A Look At American Financial Group’s Valuation As Long Term Returns Contrast With Recent Share Price Pressure

AFG stock moves and recent performance snapshot

American Financial Group (AFG) has drawn fresh investor attention after recent trading, with the stock closing at $128.95 and showing mixed short term and longer term total returns across different holding periods.

See our latest analysis for American Financial Group.

While the recent 1 month share price return of 2.19% decline and 3 month share price return of 9.47% decline suggest fading short term momentum, the 1 year total shareholder return of 11.86% and 5 year total shareholder return of 101.94% point to a much stronger longer term picture as investors reassess both growth potential and risk around American Financial Group at the current US$128.95 share price.

If this move in insurance shares has you thinking about where else capital could go to work, it might be worth scanning 23 top founder-led companies as a fresh source of ideas beyond the usual names.

With annual revenue of about US$7.9b, net income of US$842m and some signs of short term share price pressure, the key question is whether American Financial Group’s current valuation offers an opening or if the market is already pricing in future growth.

Most Popular Narrative: 9.3% Undervalued

At a last close of $128.95 versus a narrative fair value of $142.20, American Financial Group is framed as undervalued, with that gap built on detailed long term earnings and margin assumptions rather than short term trading moves.

The combination of higher interest rates, which are boosting net investment income on the $16B portfolio, and continued strong capital management with regular dividends and share buybacks is expected to enhance bottom line earnings and support per share earnings growth.

Curious what sits behind that fair value gap? The most followed narrative blends measured revenue expectations, higher profitability and a lower future earnings multiple than the wider insurance peer group. The tension between softer top line forecasts and improving earnings per share is where the detailed assumptions really start to matter.

Result: Fair Value of $142.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story can be challenged if catastrophe losses stay elevated, or if social inflation and litigation trends keep pressuring underwriting profitability.

Find out about the key risks to this American Financial Group narrative.

Another angle on valuation

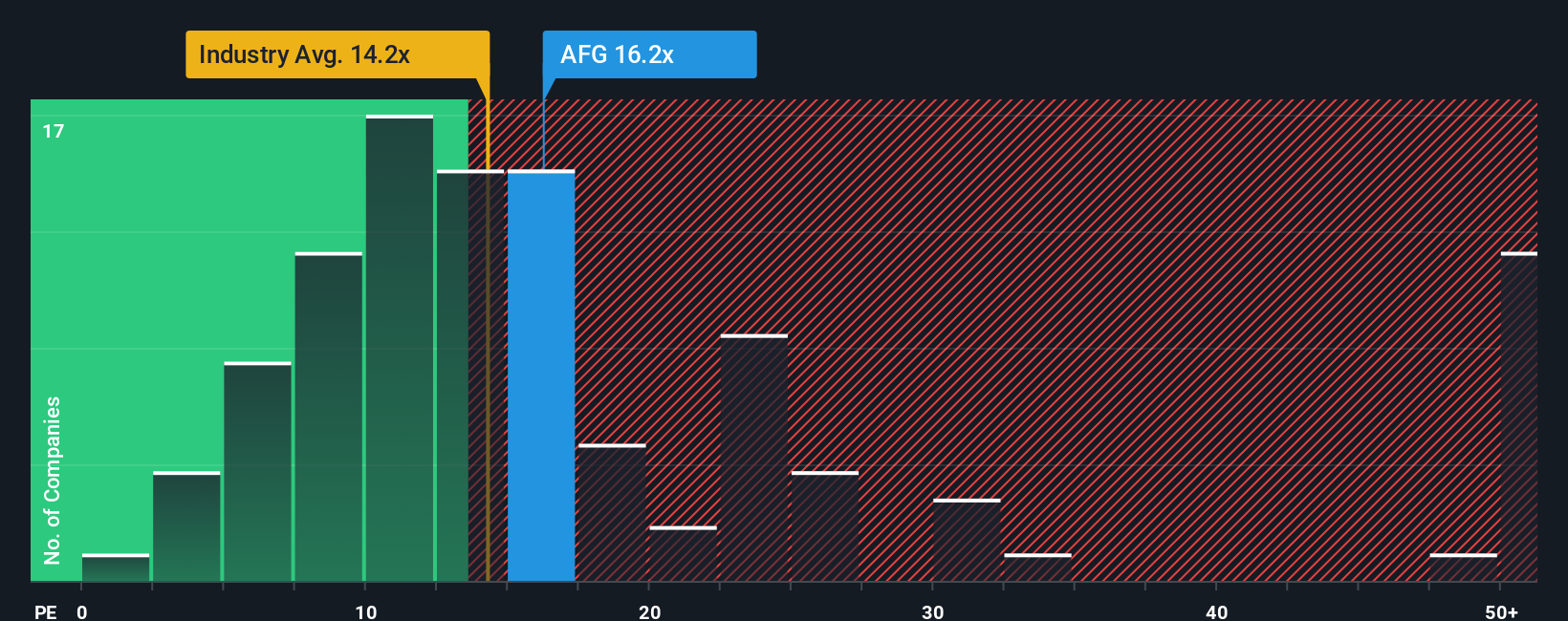

While the narrative model points to a fair value of $142.20 and labels American Financial Group as undervalued, the current P/E of 12.8x tells a different story. It is higher than the peer average of 10.4x and also above the 12.3x for the broader US insurance group, which suggests less of a clear-cut bargain.

At the same time, that 12.8x P/E sits below the 13.6x fair ratio our work suggests the market could move toward. This points to some room on the upside if sentiment improves. With conflicting signals from today’s pricing, peer comparison and the fair ratio, which side of the argument do you find more convincing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Financial Group Narrative

If you think the market is missing something here or you would rather work from your own assumptions, you can quickly build a custom thesis using Do it your way.

A great starting point for your American Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with a single insurance name. Use the tools that surface fresh, data driven ideas.

- Target value opportunities by reviewing 53 high quality undervalued stocks that combine quality fundamentals with prices that may not fully reflect underlying strength.

- Strengthen your income stream by scanning 13 dividend fortresses that focus on higher yielding companies with an eye on stability.

- Protect your downside by checking 85 resilient stocks with low risk scores that score well on balance sheet robustness and overall risk metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com