Warby Parker (WRBY) Valuation Check As New CFO Appointment Signals Long Term Growth Focus

Warby Parker (WRBY) just made a significant leadership move, appointing longtime retail operator Adrian Mitchell as Chief Financial Officer, principal financial officer, and principal accounting officer, while co founder Dave Gilboa returns full time to his Co CEO role.

See our latest analysis for Warby Parker.

The leadership news comes as Warby Parker’s share price sits at US$22.46, with a 5.1% 1 day share price return following the announcement, a 32.4% 90 day share price return, and a 3 year total shareholder return of 64.7%, despite a 12.6% total shareholder return decline over the past year.

If this CFO change has you thinking about where growth leaders might emerge next, it could be a good moment to scan 23 top founder-led companies for fresh ideas beyond eyewear.

With the stock at US$22.46, trading about 21% below the average analyst target of US$27.25 and backed by recent double digit revenue and net income growth, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 17.6% Undervalued

Warby Parker's most followed narrative pins fair value at $27.25, comfortably above the last close at $22.46, which helps explain why some see upside from here.

The partnership with Google to develop AI-powered intelligent eyewear positions Warby Parker to enter a substantially larger market, leveraging advancements in wearable technology and artificial intelligence to drive new, higher-margin revenue streams in the future.

Curious how that future eyewear platform, plus higher margin eye care and digital tools, all stack together into one valuation story? The full narrative lays out the growth runway, embeds assumptions on revenue, profitability and future earnings, and then compresses it into a single fair value number tied to that $27.25 mark. Want to see exactly how those moving parts connect?

The narrative leans on projected revenue expansion, rising margins and a future earnings profile that are all discounted back using an 8.49% rate to land on that $27.25 estimate. Against the current $22.46 share price and a 17.6% gap to that fair value, the real question for you is whether those growth and profitability assumptions feel achievable or a stretch.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story only holds if retail expansion avoids dragging on margins and the Google AI eyewear partnership does not turn into an expensive, low payoff experiment.

Find out about the key risks to this Warby Parker narrative.

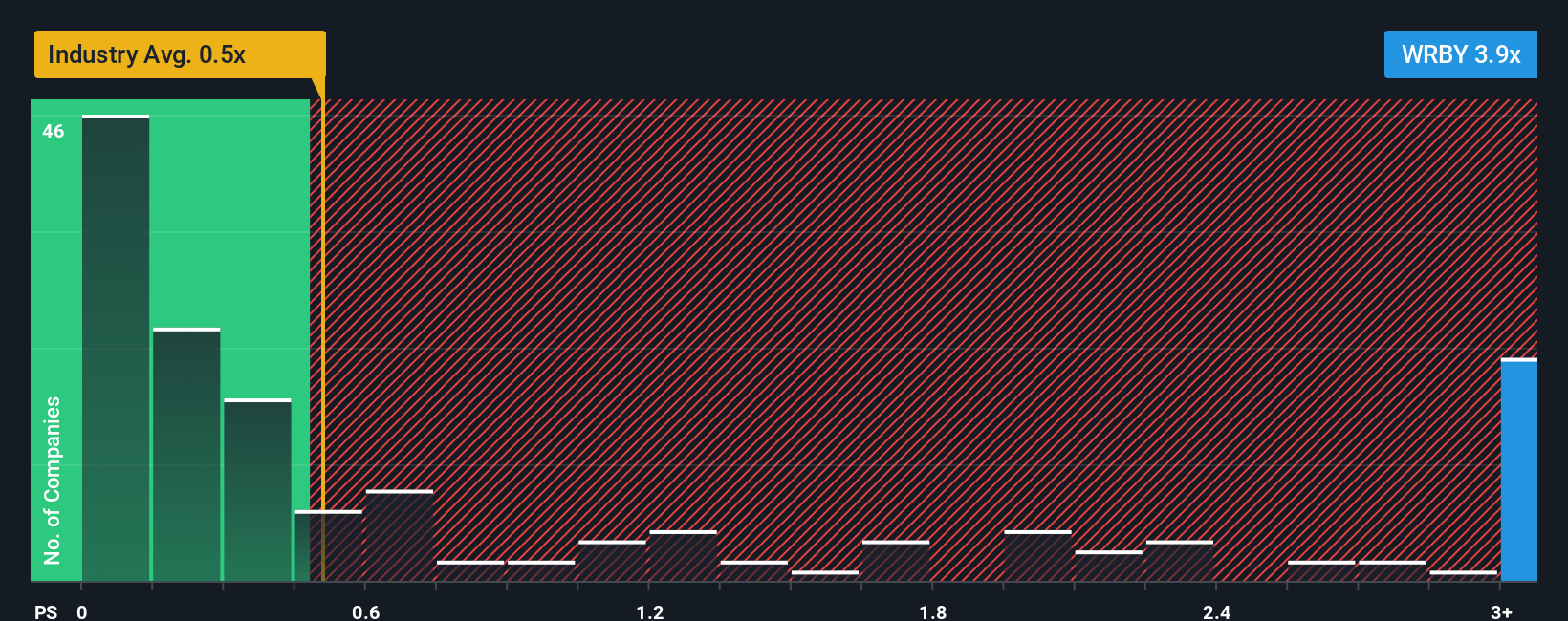

Another View: High P/S Ratio Raises The Bar

That $27.25 fair value narrative leans on growth and margin expansion, but the current P/S ratio of 3.2x is far higher than the US Specialty Retail average at 0.5x, the peer average at 0.8x, and the fair ratio of 1.4x. Is the market overpaying for the story you just read?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warby Parker Narrative

If you see the story differently or prefer to rely on your own work, you can build a complete thesis in just a few minutes: Do it your way.

A great starting point for your Warby Parker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Warby Parker has sharpened your thinking, do not stop here. Broaden your watchlist now so you are not late to the next opportunity.

- Hunt for quality at a discount by checking stocks in our 53 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect them yet.

- Strengthen the income side of your portfolio by reviewing potential payers in the 13 dividend fortresses with yields that stand out on reliability and size.

- Protect your downside by scanning companies in the 85 resilient stocks with low risk scores that score well on resilience and balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com