Assessing HCA Healthcare (HCA) Valuation After Strong Results And Growing AI And Capital Initiatives

Recent quarterly results and filings from HCA Healthcare (HCA) have drawn fresh attention to the stock, as the company reports higher revenue and net income for 2025 alongside ongoing investment in digital and AI capabilities.

See our latest analysis for HCA Healthcare.

Those headlines around strong 2025 results, new emergency facilities and heavier options activity have arrived alongside firm share price momentum, with a 15.13% 1 month share price return and a 72.15% 1 year total shareholder return pointing to building confidence.

If HCA’s mix of healthcare delivery and AI investment has your attention, it could be a good moment to scan 25 healthcare AI stocks to see what else fits that theme.

With HCA trading near its latest analyst price target and showing a 40.65% intrinsic discount estimate, the key question now is whether the recent surge still leaves room for upside or whether the market is already pricing in future growth.

Most Popular Narrative: 1.9% Overvalued

HCA Healthcare's most followed valuation narrative pegs fair value at about $530 per share, slightly below the recent $540.29 close, which sets up a tight valuation debate.

The analysts have a consensus price target of $398.571 for HCA Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $449.0, and the most bearish reporting a price target of just $333.0.

There is a detailed earnings path behind that fair value, built around measured revenue growth, a small shift in margins, and a different future P/E profile. Curious how those moving parts fit together and what they imply for long term returns versus today’s price tag.

Result: Fair Value of $530.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on policy and reimbursement remaining stable, with Medicaid changes and higher professional fee costs both capable of putting pressure on margins and earnings.

Find out about the key risks to this HCA Healthcare narrative.

Another View: Multiples Point To A Different Story

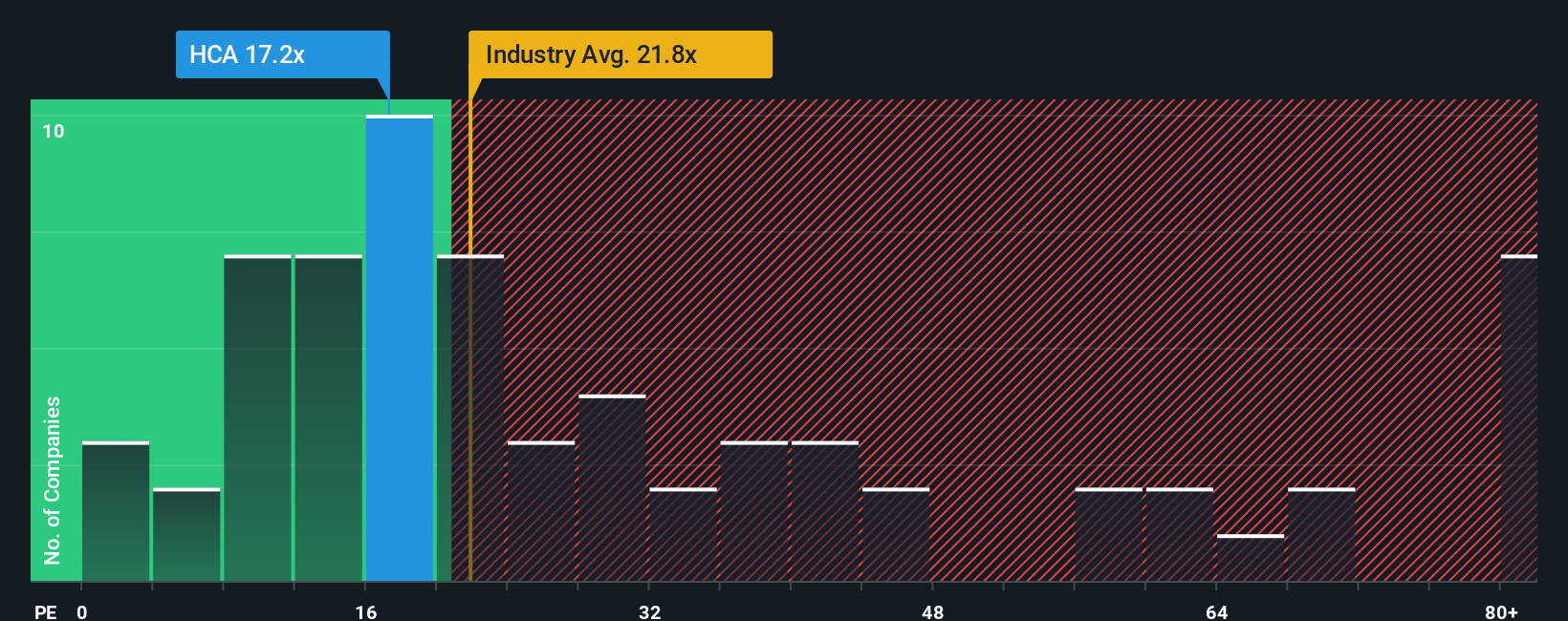

While the most followed narrative treats HCA Healthcare as 1.9% overvalued around $540, the P/E picture is quite different. HCA trades on 17.8x earnings, compared with 23.6x for the US Healthcare industry and 20.1x for peers, and a fair ratio of 32.3x.

Put simply, the share price sits well below where the fair ratio suggests the P/E could drift over time. This may indicate that valuation risk is lower than the headline narrative implies. The question for you is whether that gap reflects caution around debt and policy risks, or an opening you want to price for yourself.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HCA Healthcare Narrative

If you see the numbers differently or prefer to work from your own research, you can build and refine your personal valuation view in minutes: Do it your way.

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If HCA has sharpened your thinking, do not stop at one company. The Simply Wall St Screener can quickly surface other opportunities that might suit your approach.

- Hunt for quality at a discount by checking companies our screener flags as 53 high quality undervalued stocks with stronger fundamentals than their prices suggest.

- Lock in potential income ideas by reviewing the 12 dividend fortresses list and see which businesses pair higher yields with more robust profiles.

- Prioritize resilience by scanning the 84 resilient stocks with low risk scores to uncover businesses our model views as more durable when conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com