A Look At On Holding (ONON) Valuation As Analyst Sentiment And Growth Outlook Turn More Positive

Recent analyst revisions around On Holding (ONON) have turned more favorable after earnings and revenue previously came in ahead of expectations, with current forecasts pointing to strong revenue growth and the stock recently outperforming the broader market.

See our latest analysis for On Holding.

That backdrop of stronger analyst sentiment has come alongside a 2.30% 1 day share price return and a 4.19% 7 day share price return. However, the year to date share price return shows a 3.54% decline, which contrasts with a 108.23% 3 year total shareholder return that points to longer term momentum still intact.

If you are watching On Holding’s recent move and want to see what else is out there in growth focused names, it could be worth scanning our 23 top founder-led companies as a starting point for fresh ideas.

With analysts broadly positive and price targets sitting well above the current US$45.29 share price, the key question is whether On Holding is still trading below its potential or if the market is already pricing in expectations for its future growth.

Most Popular Narrative: 27.5% Undervalued

On Holding's most followed narrative pegs fair value at about $62.48 per share versus the recent $45.29 close. This frames a sizeable valuation gap that hinges on what happens to growth, margins, and future earnings power.

The company's ability to launch and quickly scale new product franchises (nine now >5% of revenue), expand beyond running into tennis, trail, lifestyle, and fast-growing apparel, demonstrates successful product innovation and diversification. This supports both average selling price increases and higher future revenue per customer.

Investment in innovative, automated manufacturing processes such as LightSpray is expected to materially improve supply chain efficiency, reduce production costs, and support localized supply. Over time, this should enhance gross margins and bolster scalability as demand grows.

For readers curious about what combination of revenue growth and margin improvement would justify that fair value gap, and which future earnings multiple ties it together, the full narrative outlines the growth runway, profitability path, and valuation bridge that analysts are using to connect today's price to that target.

Result: Fair Value of $62.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on premium pricing and substantial DTC investment, which could pressure margins if consumers pull back or regional growth slows from recent levels.

Find out about the key risks to this On Holding narrative.

Another Angle On Valuation

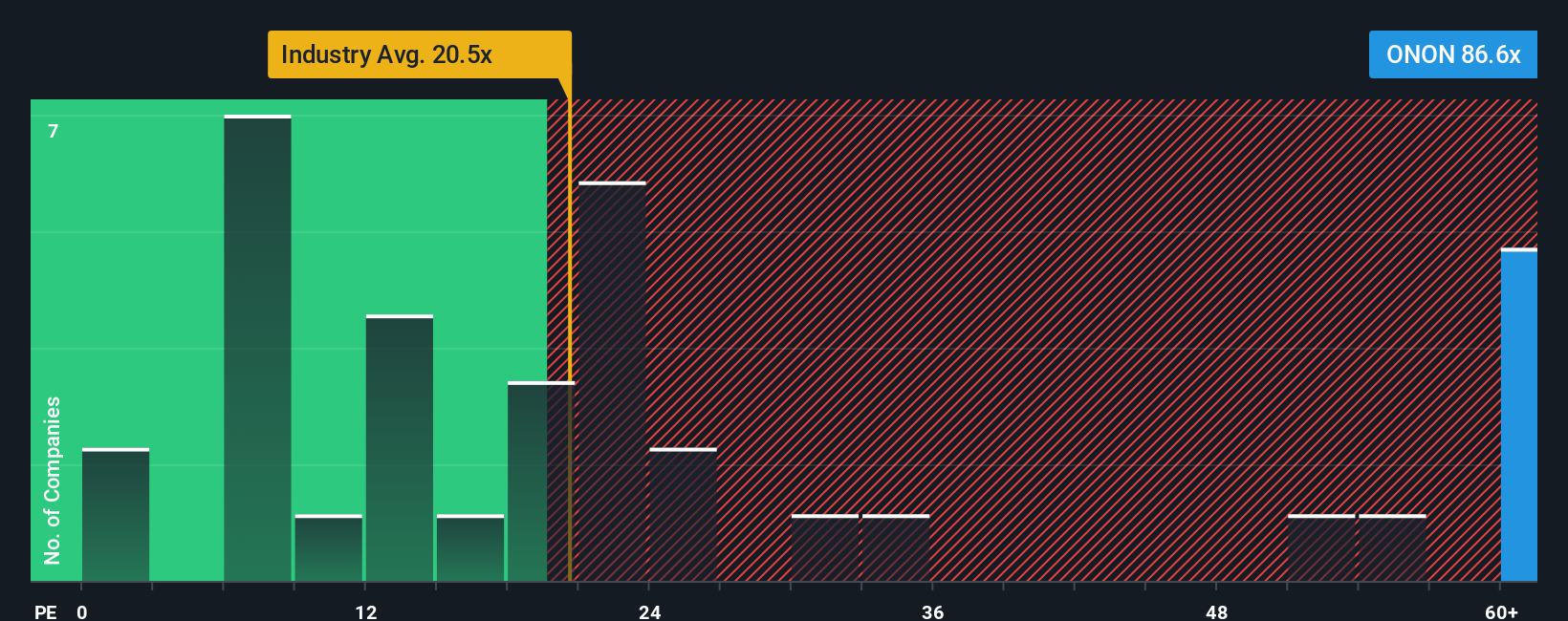

The fair value narrative points to On Holding trading at about a 27.5% discount, yet the current P/E of 51.7x is far above the US Luxury industry at 21.2x, the peer average at 29.9x, and even the 26.3x fair ratio. That kind of gap can signal elevated expectations. How comfortable are you with that risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own On Holding Narrative

If parts of this story do not quite fit your view, or you would rather work from the raw numbers yourself, you can pull the data, stress test your assumptions, and shape a custom On Holding thesis in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding On Holding.

Ready For Your Next Investment Idea?

Do not stop with just one company. Keep your momentum going by lining up a few more quality ideas before the market moves past you.

- Target potential bargains early and run your eye over our 53 high quality undervalued stocks that may suit a disciplined, price conscious watchlist.

- Protect your downside first and check out a hand picked set of 85 resilient stocks with low risk scores that could help you sleep better at night.

- Spot tomorrow's leaders before the crowd by scanning our screener containing 23 high quality undiscovered gems and see which names deserve a deeper look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com