A Look At Plains GP Holdings (PAGP) Valuation After Recent Share Price Momentum

Plains GP Holdings (PAGP) has drawn investor attention recently after a steady run in its unit price, with the stock closing at $21.59 as of the latest trading session.

See our latest analysis for Plains GP Holdings.

Beyond the latest close at $21.59, Plains GP Holdings has shown building momentum, with recent 1 week, 1 month and 3 month share price returns of 4.25%, 5.06% and 21.57% respectively, alongside a 5 year total shareholder return of 265.75%.

If this midstream move has your attention, it could be a good moment to broaden your watchlist and check out our screener of 21 elite gold producer stocks as another way to find ideas.

With Plains GP trading close to recent highs and carrying an intrinsic value estimate that suggests a large implied discount, the key question is simple: is this pricing gap a genuine opportunity, or is the market already baking in stronger growth?

Most Popular Narrative: 4% Overvalued

Plains GP Holdings' most followed narrative pegs fair value at about $20.85, slightly below the latest $21.59 close, which sets up a tight valuation debate.

The analysts have a consensus price target of $21.458 for Plains GP Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $17.5.

Curious what drives that fair value call so close to the current price? The narrative leans on shifting revenue expectations, margin rebuild and a richer future earnings multiple. The exact mix of those inputs is where things get interesting.

Result: Fair Value of $20.85 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story can be knocked off course if crude volumes soften, or if heavier capital spending fails to translate into the earnings analysts are modeling.

Find out about the key risks to this Plains GP Holdings narrative.

Another Angle On Value

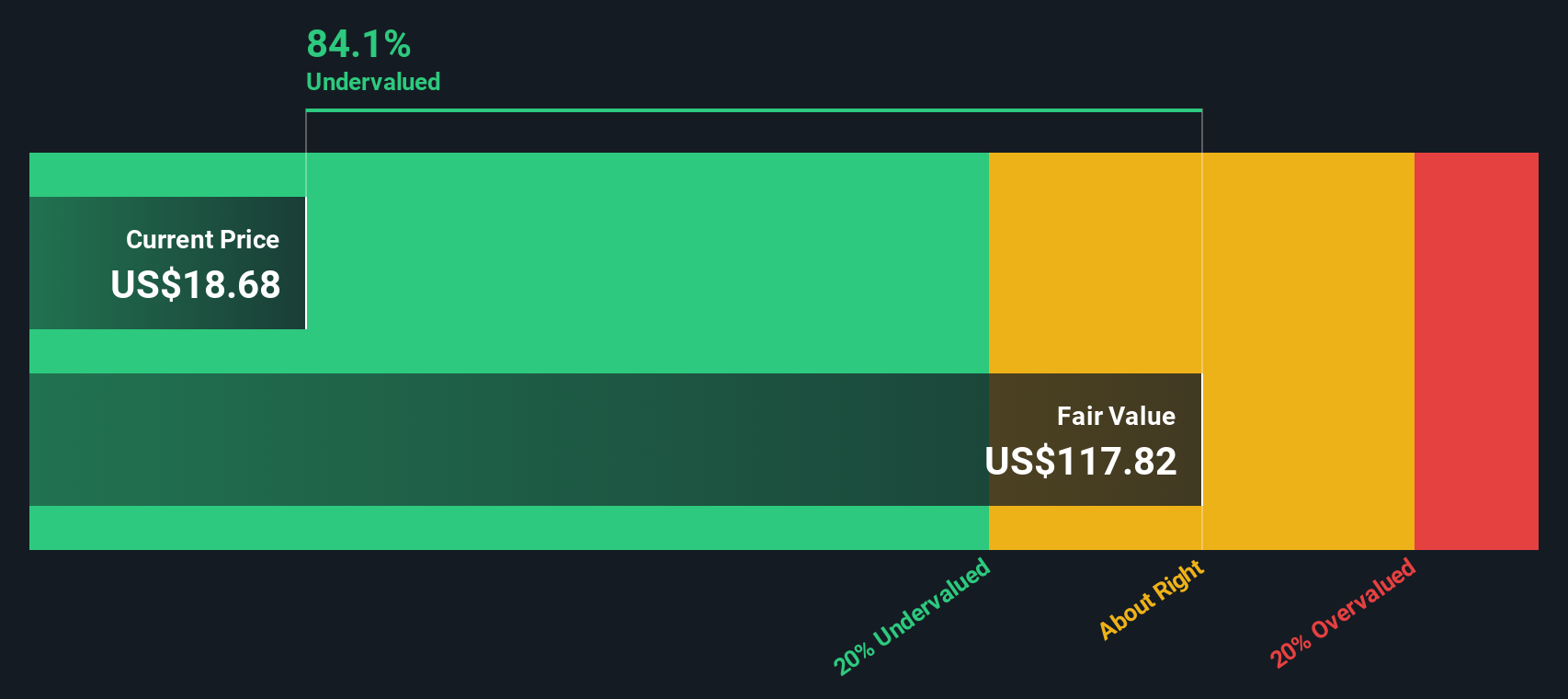

Our SWS DCF model paints a very different picture, with Plains GP trading at about an 82% discount to its estimated future cash flow value of $118.59 per unit. That kind of gap raises a simple question for you: is the model too optimistic, or is the market too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Plains GP Holdings Narrative

If you see the numbers differently or want to test your own assumptions, you can build a fresh view in just a few minutes, then Do it your way

A great starting point for your Plains GP Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one company when there is a whole market of possibilities. Use the Simply Wall St screener to widen your opportunity set quickly and confidently.

- Zero in on quality at a fair price by scanning our list of 53 high quality undervalued stocks that combine solid fundamentals with appealing valuations.

- Strengthen your focus on resilience by filtering for companies in the solid balance sheet and fundamentals stocks screener (45 results) that can better handle tougher conditions.

- Put potential income to work by reviewing the 12 dividend fortresses and see which names offer higher yields with supporting fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com