A Look At Arcus Biosciences (RCUS) Valuation After Recent Share Price Weakness

Why Arcus Biosciences (RCUS) is on investors’ radar

Arcus Biosciences (RCUS) has drawn fresh attention after recent trading left the shares around $19.96, with returns showing mixed signals across the past week, month, past 3 months, and year to date.

For investors tracking longer term performance, Arcus shows a 1 year total return of 57.17%, alongside a 3 year total return near 3% and a 5 year total return that reflects meaningful volatility over time.

See our latest analysis for Arcus Biosciences.

The share price has pulled back to $19.96 with a 1 month share price return of 12.23% decline and a year to date share price return of 14.30% decline. However, the 1 year total shareholder return of 57.17% suggests earlier momentum that has cooled recently as investors reassess growth prospects and risks around Arcus’ cancer drug pipeline.

If this biotech story has you thinking about other opportunities at the intersection of healthcare and technology, it could be a good moment to scan 24 healthcare AI stocks for more ideas beyond Arcus.

With Arcus trading near $19.96, carrying a value score of 4, recent share price declines, and a discount to a $32.30 price target, investors may ask whether this represents a buying opportunity or whether future growth is already priced in.

Most Popular Narrative: 39.5% Undervalued

Arcus Biosciences’ most followed narrative points to a fair value of $33 per share, which sits above the recent $19.96 close and puts its cancer pipeline assumptions under the spotlight.

The analysts have a consensus price target of $28.364 for Arcus Biosciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $47.0, and the most bearish reporting a price target of just $12.0.

Read the complete narrative. Read the complete narrative.

Want to see what is driving that higher fair value versus today’s price? Revenue ramps, margin shifts and a punchy future earnings multiple all play a part. Curious which assumptions carry the most weight in that $33 mark and how they tie back to casdatifan and the wider trial suite? The full breakdown lays out the numbers behind this valuation story.

Result: Fair Value of $33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if key trials disappoint or if casdatifan faces regulatory setbacks that delay or reduce the value that investors are currently assuming.

Find out about the key risks to this Arcus Biosciences narrative.

Another View on Valuation

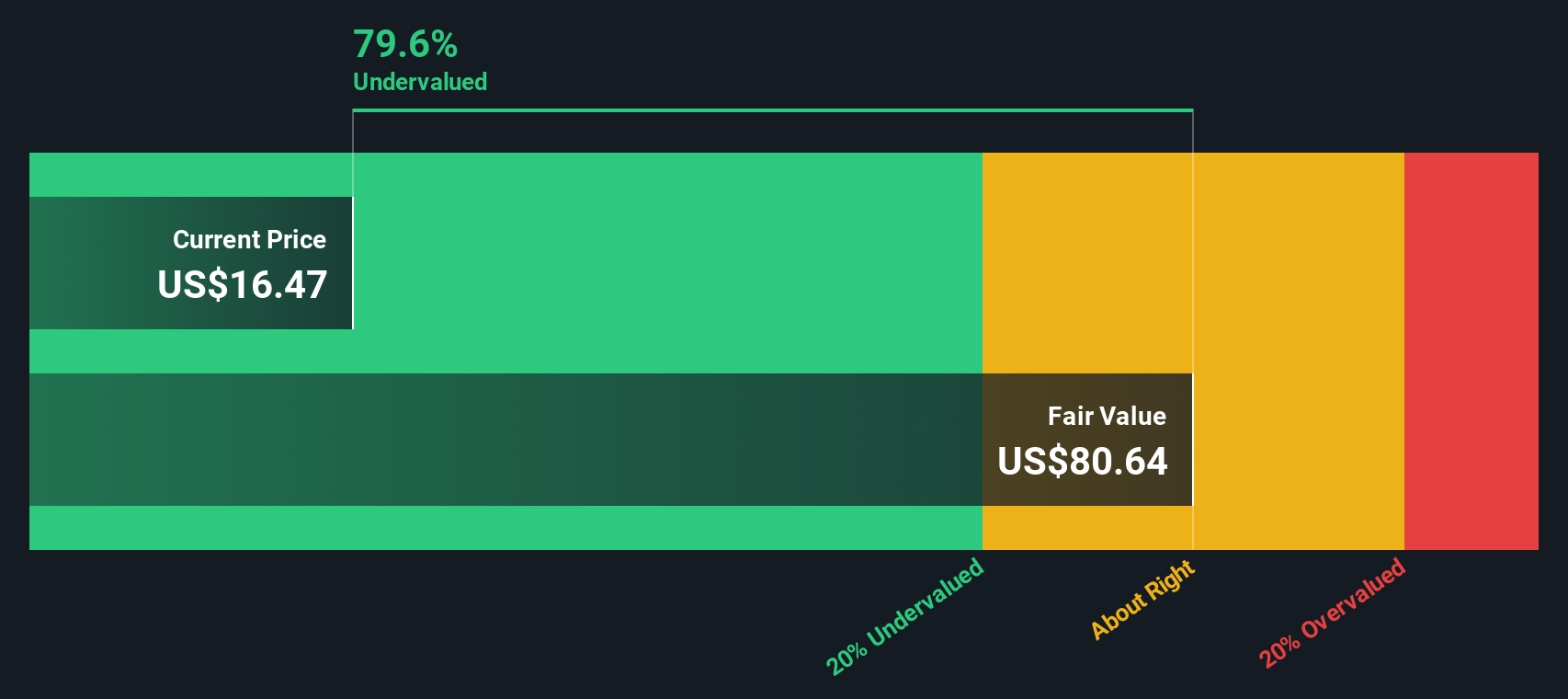

That fair value of $33 leans heavily on long term cash flow assumptions. Our DCF model points to an estimate of $130.70 per share, which indicates Arcus is very deeply undervalued based on that approach. The question is whether you are comfortable relying on such long dated projections.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Arcus Biosciences Narrative

If the story so far does not quite match how you see Arcus, you can stress test the same data, shape your own view, and build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Arcus Biosciences research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Arcus has sharpened your interest, do not stop here. Broaden your watchlist with other high conviction ideas that fit your risk appetite and income goals.

- Target resilience first by checking companies that show lower risk characteristics through our 84 resilient stocks with low risk scores and see which ones match your comfort level.

- Hunt for quality at a sensible price by scanning 55 high quality undervalued stocks and spot businesses that our metrics flag as potentially trading below their underlying strength.

- Build a steadier income stream by reviewing 16 dividend fortresses and see which higher yielding companies line up with your return and reliability expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com