IPG Photonics Leans On Defense And Medical To Redefine Growth Mix

- IPG Photonics (NasdaqGS:IPGP) has introduced the CROSSBOW MINI High-Energy Laser system, a new scalable defense product aimed at countering drone threats.

- The company reports strong momentum in its medical business, supported by new product launches and a major customer win.

- Management has indicated that medical-related revenues are expected to double or triple in the next year.

IPG Photonics, trading at about $153.91, has seen very strong recent share price performance, with the stock up 40.4% over the past week and 105.7% year to date. The shares are also up 142.3% over the past year, although the 5 year return of a 34.4% decline highlights that the longer term journey has been more mixed. Against that backdrop, fresh developments in defense and medical applications are drawing renewed investor attention.

The launch of CROSSBOW MINI and the rapid ramp in medical activity mark a shift in focus beyond IPG Photonics' traditional industrial laser base. For investors, key questions from here include how quickly these new areas scale, how durable the demand proves to be, and what this may mean for the company’s earnings mix over time.

Stay updated on the most important news stories for IPG Photonics by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on IPG Photonics.

2 things going right for IPG Photonics that this headline doesn't cover.

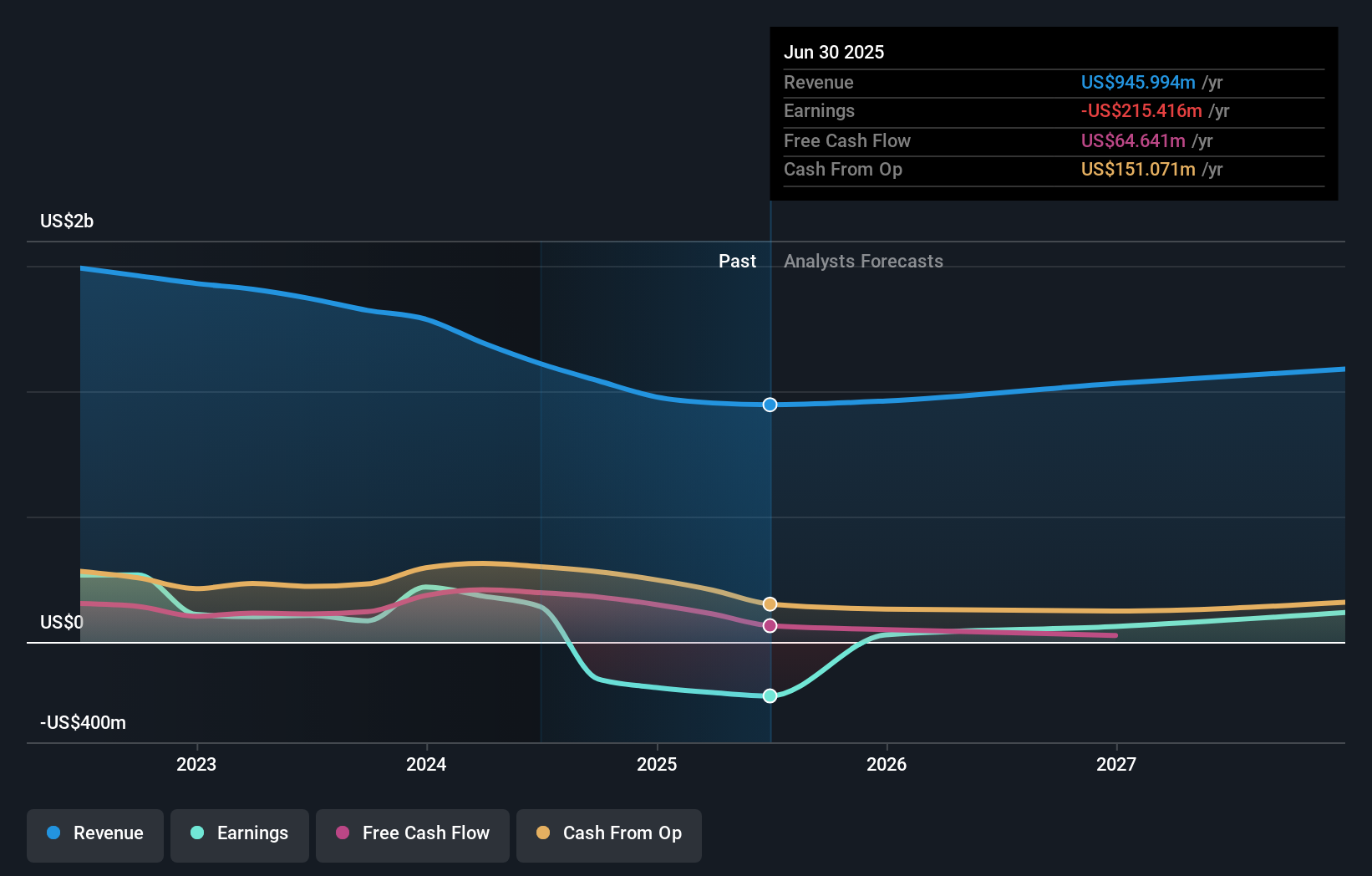

The CROSSBOW MINI launch and the acceleration in medical are both pointing IPG Photonics further away from its historically industrial-heavy profile and deeper into higher-value, application-specific niches. The new high-energy laser system is designed for counter-drone defense, and IPG is already showcasing it at the Singapore Airshow, which could help it get in front of procurement audiences that also look at suppliers like Lockheed Martin, RTX and Northrop Grumman. On the medical side, management is calling for medical-related revenue to potentially double or triple in the next year, after 21% growth in 2025 and a record contribution to full-year sales. That, together with Q4 revenue of US$274.47 million and a move from a full-year loss to a profit of US$31.1 million in 2025, gives investors a clearer sense that diversification outside materials processing is starting to matter. The new US$100 million buyback authorization, following completion of a prior program that retired 8.75% of shares, also shows the board is comfortable committing more capital while it pursues defense, medical, battery and semiconductor workflows as growth drivers.

How This Fits Into The IPG Photonics Narrative

- The CROSSBOW MINI launch and medical ramp both line up with the narrative’s focus on new verticals like medical, defense and micromachining as potential growth drivers beyond core welding and cutting.

- At the same time, the narrative highlights pressure in materials processing, so investors may want to see whether defense and medical progress can offset any ongoing softness in those legacy areas.

- The strong take-up of CROSSBOW MINI and medical products, plus the new buyback plan, add detail on execution and capital returns that are not fully captured in the high-level narrative around future growth and margins.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for IPG Photonics to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ The stock has been volatile over the past 3 months compared to the wider US market, which can make timing more sensitive for new positions or additions.

- ⚠️ Execution risk around new markets remains, as defense and medical are still smaller and less predictable than IPG’s traditional materials-processing base.

- 🎁 IPG returned to profitability in 2025, with full-year net income of US$31.1 million after a loss the year before, which gives it more flexibility to keep funding product development.

- 🎁 Earnings are forecast to grow strongly, and the combination of medical growth, defense products like CROSSBOW MINI and a fresh US$100 million buyback plan could support that trajectory if delivered as planned.

What To Watch Going Forward

From here, it is worth keeping an eye on how quickly CROSSBOW MINI converts interest at events like the Singapore Airshow into signed defense or security contracts, and whether those orders repeat. On medical, you might track whether the promised doubling or tripling of revenue is reflected in quarterly figures and margins, given the segment reached record levels in 2025. It is also useful to see how often IPG updates guidance relative to its Q1 2026 revenue range of US$235 million to US$265 million, and whether tariffs or product costs continue to weigh on profitability. Finally, with another US$100 million buyback approved after retiring 3.86 million shares previously, investors can watch how aggressively management uses that authorization at current price levels.

To ensure you're always in the loop on how the latest news impacts the investment narrative for IPG Photonics, head to the community page for IPG Photonics to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com