Is It Too Late To Consider Electronic Arts (EA) After A 56% One Year Rally?

- Wondering if Electronic Arts at around US$200 a share is still offering fair value or if the easy money has already been made? This article walks through the key numbers so you can judge for yourself.

- Electronic Arts shares most recently closed at US$200.62, with returns of 0.3% over 7 days, a 1.8% decline over 30 days, a 1.9% decline year to date, 55.8% over 1 year, 82.0% over 3 years and 41.2% over 5 years.

- Recent headlines have focused on Electronic Arts in the context of broader gaming sector interest and product pipeline updates, which often influence how investors think about growth potential and risk. These developments help frame whether the current share price reflects enthusiasm, caution or something in between.

- Despite all that attention, our valuation framework currently gives Electronic Arts a value score of 0 out of 6. Next we will compare different valuation approaches, then finish by looking at a more complete way to think about what the stock might be worth.

Electronic Arts scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Electronic Arts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company might be worth by projecting its future cash flows and then discounting those back to today using a required return. It is essentially asking what those future dollars are worth in dollar terms right now.

For Electronic Arts, the model uses a 2 Stage Free Cash Flow to Equity approach built on the latest twelve month free cash flow of about $2.31b. Analysts provide explicit free cash flow estimates for the earlier years, and Simply Wall St extends those projections further out. By 2035, the extrapolated free cash flow used in the model is around $2.83b, all in dollars.

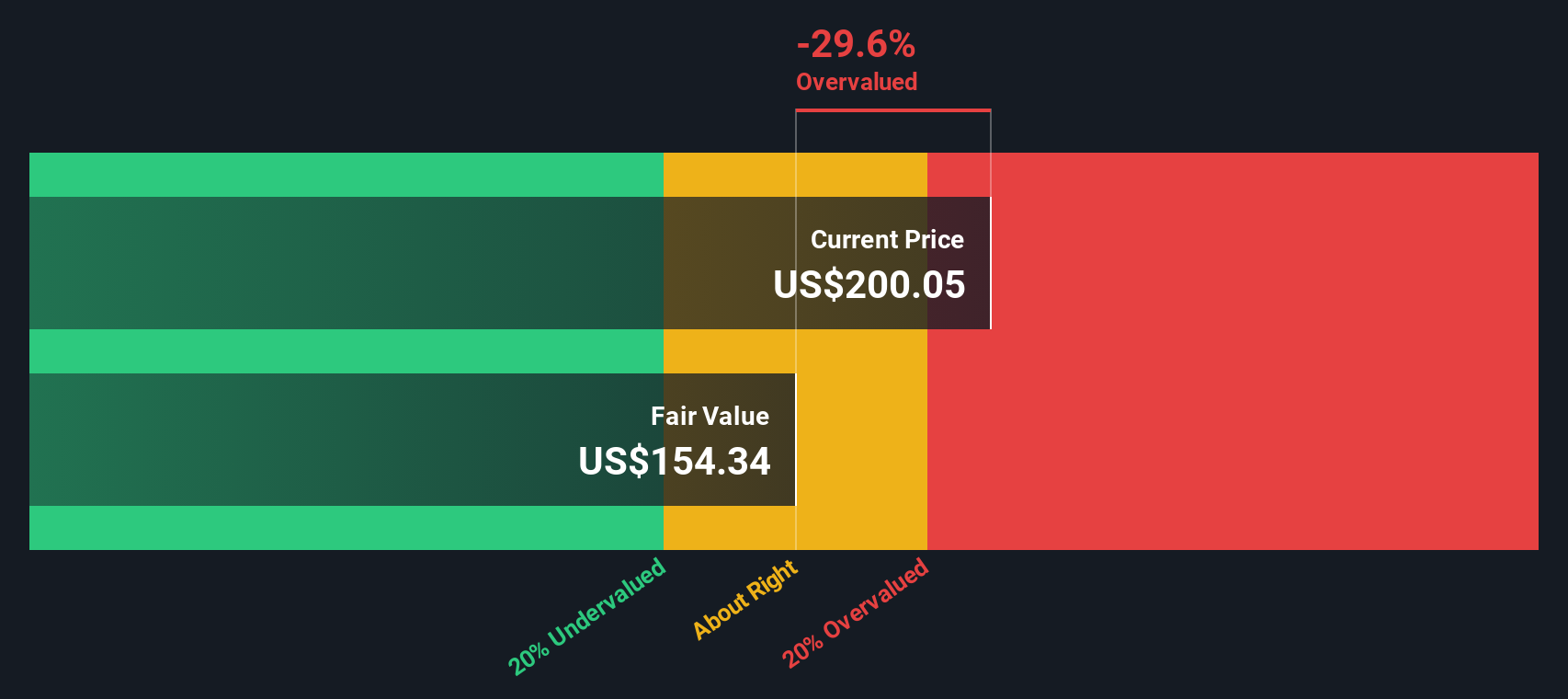

After discounting the projected cash flows back to today, the DCF model arrives at an estimated intrinsic value of around $157.05 per share. Compared with the recent share price of about $200.62, this framework suggests Electronic Arts trades at roughly a 27.7% premium to its modeled value, which indicates a stock that appears expensive on this cash flow view.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Electronic Arts may be overvalued by 27.7%. Discover 53 high quality undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Electronic Arts Price vs Earnings

For profitable companies, the P/E ratio is a useful shorthand for how many dollars investors are paying for each dollar of current earnings. It is a practical way to compare what you are paying here versus other options.

What counts as a “normal” P/E depends on what investors expect from a business, including its potential growth and the risks they see. Higher expected growth or lower perceived risk often go with a higher P/E, while slower growth or higher perceived risk usually line up with a lower P/E.

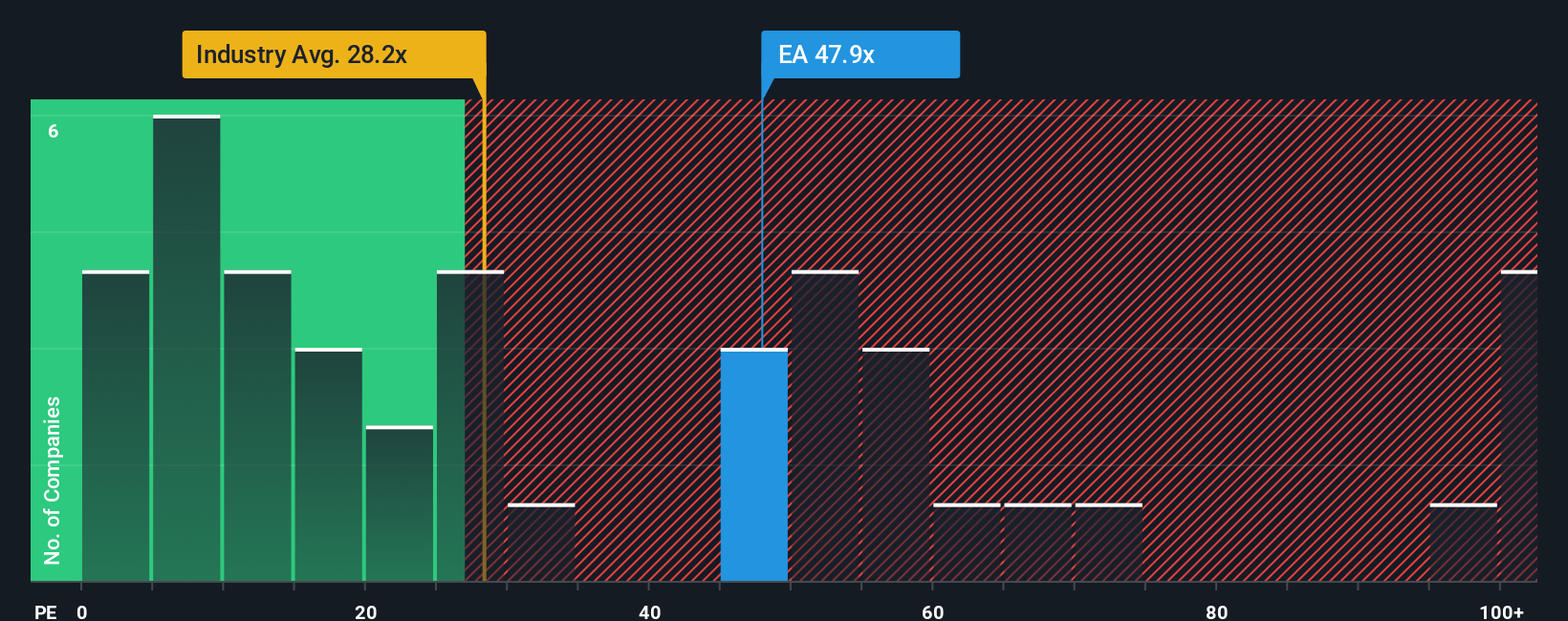

Electronic Arts currently trades on a P/E of 73.83x. That sits above the Entertainment industry average of 32.74x and also above the peer average of 71.51x. Simply Wall St’s Fair Ratio for Electronic Arts is 31.84x, which is their estimate of a suitable P/E after factoring in elements such as earnings growth, industry, profit margins, market cap and risk profile.

This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for the company’s specific characteristics rather than assuming one size fits all. With the current P/E of 73.83x versus a Fair Ratio of 31.84x, the shares look expensive on this multiple-based view.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Electronic Arts Narrative

Earlier we mentioned that there is an even better way to think about valuation. On Simply Wall St you can use Narratives, which are your own story for a company that ties together your assumptions for future revenue, earnings and margins into a forecast. This turns that into a fair value and compares it with today’s price to help you decide whether Electronic Arts looks attractive or stretched. It then keeps that view current as new earnings or news arrive. For example, one investor on the Community page currently has an Electronic Arts Narrative with a fair value of about US$146.82 per share, while another has a fair value near US$204.16 per share, showing how two people looking at the same company and data can reasonably land on very different conclusions.

For Electronic Arts, we will make it really easy for you with previews of two leading Electronic Arts Narratives:

Fair value in this narrative: US$204.16 per share

Implied discount vs recent price: about 1.7% undervalued using the narrative fair value

Assumed annual revenue growth: 7.70%

- Focus on live services, new titles like Battlefield and Skate, and big events such as the World Cup is expected to support higher player engagement and net bookings.

- AI use in development and tight cost control are built into the story as reasons for stronger margins and earnings, alongside ongoing share buybacks.

- The narrative also flags risks around weaker titles, Apex Legends softness, macro pressures on gaming spend and the shift from full game sales to live services.

Fair value in this narrative: US$146.82 per share

Implied premium vs recent price: about 36.7% overvalued using the narrative fair value

Assumed annual revenue growth: 5.33%

- This viewpoint anchors on a lower fair value than the current share price, so it treats the stock as pricing in more optimism than the model supports.

- The assumptions build in slower revenue growth and lower profit margins than the bullish narrative, which pulls down the estimated worth of future earnings.

- On this read, investors are encouraged to think carefully about how much they are paying today relative to more conservative expectations for growth and profitability.

Both narratives use the same company and public information, yet they land far apart on what Electronic Arts might be worth. That spread is a useful reminder to pressure test the assumptions that best match your own view of the business before deciding how comfortable you are with the current US$200.62 share price.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Electronic Arts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com