Motorola Solutions (MSI) EPS Surge Versus Mid Single Digit Revenue Growth Tests Bullish Narratives

How Motorola Solutions' FY 2025 Numbers Stack Up

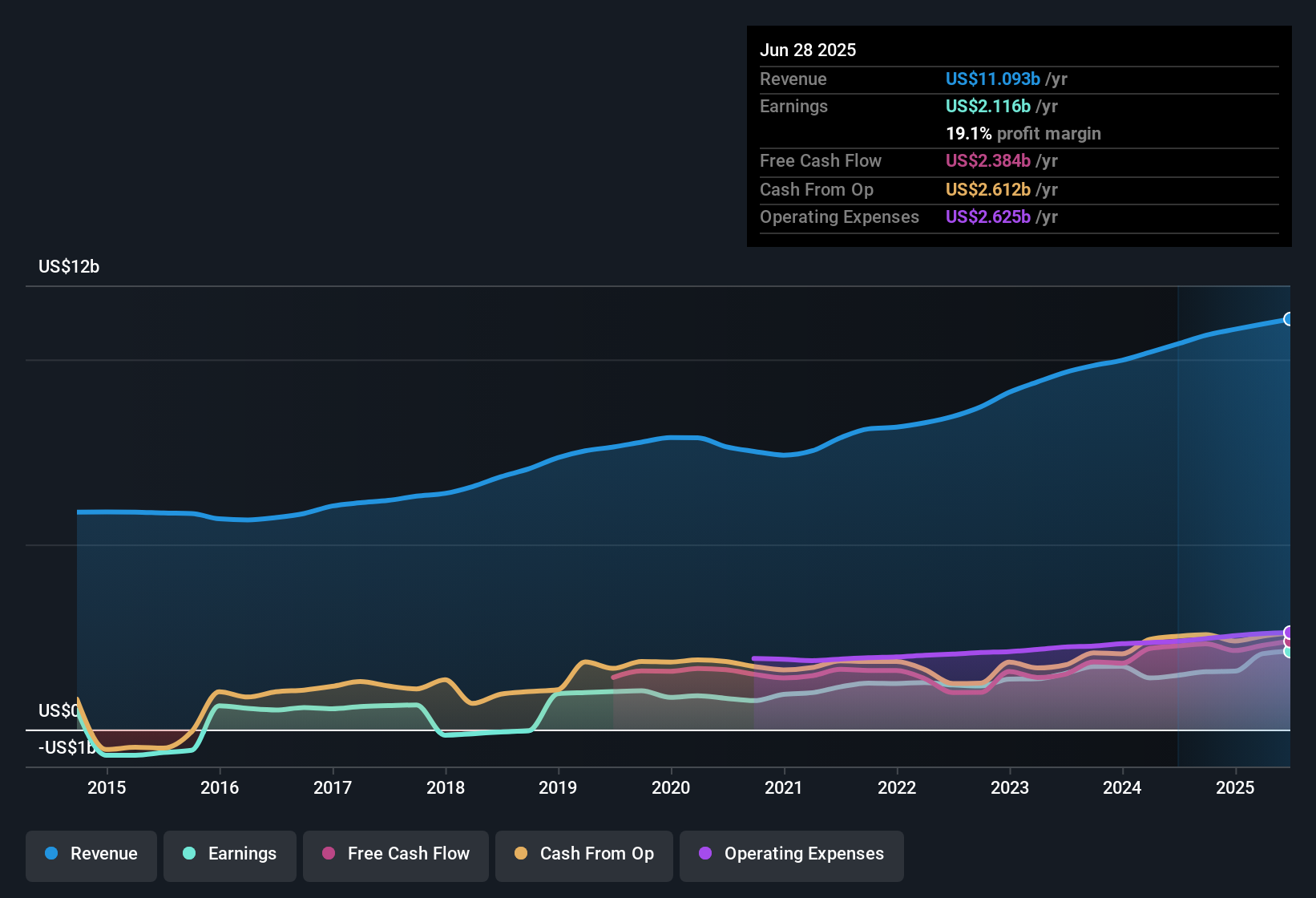

Motorola Solutions (MSI) just wrapped up FY 2025 with Q4 revenue of US$3.4b and basic EPS of US$3.90, alongside trailing twelve month revenue of US$11.7b and EPS of US$12.93 that reflect the 36.6% earnings growth and 18.4% net margin cited in recent analysis. The company has seen quarterly revenue range from US$2.5b in Q1 2025 to US$3.4b in Q4 2025, while basic EPS stepped through US$2.58, US$3.08, US$3.37, then US$3.90 over the same period. This progression gives investors a clearer view of how the earnings power has built into those latest trailing twelve month figures. Taken together with the margin profile flagged in the analysis, this earnings print provides a basis for investors to assess how durable the current profitability may be over the longer term.

See our full analysis for Motorola Solutions.With the numbers on the table, the next step is to see how these results line up against the most widely followed narratives around Motorola Solutions, and where those stories might need updating.

See what the community is saying about Motorola Solutions

Margins Backed By US$2.2b Net Income

- On a trailing basis, Motorola Solutions earned US$2.2b in net income with an 18.4% net margin, compared with US$1.6b and a 14.6% margin a year earlier. This shows more profit being kept from US$11.7b of revenue.

- Analysts' consensus view highlights a shift toward higher margin, recurring software and services, and the higher trailing net income and margin align with that, although:

- Hardware driven quarters like Q4 still matter, with US$3.4b of revenue and US$649m of net income, so the mix between equipment and services is still a key swing factor.

- The consensus also flags expansion into areas like AI video and unmanned systems, and the improved margin gives some support to that bullish angle while not removing the execution risks they mention.

EPS Growth Versus Mid Single Digit Revenue

- Trailing twelve month basic EPS of US$12.93 compares with US$9.45 a year earlier, while revenue over the same trailing period moved from US$10.8b to US$11.7b. EPS therefore grew faster than the top line, which is described as roughly 6.2% per year on a forecast basis.

- Supporters of the bullish narrative point to operating leverage from software and services, and the current EPS profile and margin level are consistent with that, but:

- Earnings growth of 36.6% over the past year and 14.5% per year over five years sits ahead of the roughly 8.3% annual earnings growth that is forecast, so expectations in the data already assume slower growth than the recent past.

- At the same time, consensus comments about long multi year contract cycles and product refreshes help explain how EPS can grow faster than revenue for a period, but do not guarantee that this spread between revenue and EPS growth continues indefinitely.

Valuation Tension At 35.1x P/E

- Motorola Solutions trades on a trailing P/E of 35.1x at a share price of US$453.44, compared with a DCF fair value of US$378.79 and a 30.9x P/E for the wider US Communications industry, while peers in the data average 71.3x.

- Analysts' consensus narrative talks about a strong multi year growth backdrop, but the current numbers give a more mixed picture for investors to weigh:

- The stock sits above the DCF fair value cited, which can make it less appealing for investors who focus heavily on cash flow based estimates, even though the company has grown earnings strongly in the past year.

- The data also flags a high debt level as a risk, so anyone leaning into the higher P/E multiple is doing so with awareness that leverage and valuation are both factors alongside the margin and earnings profile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Motorola Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this earnings story gives you a different angle, shape it into your own take in just a few minutes: Do it your way

A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

The current 35.1x P/E at a share price above the cited DCF fair value, alongside flagged debt risks, suggests valuation and balance sheet strength may be pressure points.

If that mix of a richer multiple and higher leverage gives you pause, take a fresh look at solid balance sheet and fundamentals stocks screener (45 results) that aim to pair resilience with financial discipline.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com