Assessing Dynatrace (DT) Valuation After Strong Q3, Raised 2026 Guidance And New US$1b Buyback

Dynatrace (DT) just delivered third quarter results that topped its own guidance, raised its full year 2026 outlook, launched a new US$1b buyback program, and introduced Dynatrace Intelligence for its AI observability platform.

See our latest analysis for Dynatrace.

Even with the post earnings bounce, Dynatrace’s recent share price performance has been under pressure, with a 30 day share price return of an 11.65% decline and a 1 year total shareholder return of a 41.39% loss. This suggests that recent enthusiasm around the raised guidance, new AI features, and extended buyback is coming off a weaker longer term base.

If this AI observability update has your attention, it could be a good moment to look across the sector and see what else is on the move through our 59 profitable AI stocks that aren't just burning cash.

With the shares down sharply over the past year, trading at a discount to analyst targets and company estimates of intrinsic value, the key question is whether this is a reset that leaves Dynatrace undervalued or if the market is already accounting for its future growth.

Most Popular Narrative: 29.7% Undervalued

At a last close of $36.56 against a narrative fair value of $52.03, the story framing Dynatrace today leans heavily on AI driven expansion and recurring revenue.

The company's unified platform approach, particularly the growing success of Grail powered log management (over 100% YoY log consumption growth and targeting $100M in annualized consumption), is driving multi product adoption and higher customer stickiness, which should improve net retention rates, recurring revenue, and long term earnings predictability.

Curious what sits behind that confidence in stickier revenue and higher predictability? The most followed narrative leans on specific growth, margin, and valuation assumptions that are anything but modest.

Result: Fair Value of $52.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can quickly change if hyperscalers and open source tools squeeze pricing, or if longer and lumpier enterprise deals start to disrupt revenue timing.

Find out about the key risks to this Dynatrace narrative.

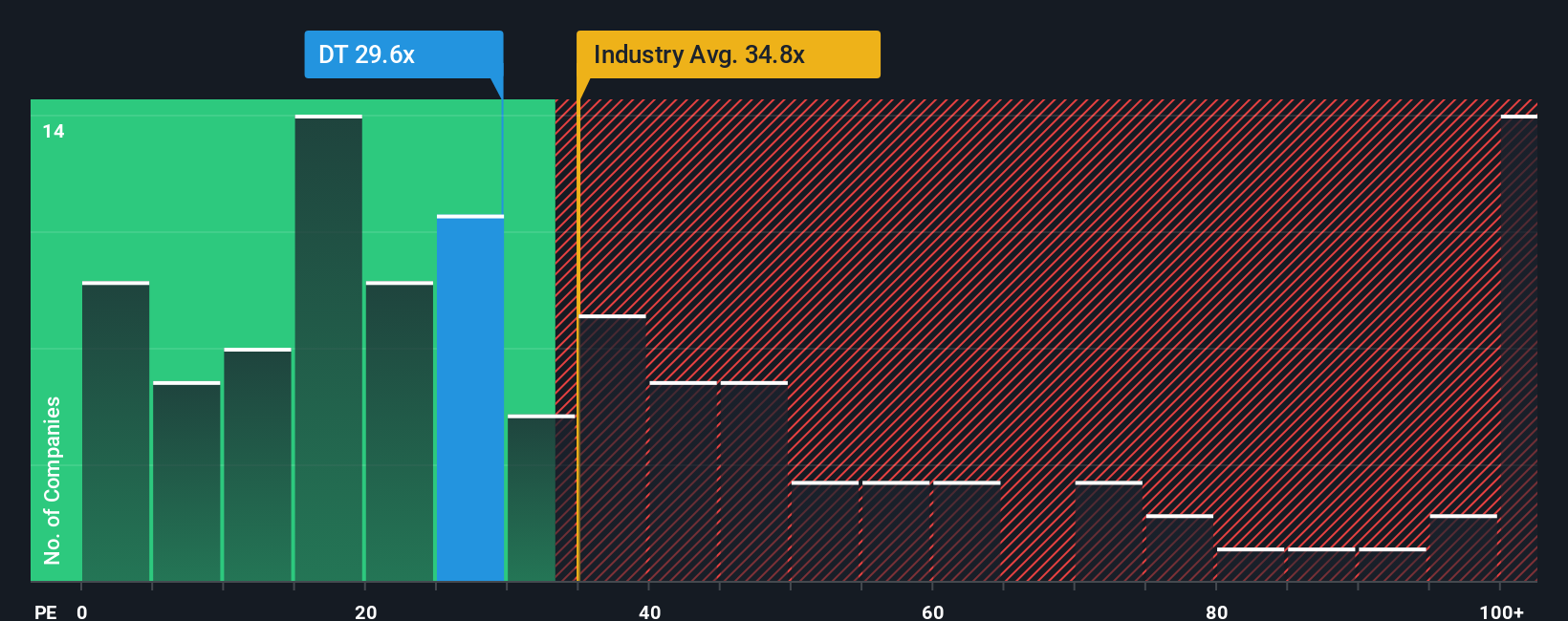

Another View: Earnings Multiple Sends A Different Signal

That 29.7% undervaluation story sits awkwardly next to how the market is actually pricing Dynatrace today. The shares trade on a P/E of 59.1x, versus a fair ratio of 34.3x, 57.2x for peers, and 26.7x for the broader US Software industry. That is a lot of optimism embedded in the current price. Which story do you trust more: the narrative model or what the multiples are hinting at?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dynatrace Narrative

If you see the numbers differently or want to stress test your own assumptions, you can spin up a custom Dynatrace story in just a few minutes. Start by hitting Do it your way.

A great starting point for your Dynatrace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Dynatrace has sharpened your thinking, do not stop here. The strongest portfolios often come from comparing many high quality ideas side by side.

- Target long term value by scanning a curated set of 55 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them.

- Focus on resilience first and check out 85 resilient stocks with low risk scores where financial strength and lower risk scores sit at the center of the filter.

- Hunt for future leaders before the crowd by reviewing our screener containing 23 high quality undiscovered gems with solid fundamentals that are not yet widely followed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com