Is It Too Late To Consider Encompass Health (EHC) After Strong Multi‑Year Share Gains?

- For investors wondering whether Encompass Health at around US$110 a share still offers value, or if the easy money has already been made, this article explains what the current price reflects.

- The stock has returned 4.5% over the last 7 days, 9.6% over 30 days, 3.5% year to date, 9.9% over 1 year, 79.3% over 3 years and 81.5% over 5 years. These figures naturally raise questions about what is now priced in.

- Recent attention on Encompass Health has focused on its position within US healthcare services and how investors view its role in providing rehabilitation care, which helps frame those share price moves. At the same time, broader interest in healthcare exposure has kept the stock on many watchlists. This provides additional context for how the market is treating its valuation today.

- On our framework, Encompass Health scores a 6 out of 6 valuation score. Next we look at what different valuation methods suggest about that price, then finish with a way to think about value that goes beyond the headline models.

Approach 1: Encompass Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and discounts those amounts back to what they might be worth today. It is essentially asking what a stream of future cash flows could be worth in present dollar terms.

For Encompass Health, the latest twelve month Free Cash Flow is about $452.7 million. Analysts provide detailed forecasts out to 2028, and Simply Wall St extrapolates further to build a 10 year view. On those projections, Free Cash Flow is expected to reach about $694.9 million in 2035, with interim years such as 2026 and 2028 modeled at $484.5 million and $550 million respectively.

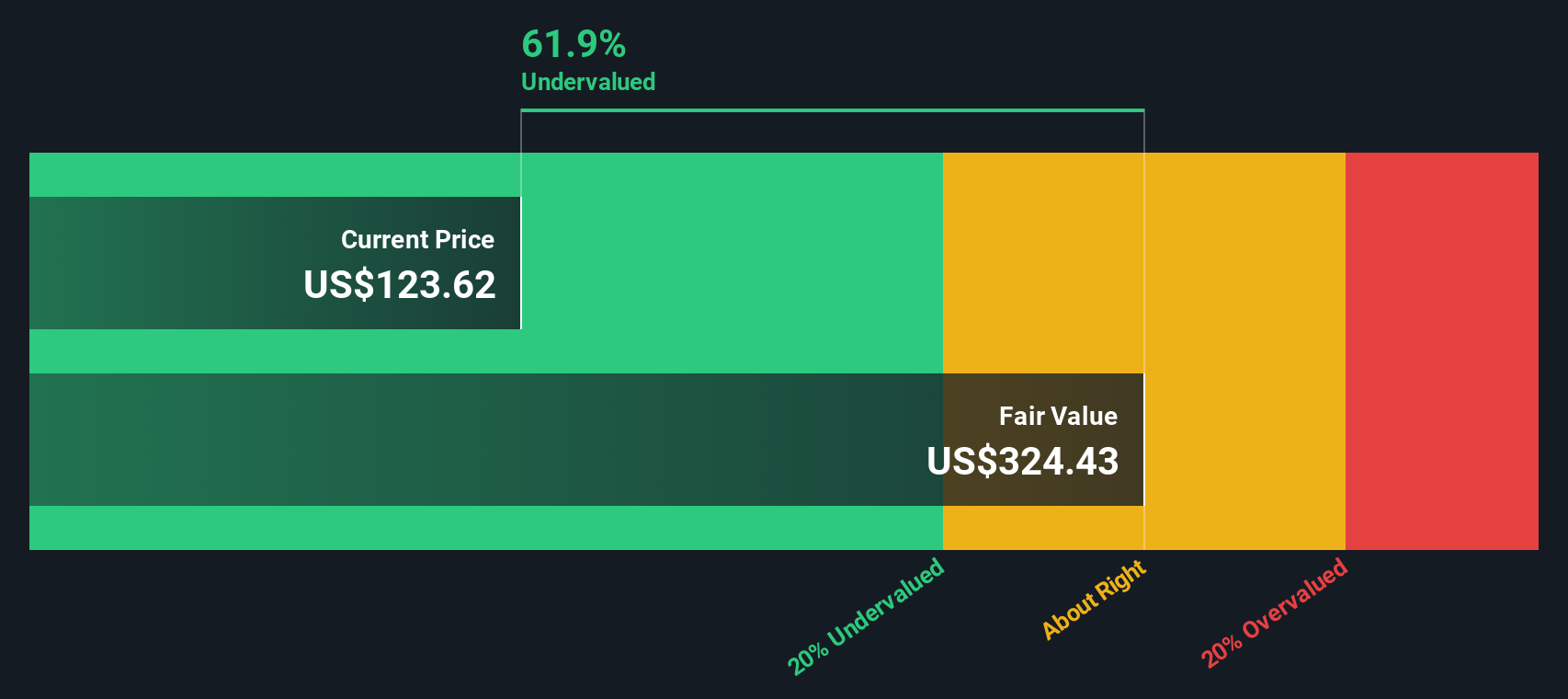

Using a 2 Stage Free Cash Flow to Equity model based on these projections, the estimated intrinsic value comes out at roughly $142.87 per share. Compared with a current share price around $110, the DCF output suggests the stock is 22.9% undervalued on these inputs.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Encompass Health is undervalued by 22.9%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

Approach 2: Encompass Health Price vs Earnings

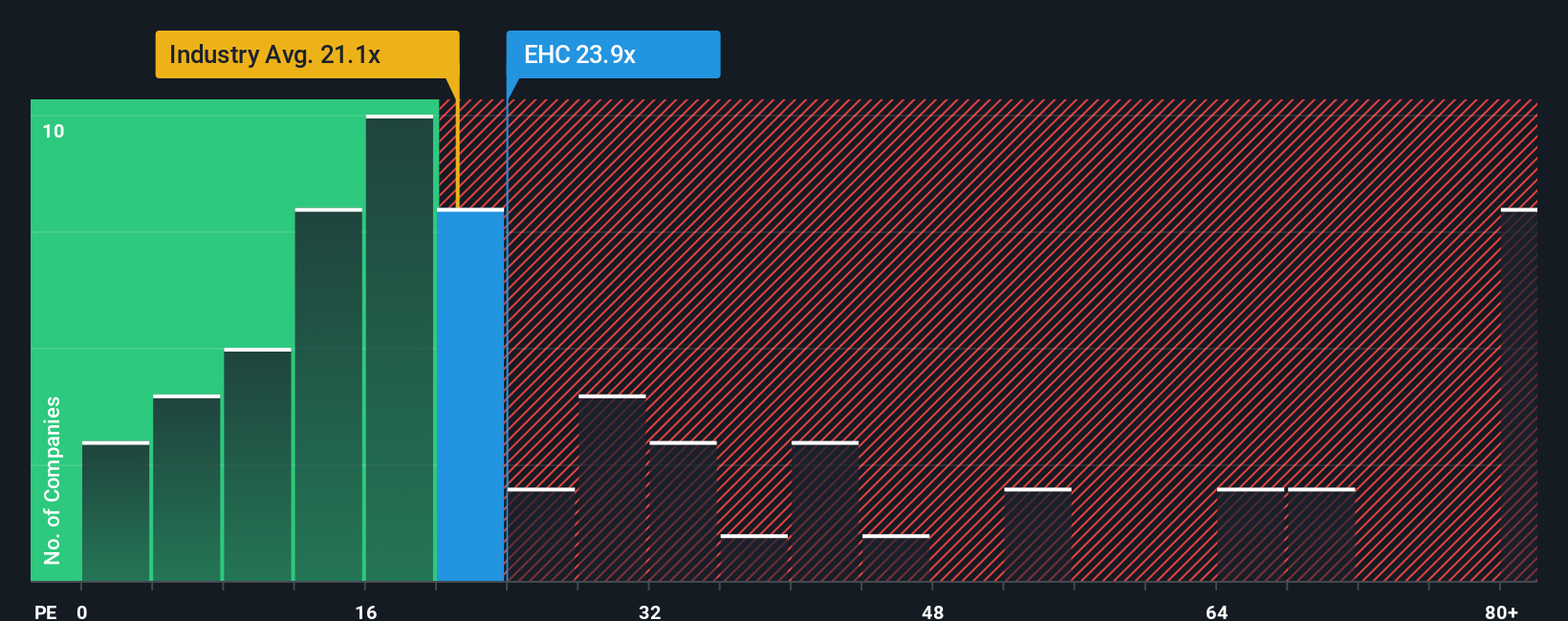

For a profitable business like Encompass Health, the P/E ratio is a useful way to think about what you are paying for each dollar of earnings. Investors usually accept a higher P/E if they expect stronger growth or see lower risk, and prefer a lower P/E if growth looks limited or risks feel higher.

Encompass Health currently trades on a P/E of about 19.5x. That sits below the Healthcare industry average of roughly 23.6x and also below the peer group average of about 24.0x. On the surface, that suggests the market is assigning a lower earnings multiple than it does to many comparable companies.

Simply Wall St also calculates a proprietary “Fair Ratio” for Encompass Health of 25.5x. This is designed to be more tailored than a simple peer or industry comparison because it factors in elements such as earnings growth characteristics, profit margins, the company’s industry and market capitalization, as well as risk indicators. Given that this Fair Ratio of 25.5x is higher than the current 19.5x P/E, the multiple based view points to the shares trading below that modelled fair level.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Encompass Health Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives on the Community page to turn your view of Encompass Health into a clear story that links its business drivers to a financial forecast and a fair value. You can then compare that fair value with the current price to help you decide what to do. These Narratives automatically update as new news or earnings arrive. One investor might build a Narrative that leans on the higher fair value assumption around US$143 and a future P/E near 22.0x, while another might anchor on a more cautious view using lower forecasts. Both can see how their story translates into numbers and how their price versus value gap changes over time.

Do you think there's more to the story for Encompass Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com