Cytek Biosciences, Inc.'s (NASDAQ:CTKB) Share Price Is Still Matching Investor Opinion Despite 27% Slump

The Cytek Biosciences, Inc. (NASDAQ:CTKB) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 20% in that time.

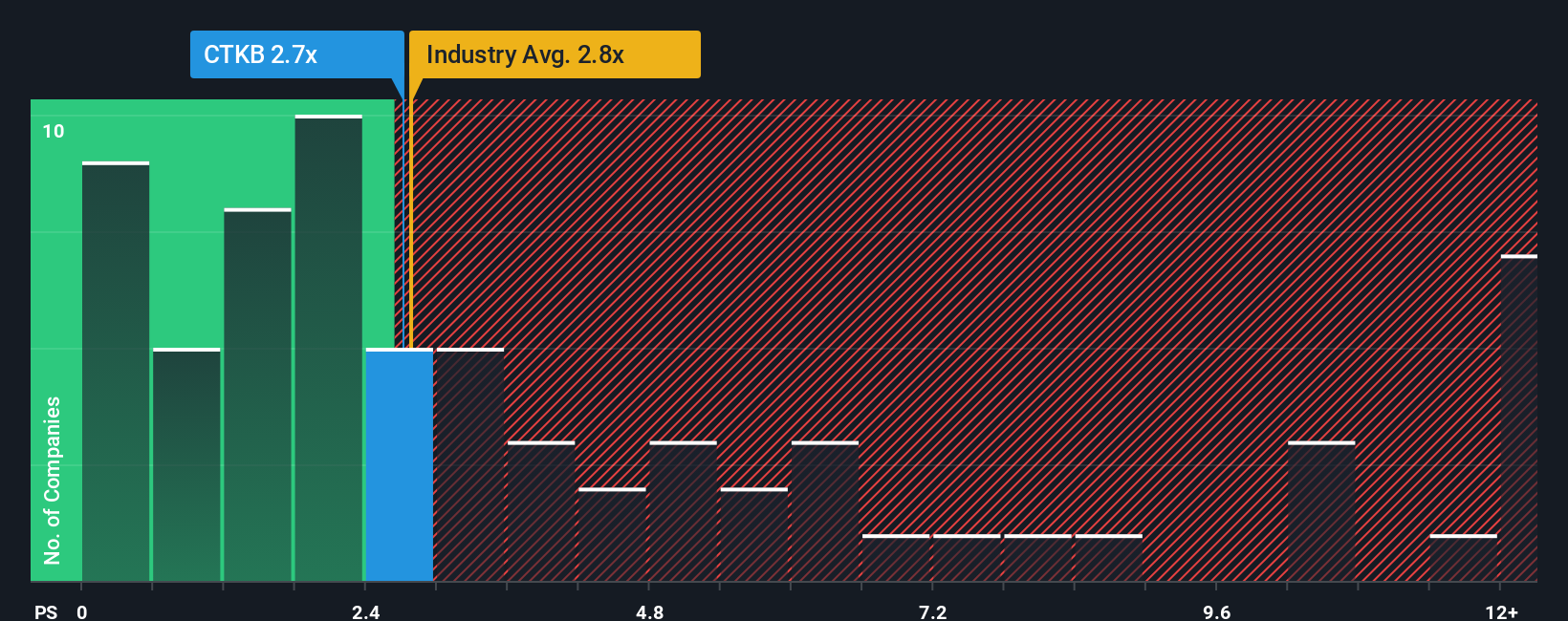

Even after such a large drop in price, it's still not a stretch to say that Cytek Biosciences' price-to-sales (or "P/S") ratio of 2.7x right now seems quite "middle-of-the-road" compared to the Life Sciences industry in the United States, where the median P/S ratio is around 2.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Cytek Biosciences

What Does Cytek Biosciences' Recent Performance Look Like?

Cytek Biosciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Cytek Biosciences' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Cytek Biosciences' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.3% per annum during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 7.7% each year growth forecast for the broader industry.

With this in mind, it makes sense that Cytek Biosciences' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Cytek Biosciences' P/S?

Following Cytek Biosciences' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Cytek Biosciences maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Cytek Biosciences (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.