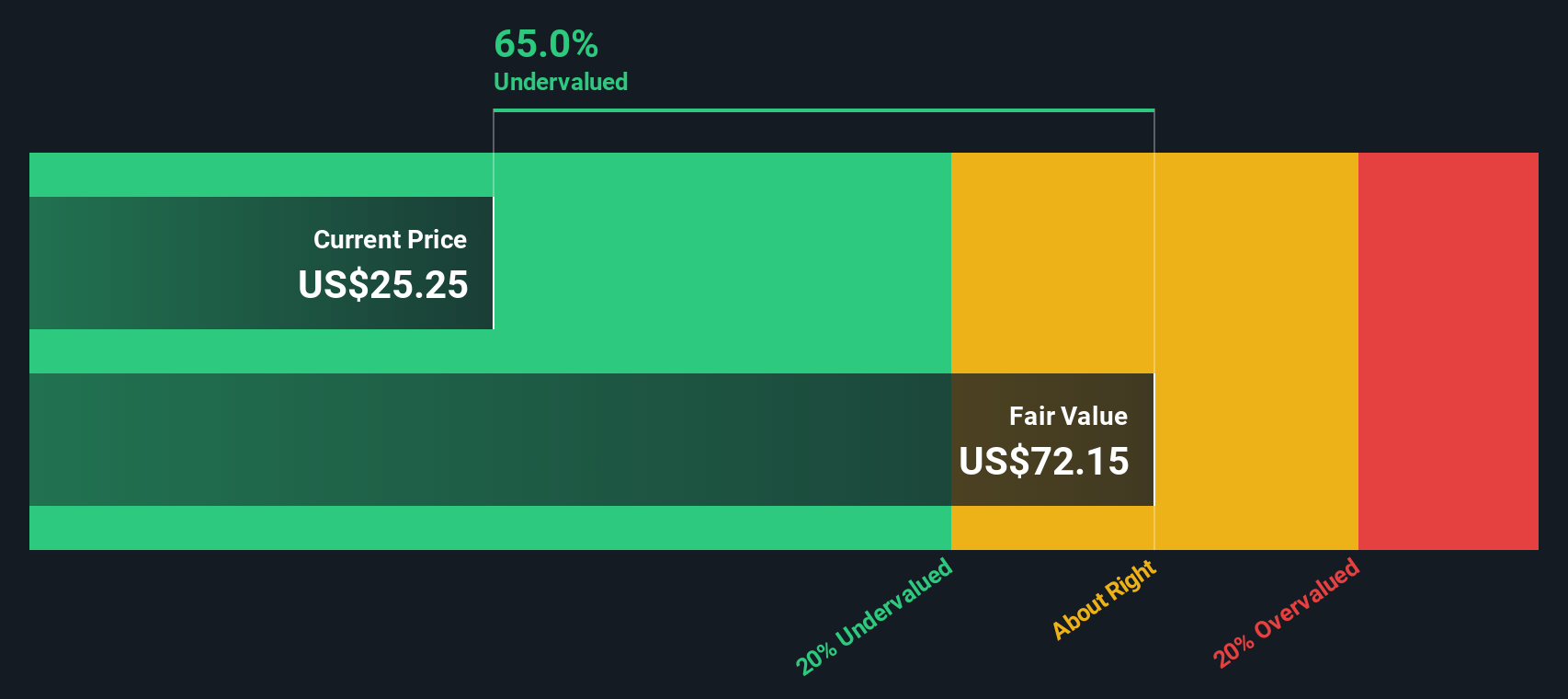

With DMLP trading at a very large intrinsic discount of about 64% and a long run total return that is also very large, you have to ask: is this a genuine value opportunity, or is the market already factoring in its future potential?

Preferred P/E of 22.8x: Is it justified?

On our data, Dorchester Minerals trades on a P/E of 22.8x, which sits below its direct peer average of 25.2x but above the wider US Oil and Gas group at 14.5x.

The P/E ratio compares the current unit price with earnings per unit, so for DMLP it effectively reflects what investors are paying for each dollar of royalty related profit today.

Over the past five years, earnings have grown by 13.8% a year. However, the most recent year showed a 51.9% earnings decline and profit margins narrowing from 66.7% to 37.1%. Against that mix of longer term growth and a weaker latest year, a 22.8x P/E below peers but above the industry suggests the market is weighing both the income appeal and the recent earnings setback quite carefully.

Compared with the broader US Oil and Gas industry average P/E of 14.5x, DMLP’s 22.8x multiple is materially richer. This signals investors are currently willing to pay a premium price tag versus the sector even after a year where returns lagged both the market and industry.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 22.8x (ABOUT RIGHT)

However, you also need to weigh the recent 51.9% earnings drop and the 12.47% total return decline over the past year as possible signals that the premium could compress.

Find out about the key risks to this Dorchester Minerals narrative.

Another View: DCF points to a much bigger gap

While the 22.8x P/E feels roughly in line with peers, our DCF model presents a very different perspective. It puts DMLP’s future cash flow value at $69.37 per unit versus a $25.22 price today, implying the units trade at about a 64% discount. Which signal appears more compelling?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dorchester Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dorchester Minerals Narrative

If you see the data differently or simply prefer to run your own checks, you can shape a complete view in just a few minutes: Do it your way.

A great starting point for your Dorchester Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next investment idea?

If you stop with just one stock today, you could be walking past other opportunities that fit your goals and risk comfort just as well.

- Zero in on quality at a discount by checking companies in our 55 high quality undervalued stocks that pair stronger fundamentals with appealing valuations.

- Prioritise resilience and sleep better at night by scanning companies in the 84 resilient stocks with low risk scores that score well on risk factors.

- Spot future contenders early by reviewing our screener containing 23 high quality undiscovered gems packed with lesser known names backed by solid financial profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com