United Parcel Service (UPS) Valuation Check As Turnaround Progress Meets Fresh Union Uncertainty

Why UPS Stock Is Back in Focus

United Parcel Service (UPS) is back on investors’ radar after better than expected fourth quarter results, higher 2026 guidance, and an aggressive overhaul that includes workforce reductions and facility closures.

At the same time, fresh legal challenges from the Teamsters over driver buyout programs are testing UPS’s plan to shift away from lower margin Amazon related deliveries toward higher margin segments, adding another layer for shareholders to watch.

See our latest analysis for United Parcel Service.

UPS shares have climbed recently, with a 30 day share price return of 11.53% and a 90 day gain of 26.60%. The 1 year total shareholder return of 9.65% still sits against a 3 year total shareholder return decline of 24.85%, signaling improving short term momentum after a tougher multi year stretch.

If this turnaround story has your attention, it could be a good moment to scan beyond shipping and check out our 25 power grid technology and infrastructure stocks as another way to spot infrastructure related opportunities.

With UPS trading at $119.24 and one DCF model suggesting roughly a 26% intrinsic discount, while the stock sits slightly above the average analyst target, the key question is whether there is still a window of opportunity or if the market has already priced in the turnaround.

Most Popular Narrative: 25.2% Overvalued

According to NVF, the most followed narrative on United Parcel Service pegs fair value at $95.21, well below the latest close at $119.24. This difference sets up a clear valuation gap to unpack.

Prioritizing short term liquidity to promote efficiency and innovation will increase interest expenses in the long term that will weigh on net income in future earning cycles. This highlights a constraint on their financial flexibility going forward unless profit margins and/or revenues increase.

Curious what has to go right for that $95.21 figure to make sense? The narrative leans on modest revenue gains, firmer margins, and a richer future earnings multiple. The mix of balance sheet leverage and profit assumptions is more intricate than it looks at first glance.

Result: Fair Value of $95.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, union disputes or higher than expected interest costs on new debt could easily change how realistic that $95.21 fair value call appears.

Find out about the key risks to this United Parcel Service narrative.

Another Angle on Valuation

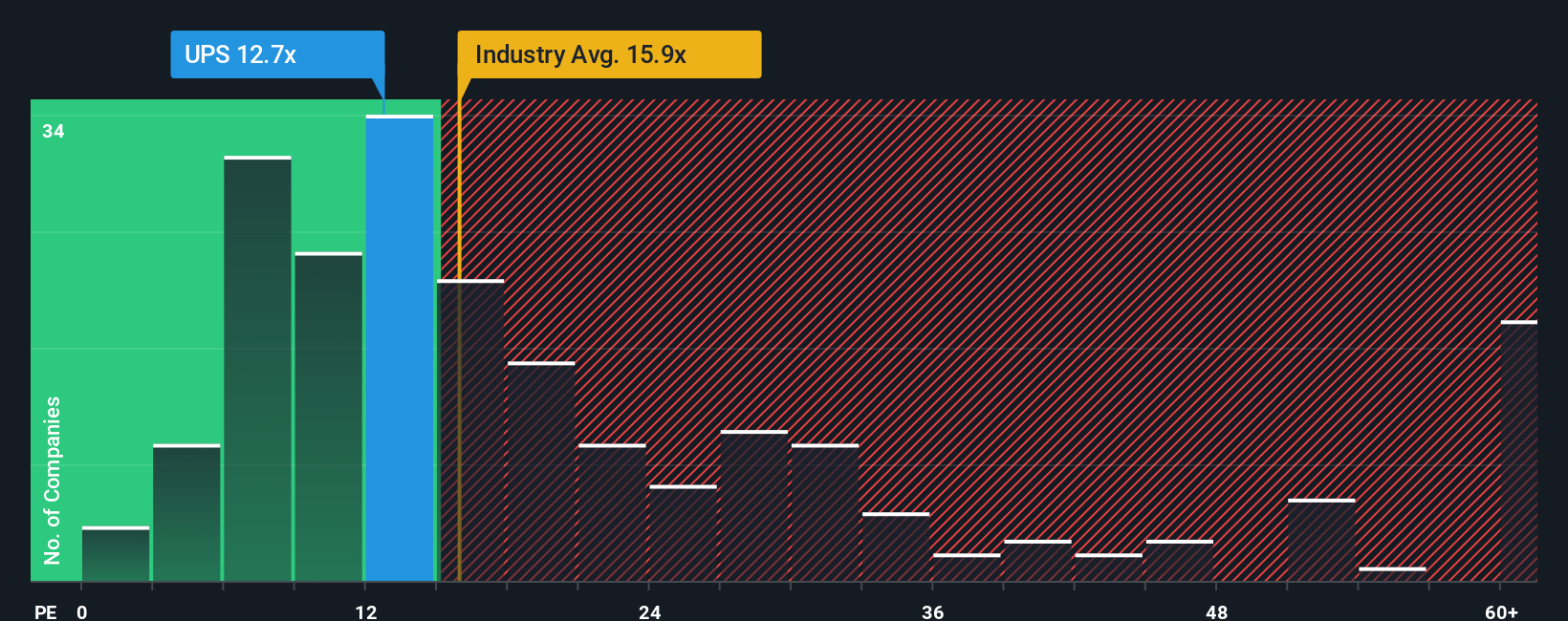

While the NVF narrative lands on UPS as 25.2% overvalued at $95.21, our multiples view is more forgiving. UPS trades on a P/E of 18.2x, below its peer average of 23.5x and under our fair ratio of 21.7x. This suggests that valuation risk and opportunity are more finely balanced than that $95.21 target implies. Which version of “fair” do you put more weight on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Parcel Service Narrative

If you see UPS differently or prefer to evaluate the numbers yourself, you can build a custom view in minutes on your own terms, your own angle, your own story, starting with Do it your way

A great starting point for your United Parcel Service research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If UPS has sharpened your focus, do not stop here. Broaden your watchlist now so you are not looking back wishing you had acted sooner.

- Target resilient cash generators by checking companies in our solid balance sheet and fundamentals stocks screener (45 results), where financial footing is central to the story.

- Spot potential value opportunities early with our 53 high quality undervalued stocks, built to surface quality businesses that screen as priced below their fundamentals.

- Lock in income focused ideas by scanning our 12 dividend fortresses, featuring companies that pair higher yields with an emphasis on durability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com