A Look At NETSTREIT (NTST) Valuation After The Recent Follow On Equity Offering

NETSTREIT (NTST) has just completed a follow on equity offering, raising about US$208.6 million by issuing 10,980,000 common shares at US$19 each, which represents a US$0.76 discount to the offer price.

See our latest analysis for NETSTREIT.

The follow on equity raise comes on the heels of NETSTREIT’s recent earnings release, dividend increase and 2025 investment update. The stock’s 30 day share price return of 9.49% and 1 year total shareholder return of 53.13% suggest momentum has recently been building rather than fading.

If this capital raise has you thinking more broadly about where cash is being put to work in markets, it could be a good time to scan 23 top founder-led companies as potential next ideas.

With NETSTREIT’s shares up strongly over the past year, a recent equity raise at a discount, and an intrinsic value estimate suggesting a wide gap, the key question is whether there is still an attractive entry point or if the market is already pricing in future growth.

Most Popular Narrative: 1.1% Undervalued

NETSTREIT's most followed narrative puts fair value at about $20.42, slightly above the last close of $20.20. This suggests only a modest valuation gap.

Conservative balance sheet management, ample liquidity, and an improving cost of capital position NETSTREIT to pursue attractive external growth opportunities, enabling the company to accelerate accretive acquisitions that should positively impact AFFO per share and long-term earnings.

Want to see what kind of revenue path and margin profile are baked into that value, and how rich the future earnings multiple really is? The full narrative lays out the growth runway, capital assumptions, and timing behind those cash flow projections in a way the headline number alone cannot.

Result: Fair Value of $20.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that physical retail demand weakens or that acquisition returns disappoint, as this could challenge the cash flow story underpinning that fair value.

Find out about the key risks to this NETSTREIT narrative.

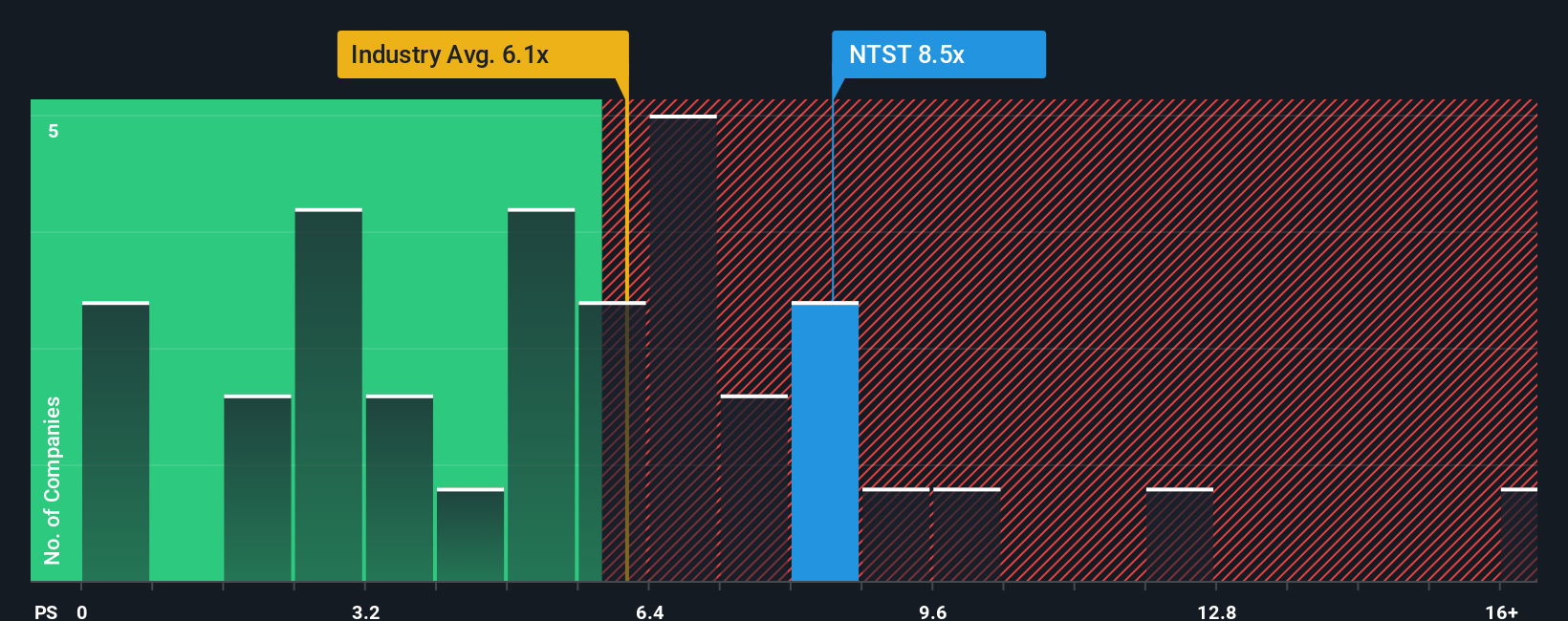

Another Angle: Expensive On Sales

That modest 1.1% undervaluation signal sits awkwardly next to the sales based view. On a P/S of 10.1x, NETSTREIT trades richer than the US Retail REITs industry at 6.6x, its peer average at 9.7x, and even a fair ratio of 8.1x. Is that extra premium comfort or risk for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NETSTREIT Narrative

If you see the story differently or prefer to work from the raw numbers yourself, you can build a custom view of NETSTREIT in just a few minutes. To get started, use Do it your way.

A great starting point for your NETSTREIT research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about putting your capital to work, do not stop at one stock. Broaden your watchlist with focused ideas other investors might overlook.

- Target reliable cash generation by reviewing 12 dividend fortresses, built for income seekers who want yield with substance behind it.

- Hunt for quality at a discount using 53 high quality undervalued stocks, where solid fundamentals meet prices that may not fully reflect them yet.

- Prioritize peace of mind with 84 resilient stocks with low risk scores, highlighting companies that pair sturdier risk profiles with clearer financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com