CACI International Award Shines As Insider Activity And Backlog Draw Focus

- CACI International (NYSE:CACI) was named a 2026 Best Place to Work in Manufacturing & Energy by Glassdoor, highlighting its culture, career paths, and leadership.

- A senior executive recently sold company stock, drawing attention to insider activity at the current share price of about $573.30.

- The company has reported a growing contract backlog along with upgraded guidance and supportive analyst commentary on margins and its contract pipeline.

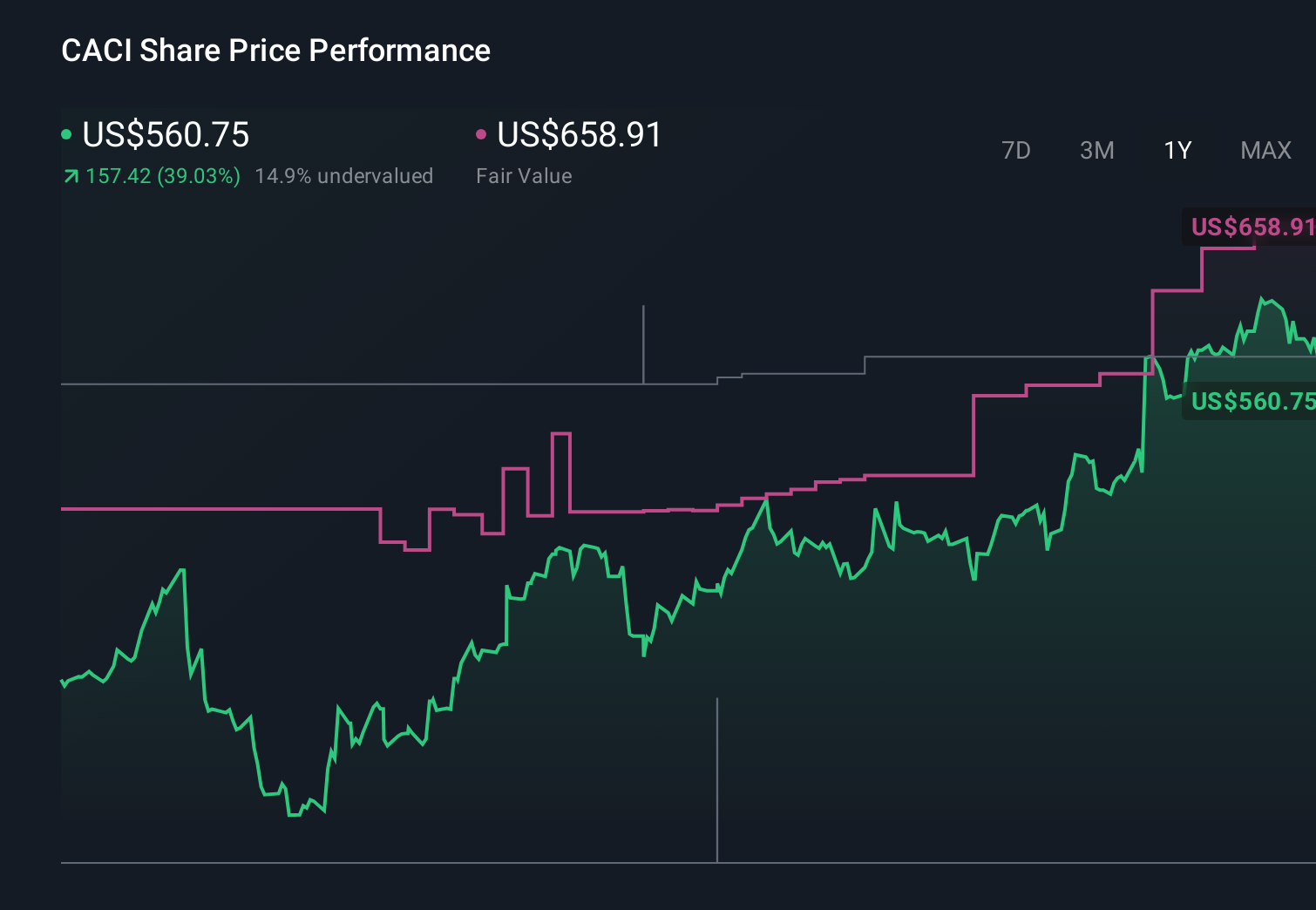

For investors tracking NYSE:CACI, the combination of workplace recognition and business updates adds context to a stock that has gained 6.7% year to date and 69.4% over the past year, with a 3-year return of 88.6% and a 5-year return of 143.9%. Recent weakness, with a 7.3% decline over the past week and a 9.8% decline over the past month, comes alongside that longer-run performance and a current share price around $573.30.

The Glassdoor award reflects CACI International's ability to attract and retain talent, which can be important for delivering on its contract backlog and pipeline. The insider sale and guidance changes provide additional data points to consider when assessing how the business and its leadership are positioning the company in relation to upcoming contract work and margin trends.

Stay updated on the most important news stories for CACI International by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on CACI International.

See which insiders are buying and buying and selling CACI International following this latest news.

The recent mix of workplace recognition, insider selling, and contract-related commentary gives you a fuller picture of how different stakeholders are reacting to CACI International. The Glassdoor Best Place to Work award points to a culture that may help CACI compete for scarce, security-cleared talent, which is central for defense and intelligence work. At the same time, the insider sale by Executive Vice President and General Counsel William Koegel, plus the pattern of insider sells over the past year, may cause some investors to pause and look more closely at incentives, compensation, and timing around recent share price strength. On the business side, average backlog growth of 11.5% over the past two years and upgraded guidance, together with analyst comments about revenue, margins, and free cash flow, suggest that the company is leaning into demand for technology-heavy government contracts. Investor sentiment is also being shaped by upcoming public appearances from senior executives, such as the scheduled presentation at the TD Cowen Aerospace and Defense Conference, where management commentary could either reinforce or temper current expectations around contract wins, funding visibility, and balance sheet leverage.

How This Fits Into The CACI International Narrative

- The recognition for culture and career paths fits with the narrative that CACI needs a strong, cleared workforce to support long-term government digital transformation and spectrum, cyber, and AI-focused contracts.

- Regular insider selling and higher post-acquisition leverage raise questions around execution risk and capital allocation, which the narrative flags as potential constraints on growth and margins.

- The Glassdoor award and detailed insider trading pattern are not fully reflected in the existing narrative, yet both could influence how CACI competes with peers such as Booz Allen Hamilton, Leidos, and Science Applications International for talent and long-duration work.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for CACI International to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Heavy dependence on U.S. government budgets exposes CACI to funding delays, shutdowns, or policy shifts that could affect contract timing and earnings stability.

- ⚠️ A track record of insider selling and higher leverage after acquisitions may signal governance or balance sheet risks that investors will want to monitor closely.

- 🎁 Backlog growth of 11.5% on average over two years and analyst views on revenue, margin expansion, and free cash flow point to a business that is currently securing substantial work.

- 🎁 The Best Place to Work award suggests CACI may be better positioned to attract and retain qualified staff in areas such as cyber and electronic warfare, which can support delivery on higher value contracts.

What To Watch Going Forward

From here, it is worth watching how CACI converts its growing backlog into revenue and cash flow, and whether guidance continues to reflect confidence in contract execution and margin trends. You might also track insider trading disclosures to see if the recent pattern of sales continues, stabilizes, or shifts toward purchases. Management commentary at the TD Cowen Aerospace and Defense Conference and future earnings calls will be important for updates on government funding, pipeline quality, and leverage plans. Finally, keep an eye on how CACI competes for large, tech-focused awards alongside peers such as Booz Allen Hamilton, Leidos, and Science Applications International, since win rates in those areas can shape the longer-term earnings profile.

To ensure you're always in the loop on how the latest news impacts the investment narrative for CACI International, head to the community page for CACI International to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com