Alamo Group Weighs Margin Pressure Against Resilient Share Price Performance

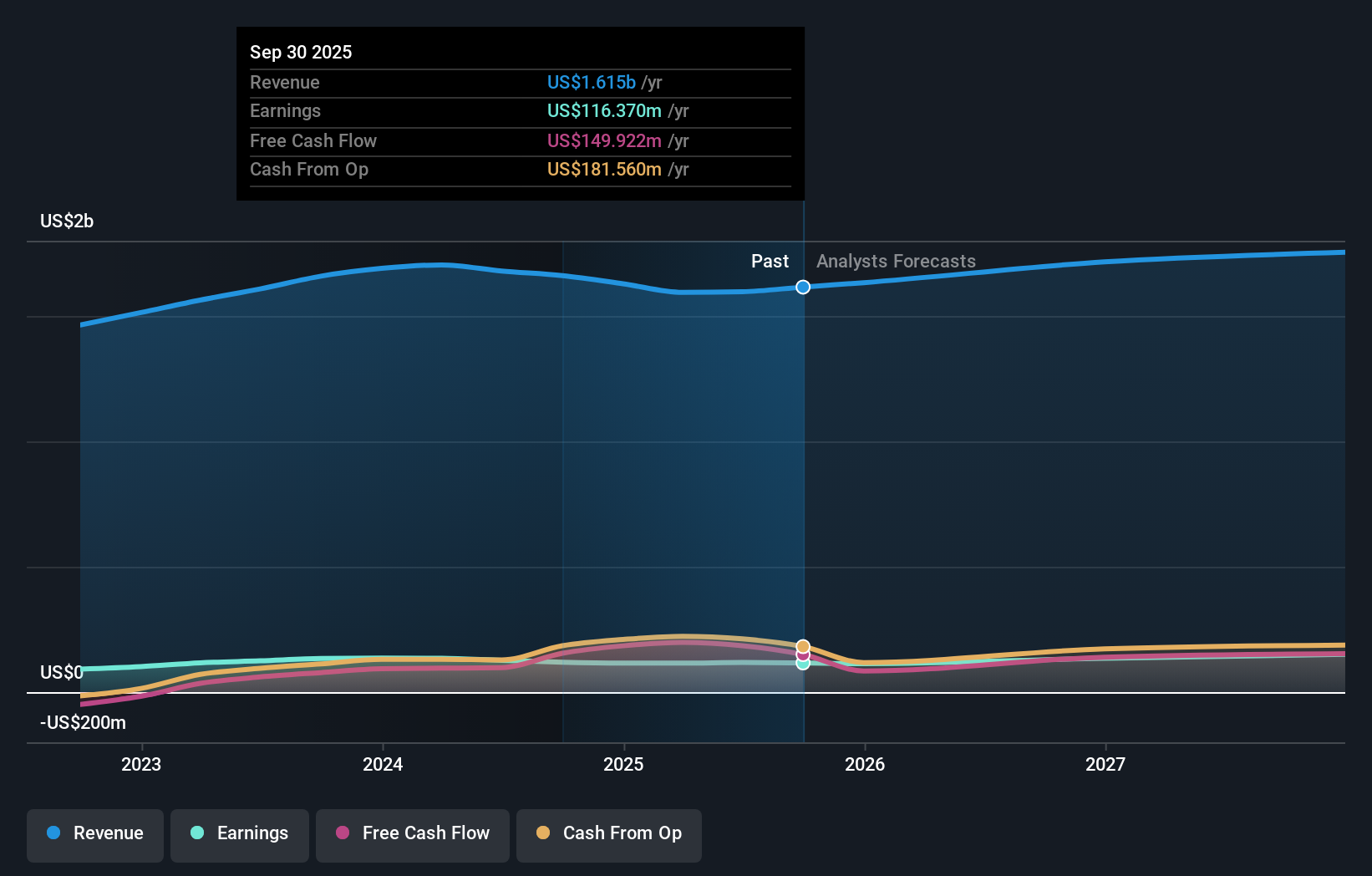

- Alamo Group (NYSE:ALG) is experiencing ongoing revenue and earnings declines tied to persistently high production costs.

- These elevated costs are compressing the company’s gross margin and weighing on overall financial performance.

- The trend has continued over multiple years, raising fresh questions about operational efficiency and long term profitability.

Alamo Group, trading at around $209.2, is coming under closer scrutiny as its revenue and earnings move lower while production costs stay high. The stock has delivered a 22.7% return year to date and 13.7% over the past year. This suggests the market has not fully turned away from the story. For you as an investor, that mix of share price resilience and weaker fundamentals is an important tension to understand.

With several years of compressed gross margins already reported, a key question is how effectively Alamo Group can address its cost base and protect profitability. You may want to watch for concrete steps to improve manufacturing efficiency, adjust pricing, or reshape the product mix. How the company responds to this pressure could be important for the future risk and reward profile of NYSE:ALG.

Stay updated on the most important news stories for Alamo Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Alamo Group.

We've flagged 0 risks for Alamo Group. See which could impact your investment.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$209.20, Alamo Group trades about 5% below the US$219.75 analyst target, which sits comfortably inside the US$190 to US$252 range.

- ⚖️ Simply Wall St Valuation: Shares are described as trading close to estimated fair value, so the price does not screen as either clearly cheap or expensive.

- ✅ Recent Momentum: A 30 day return of roughly 10.8% shows the share price has been firm even as revenue and earnings come under pressure from higher production costs.

The timing of any decision to buy, sell or hold Alamo Group depends on your own analysis and circumstances. For more detail, visit Simply Wall St's company report for the latest assessment of Alamo Group's fair value.

Key Considerations

- 📊 Persistently high production costs are pressuring revenue and earnings, so you may want to weigh current pricing against the risk that margins remain tight.

- 📊 Keep an eye on gross margin trends, cost saving initiatives, and whether the P/E of 21.8x stays below the Machinery industry average of 29.9x.

- ⚠️ The key risk in this story is that cost inflation outpaces any operational improvements, which could limit profitability even if demand holds up.

Dig Deeper

For the full picture, including more risks and potential rewards, check out the complete Alamo Group analysis. You can also visit the community page for Alamo Group to see how other investors believe this latest news may affect the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com