How Investors Are Reacting To Hershey (HSY) Earnings Rebound Guidance And 384th Straight Dividend

- In early February 2026, The Hershey Company reported full-year 2025 results showing net sales of US$11.69 billion and net income of US$883.26 million, while its Board declared its 384th consecutive regular quarterly dividend on the Common Stock, payable on March 16, 2026.

- Despite weaker 2025 earnings, Hershey issued 2026 guidance that, if achieved, would imply a very large increase in diluted earnings per share versus 2025, underscoring management’s confidence alongside continued product innovation across seasonal, licensed, and non-chocolate offerings.

- We’ll now examine how Hershey’s earnings rebound guidance and continued product innovation reshape the company’s investment narrative for investors.

Find 53 companies with promising cash flow potential yet trading below their fair value.

Hershey Investment Narrative Recap

To own Hershey, you need to believe its brands, pricing power, and innovation can offset margin pressures from tariffs, cocoa costs, and a value-focused consumer. The sharp 2025 earnings drop heightens attention on whether 2026’s ambitious EPS rebound guidance becomes the key short term catalyst, while sustained input cost inflation and demand softness remain the biggest risks. The latest results and outlook do not remove these concerns, but they do not fundamentally change them either.

Against this backdrop, the Board’s decision to declare Hershey’s 384th consecutive quarterly dividend on the Common Stock stands out. Continuing regular dividends alongside weaker 2025 earnings and upbeat 2026 EPS guidance gives investors a mixed but important signal about capital return priorities and management confidence at a time when cost inflation, tariffs, and a tougher consumer are all pressing on earnings quality and the pace of any recovery.

Yet beneath the reassuring dividend history, there is a risk investors should be aware of around sustained cocoa inflation and tariff costs potentially pressuring margins...

Read the full narrative on Hershey (it's free!)

Hershey's narrative projects $12.2 billion revenue and $1.8 billion earnings by 2028. This requires 4.3% yearly revenue growth and an earnings increase of about $0.2 billion from $1.6 billion today.

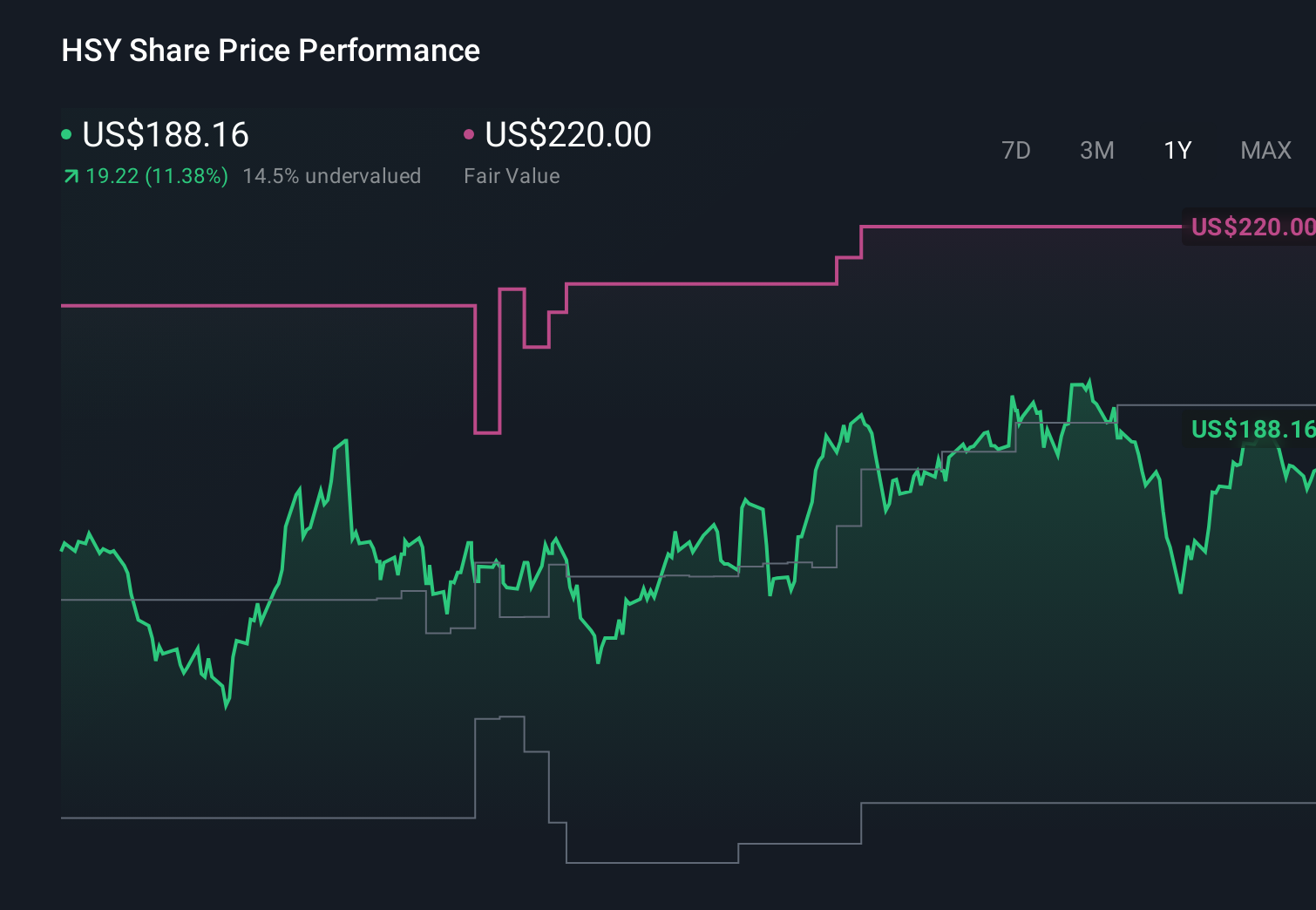

Uncover how Hershey's forecasts yield a $194.35 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Some of the lowest ranked analysts were far more cautious, assuming profit margins could shrink toward 11.4 percent on roughly US$11.9 billion of revenue, which is a very different story from management’s confident 2026 EPS guidance and shows how widely your view of Hershey can differ before this latest earnings update is even fully reflected in forecasts.

Explore 6 other fair value estimates on Hershey - why the stock might be worth as much as 35% more than the current price!

Build Your Own Hershey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hershey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hershey's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- The future of work is here. Discover the 30 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Uncover the next big thing with 28 elite penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com