Is PennyMac Mortgage Investment Trust (PMT) Pricing Look Stretched After Recent Share Price Weakness

- If you are wondering whether PennyMac Mortgage Investment Trust is offering good value at its recent share price, you are not alone. This article is designed to help you make sense of that question.

- The stock most recently closed at US$12.49, with returns of 2.0% over the past week, a 5.2% decline over the past month, a 1.3% decline year to date, and a 3.4% return over the last year, alongside cumulative returns of 26.2% over three years and 22.1% over five years.

- Recent coverage has focused on the trust's position in the mortgage investment space and how broader sector conditions, interest rate expectations, and credit trends may be influencing investor sentiment. These developments help frame why the share price has moved the way it has over shorter and longer timeframes.

- On Simply Wall St's 6 point valuation check, PennyMac Mortgage Investment Trust scores 2 out of 6, as shown in the valuation score. Next, we will look at how different valuation approaches measure that, before finishing with a way to think about valuation that goes beyond a single score.

PennyMac Mortgage Investment Trust scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: PennyMac Mortgage Investment Trust Excess Returns Analysis

The Excess Returns model looks at whether PennyMac Mortgage Investment Trust is expected to earn more on its equity than the return investors require. It takes the trust’s book value, estimates a sustainable level of earnings, subtracts the cost of equity, and then values the stream of those “excess” profits.

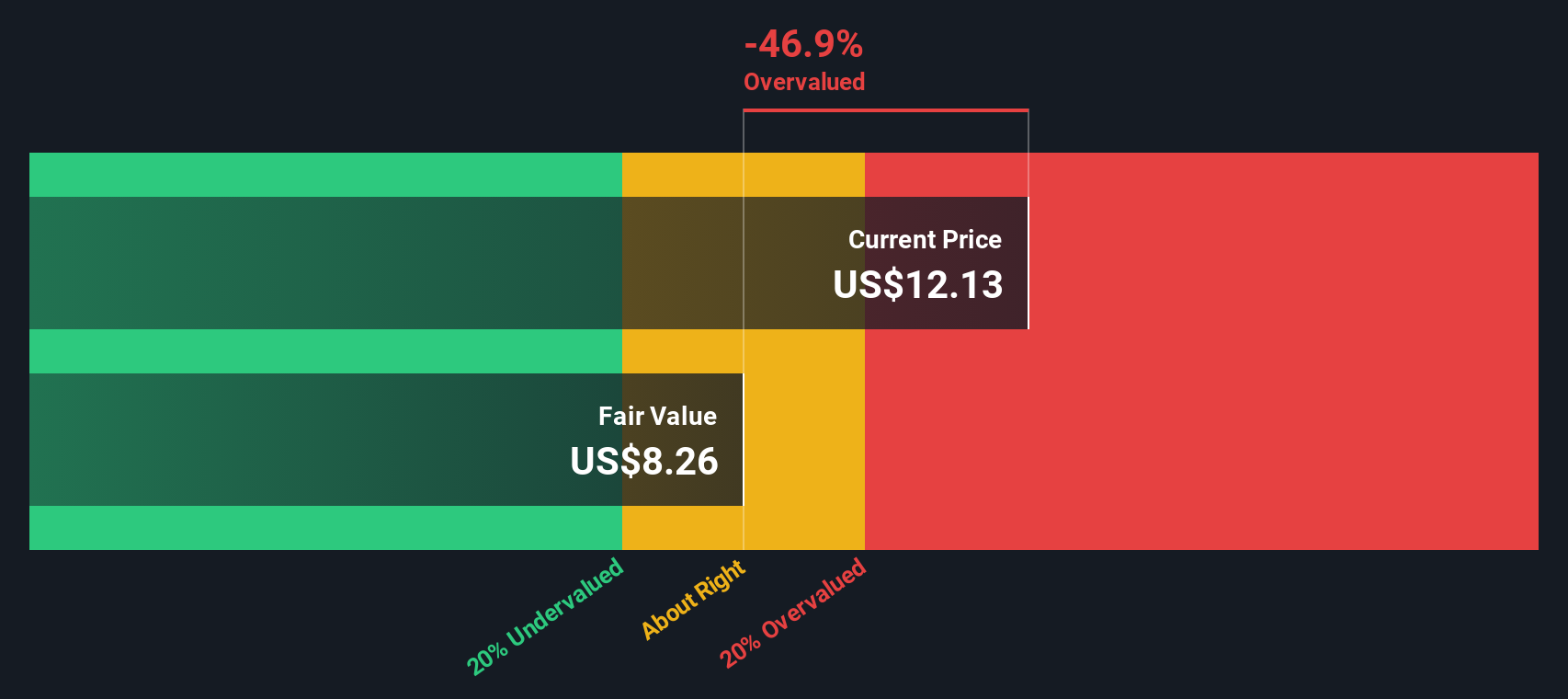

For PennyMac Mortgage Investment Trust, book value is $15.47 per share and the model assumes stable EPS of $1.02 per share, based on the median return on equity from the past 5 years. The implied cost of equity is $1.41 per share, which leads to an excess return of $0.38 per share in the model. The average return on equity used is 6.60%, with a stable book value assumption of $15.50 per share, based on weighted future book value estimates from 3 analysts.

Putting these inputs together, the Excess Returns valuation produces an intrinsic value of about $8.74 per share. Compared with the recent share price of US$12.49, this implies the stock is around 43.0% overvalued on this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests PennyMac Mortgage Investment Trust may be overvalued by 43.0%. Discover 55 high quality undervalued stocks or create your own screener to find better value opportunities.

Approach 2: PennyMac Mortgage Investment Trust Price vs Earnings

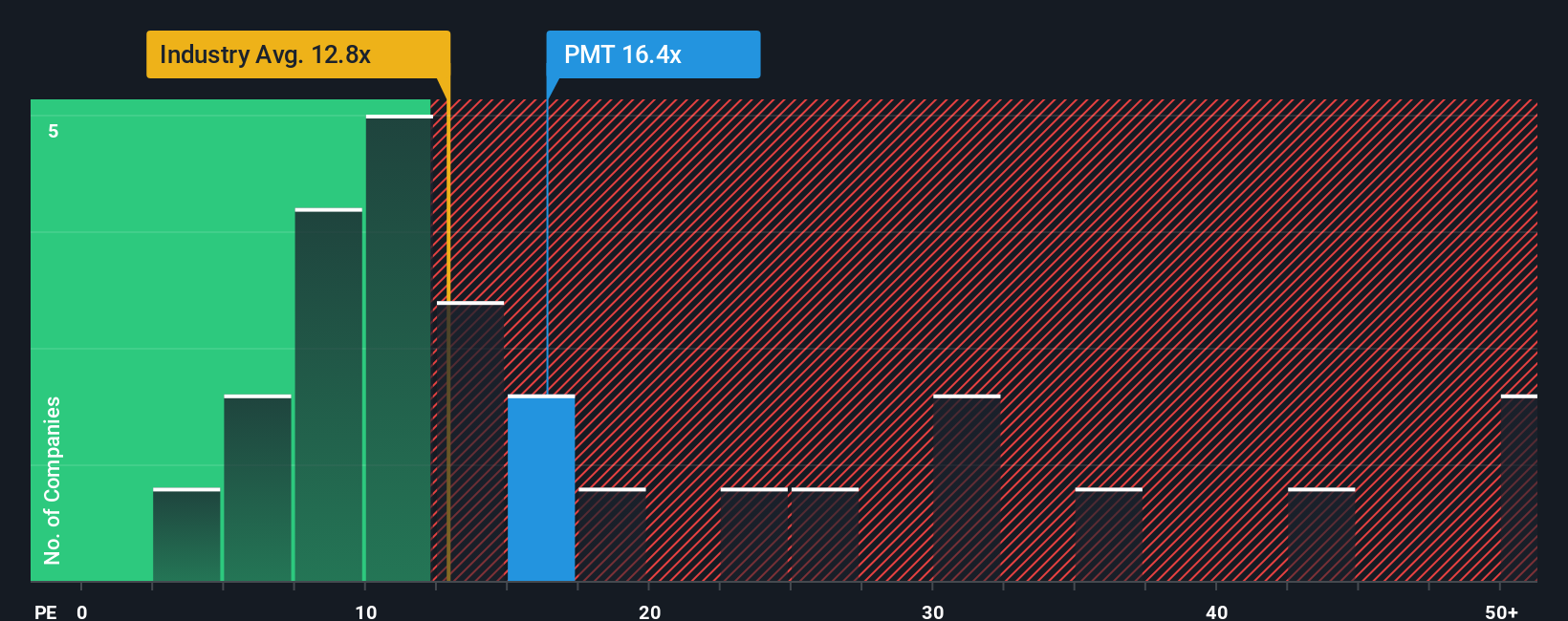

For a profitable company, the P/E ratio is a useful shorthand because it links what you pay today with the earnings the business is currently producing. Investors usually accept a higher P/E when they expect stronger growth or see the earnings stream as relatively stable, and a lower P/E when growth expectations or perceived risk point the other way.

PennyMac Mortgage Investment Trust is trading on a P/E of 12.63x. That sits above the Mortgage REITs industry average of 11.67x, but below the peer average of 13.81x. Simply Wall St also calculates a Fair Ratio for the trust of 13.68x. This Fair Ratio is the P/E level that would typically be expected given factors such as the company’s earnings profile, its industry, profit margins, market value and risk characteristics.

Compared with a simple peer or industry comparison, the Fair Ratio can be more informative because it adjusts for these company specific features rather than assuming all Mortgage REITs deserve the same multiple. Setting the current P/E of 12.63x against the Fair Ratio of 13.68x suggests the stock is trading at a discount on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your PennyMac Mortgage Investment Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you write the story behind your numbers by linking your view on PennyMac Mortgage Investment Trust’s business, its forecast revenue, earnings and margins, and the fair value you think is reasonable.

On Simply Wall St’s Community page, Narratives are an easy tool used by millions of investors to connect a company’s story to a financial forecast and then to a fair value that can be compared with today’s share price to help inform a decision about whether to wait, buy more, or take money off the table.

Narratives are also kept current because they refresh when new information such as news or earnings is added to the platform. This helps your story, forecast and fair value stay aligned with the latest data instead of going stale.

For example, one PennyMac Mortgage Investment Trust Narrative might lean toward the higher fair value of about US$15.50 if you think its vertically integrated operations, technology investments and securitization capabilities support stronger earnings over time. Another might sit closer to US$12.50 if you are more focused on risks like interest rate exposure, credit quality, leverage and dividend sustainability.

Do you think there's more to the story for PennyMac Mortgage Investment Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com