FormFactor Rally Faces Valuation Questions As Advanced Test Demand Builds

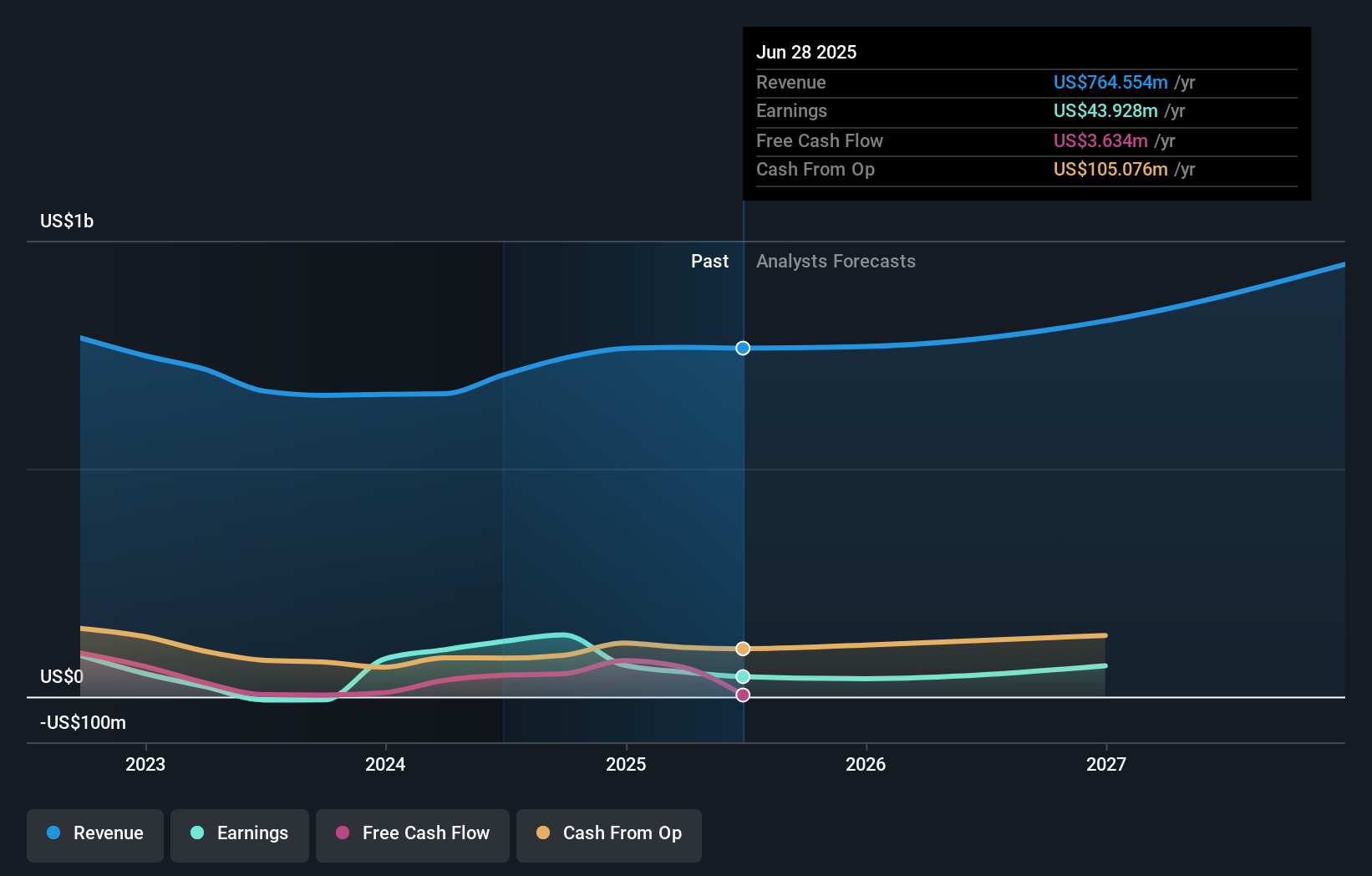

- FormFactor (NasdaqGS:FORM) reported strong quarterly results, with management citing operational improvements and rising demand for advanced semiconductor testing.

- Company leadership highlighted new product qualifications, particularly around its SmartMatrix architecture, as well as expanding output capacity as key focus areas.

- Management pointed to growing activity in DRAM and advanced packaging test as important contributors to recent performance.

For investors tracking semiconductor test equipment, FormFactor stands out right now. The stock trades at $93.68, with returns of 11.7% over the past week, 29.1% over the past month, and 58.3% year to date. Over the past 1 year the share price is up 155.0%, and over 3 years it is up 189.4%, with a 5 year gain of 97.5%.

Management is focusing on demand around SmartMatrix, DRAM and advanced packaging while also working on manufacturing capability and product development. These efforts, and how they translate into execution and product uptake, may influence how the company competes in advanced semiconductor testing and how investors view NasdaqGS:FORM over time.

Stay updated on the most important news stories for FormFactor by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on FormFactor.

📰 Beyond the headline: 1 risk and 1 thing going right for FormFactor that every investor should see.

Quick Assessment

- ❌ Price vs Analyst Target: At $93.68, FormFactor trades about 11% above the US$84.11 consensus price target.

- ❌ Simply Wall St Valuation: Shares are described as trading 58.5% above estimated fair value, which flags valuation risk.

- ✅ Recent Momentum: The stock is up about 29.1% over the past 30 days, showing strong recent momentum following the results.

There is only one way to know the right time to buy, sell or hold FormFactor. Head to Simply Wall St's company report for the latest analysis of FormFactor's Fair Value.

Key Considerations

- 📊 Strong quarterly results tied to advanced semiconductor testing demand suggest the core business is closely aligned with current test needs.

- 📊 Investors may want to watch execution on SmartMatrix qualifications, output capacity expansion and whether earnings growth supports the current 133.6x P/E and 69.3x forward P/E.

- ⚠️ One flagged risk is significant insider selling over the past 3 months, which some investors may weigh against the recent share price strength.

Dig Deeper

For the full picture including more risks and rewards, check out the complete FormFactor analysis. Alternatively, you can check out the community page for FormFactor to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com