Ridgepost Capital (RPC) Valuation Check After Rebrand And High P/E Versus Peers

Why Ridgepost Capital Is On Investors’ Radar

Ridgepost Capital (RPC) recently rebranded from P10, Inc. This shift is putting fresh attention on how this multi asset class private market solutions provider is positioned across private equity, venture capital, impact investing, and private credit.

See our latest analysis for Ridgepost Capital.

At a latest share price of $8.70, Ridgepost Capital has seen a 2.35% 1 day share price return. Its 30 day share price return of 18.77% and 1 year total shareholder return of 30.08% suggest momentum has recently been under pressure despite the rebrand drawing fresh attention.

If you are reassessing your exposure to alternative asset managers after Ridgepost Capital’s rebrand, it could be a good moment to broaden your search with our 23 top founder-led companies.

With a latest price of $8.70, a 1-year total shareholder return of negative 30.08% and an analyst price target of $18.50, you have to ask: is Ridgepost Capital undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 39.7% Undervalued

Ridgepost Capital’s most followed valuation narrative points to a fair value of $14.42 compared to the last close of $8.70. This is a sizable gap that hinges on how its growth plans play out.

The diversity and expansion of their fund offerings, with 19 funds in the pipeline for 2025, indicates potential for revenue growth as they broaden their client and investor base, increasing opportunities for asset gathering. Execution of a disciplined and programmatic M&A strategy suggests potential for earnings growth, as economies of scale and integration synergies are realized, possibly leading to expanded margins over time.

Want to see what kind of revenue curve and margin profile would need to support that valuation gap? The key assumptions connect faster top line growth with a sharply different earnings power and a premium future earnings multiple. Curious how much improvement the narrative is baking into both profitability and capital efficiency over just a few years?

Result: Fair Value of $14.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are real pressure points here, including lower margin newer strategies and upcoming fee step downs that could leave revenues and earnings below what this narrative assumes.

Find out about the key risks to this Ridgepost Capital narrative.

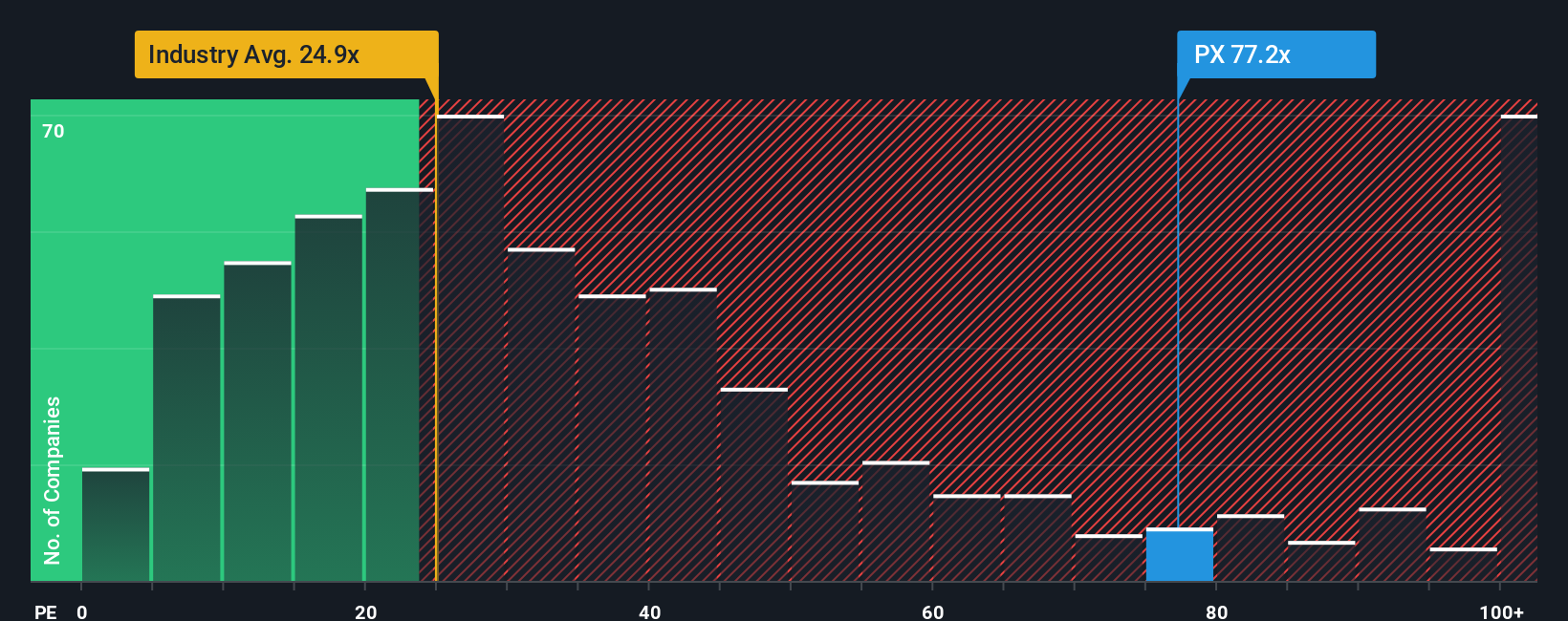

Another View: Earnings Multiple Sends A Different Signal

That $14.42 fair value leans on growth assumptions, but the current P/E of 48.9x is far higher than both peers at 8.5x and the US Capital Markets average of 23.1x. That kind of gap can indicate either upside optimism or valuation risk. Which side do you think it reflects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ridgepost Capital Narrative

If you are not fully convinced by these views or prefer to rely on your own work, you can quickly build a personalized thesis with Do it your way.

A great starting point for your Ridgepost Capital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ridgepost Capital has you rethinking your watchlist, do not stop here. Your next strong idea could be sitting just one screener away.

- Spot potential value candidates early by checking companies that appear in our 53 high quality undervalued stocks based on fundamentals and pricing signals.

- Protect the downside first by scanning companies with our 84 resilient stocks with low risk scores that focuses on resilience and lower risk profiles.

- Get ahead of the crowd by searching our screener containing 23 high quality undiscovered gems filled with underfollowed names that still show solid underlying numbers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com