Crane NXT (CXT) Is Down 5.9% After Mixed 2025 Results And 2026 Outlook Update - Has The Bull Case Changed?

- In February 2026, Crane NXT reported fourth-quarter and full-year 2025 results showing higher sales and revenue than a year earlier, while net income and diluted EPS declined, and the company issued 2026 sales growth and EPS guidance alongside a first-quarter dividend of US$0.18 per share, up about 6% year on year.

- Management also highlighted plans to use free cash flow to reduce debt to an expected net leverage of about 2.3x by the end of 2026, while still funding acquisitions such as its initial equity investment in Antares Vision, reinforcing a balanced approach between balance sheet strength, M&A, and a growing dividend.

- Next, we’ll explore how Crane NXT’s combination of stronger revenue, higher backlog, and an increased dividend reshapes the existing investment narrative.

We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

Crane NXT Investment Narrative Recap

To own Crane NXT, you need to believe it can steadily shift from legacy cash and hardware solutions toward higher value authentication, software, and services. The latest quarter supports that revenue-focused story with strong sales and a larger backlog, but weaker net income keeps execution risk in focus, especially around integrating acquisitions and improving margins. The guidance for 2026 and continued use of free cash flow for both debt reduction and deals does not materially change that near term risk and catalyst balance.

The most relevant update here is management’s plan to direct free cash flow toward lowering net leverage to about 2.3x by the end of 2026 while still funding acquisitions. For a business whose key catalyst is scaling higher margin authentication and digital offerings through M&A, this suggests Crane NXT is trying to leave room for future deals even as it works on its balance sheet. That balance between debt, acquisitions, and dividends now sits at the center of the story.

Yet while sales and backlog are moving in the right direction, investors should also be aware that margin dilution and integration risk could pressure earnings if...

Read the full narrative on Crane NXT (it's free!)

Crane NXT's narrative projects $1.9 billion revenue and $367.2 million earnings by 2028.

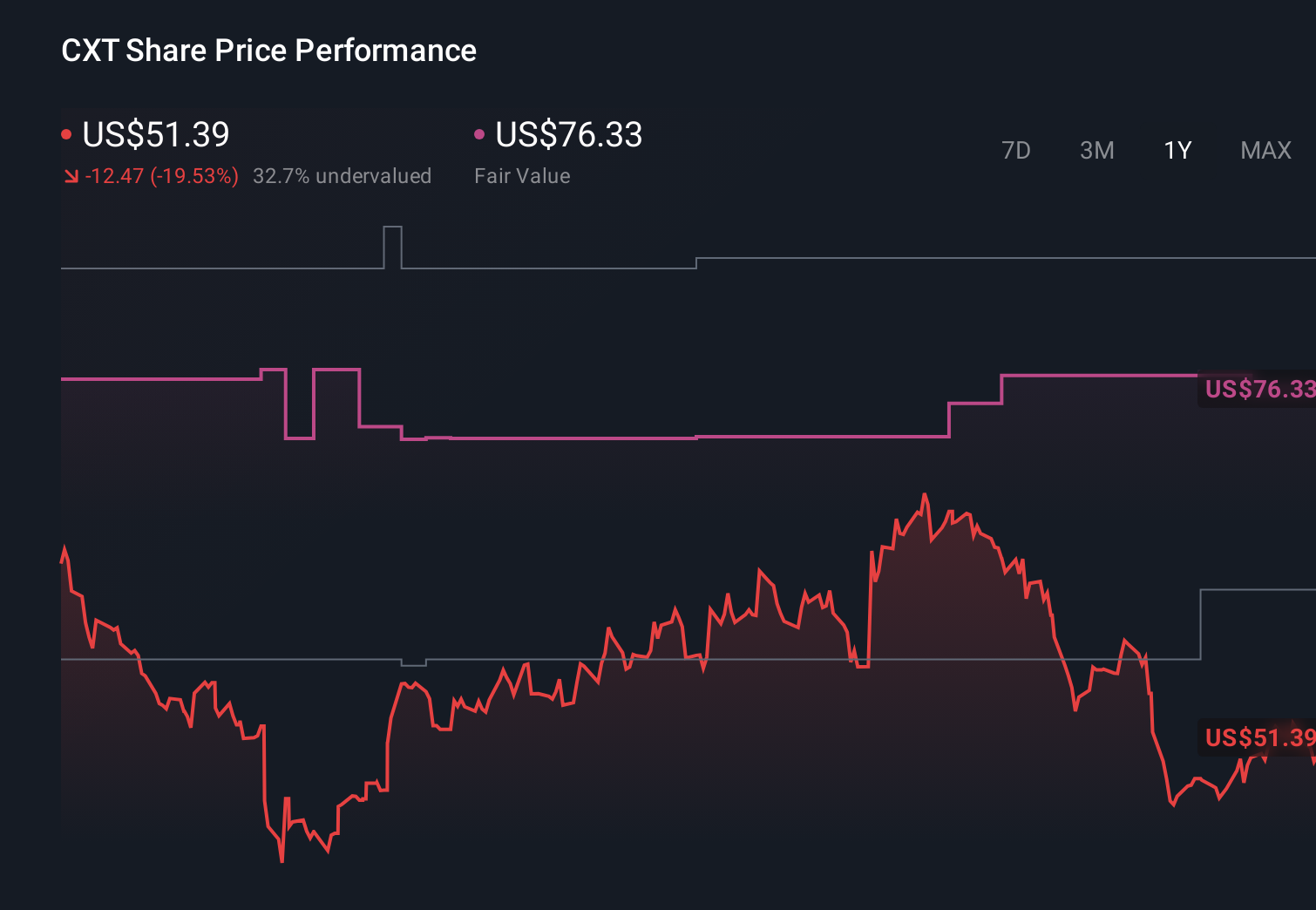

Uncover how Crane NXT's forecasts yield a $76.33 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already assuming earnings could climb toward about US$378 million by 2028, and see faster authentication growth than consensus, so this latest mix of higher sales, softer EPS, and active M&A may either reinforce that upbeat view or force a rethink depending on how you weigh the trade off between growth and near term margin pressure.

Explore 4 other fair value estimates on Crane NXT - why the stock might be worth as much as 45% more than the current price!

Build Your Own Crane NXT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crane NXT research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Crane NXT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crane NXT's overall financial health at a glance.

No Opportunity In Crane NXT?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Invest in the nuclear renaissance through our list of 85 elite nuclear energy infrastructure plays powering the global AI revolution.

- Find 53 companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com