Assessing Photronics (PLAB) Valuation After Mixed Earnings And Cautious Outlook

Why Photronics Earnings Are Drawing Fresh Investor Attention

Photronics (PLAB) recently released quarterly results that highlighted steady revenue growth from foundry, logic, and high-end display customers, while pairing that with cautious guidance around inventory digestion and new technology ramp timing.

See our latest analysis for Photronics.

That mixed earnings message is landing against a backdrop of strong momentum, with the share price at $38.80 and a 90 day share price return of 87.08%, alongside a 1 year total shareholder return of 74.23%, pointing to meaningful recent repricing of Photronics prospects.

If strong semiconductor demand has your attention, this is a good moment to look across the sector and see what else stands out in our 34 AI infrastructure stocks.

With shares at $38.80, a recent 1-year total return of 74.23%, and only an 8% gap to the US$42 price target, the key question now is whether Photronics still trades at a discount or if the market is already pricing in future growth.

Most Popular Narrative: 7.6% Undervalued

With Photronics last closing at $38.80 and the most followed fair value estimate sitting at $42.00, the current price sits below what that narrative considers reasonable, which is why the underlying assumptions matter.

Analysts have modestly raised their price target on Photronics to US$42.00, reflecting slightly lower estimated discount rates and a small adjustment to the future P/E assumption, while keeping fair value unchanged.

Fair Value: The fair value estimate remains unchanged at US$42.00 per share. Read the complete narrative.

Curious what keeps that fair value steady even as the discount rate and future earnings multiple move around? The narrative leans heavily on measured revenue growth, stable margins and a specific earnings path years out. Want to see how those pieces fit together and what kind of profit profile is baked into that $42 mark?

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh geopolitical trade restrictions and high capital spending, which could pressure cash flow if demand or revenue timing does not cooperate.

Find out about the key risks to this Photronics narrative.

Another View: Our DCF Model Points The Other Way

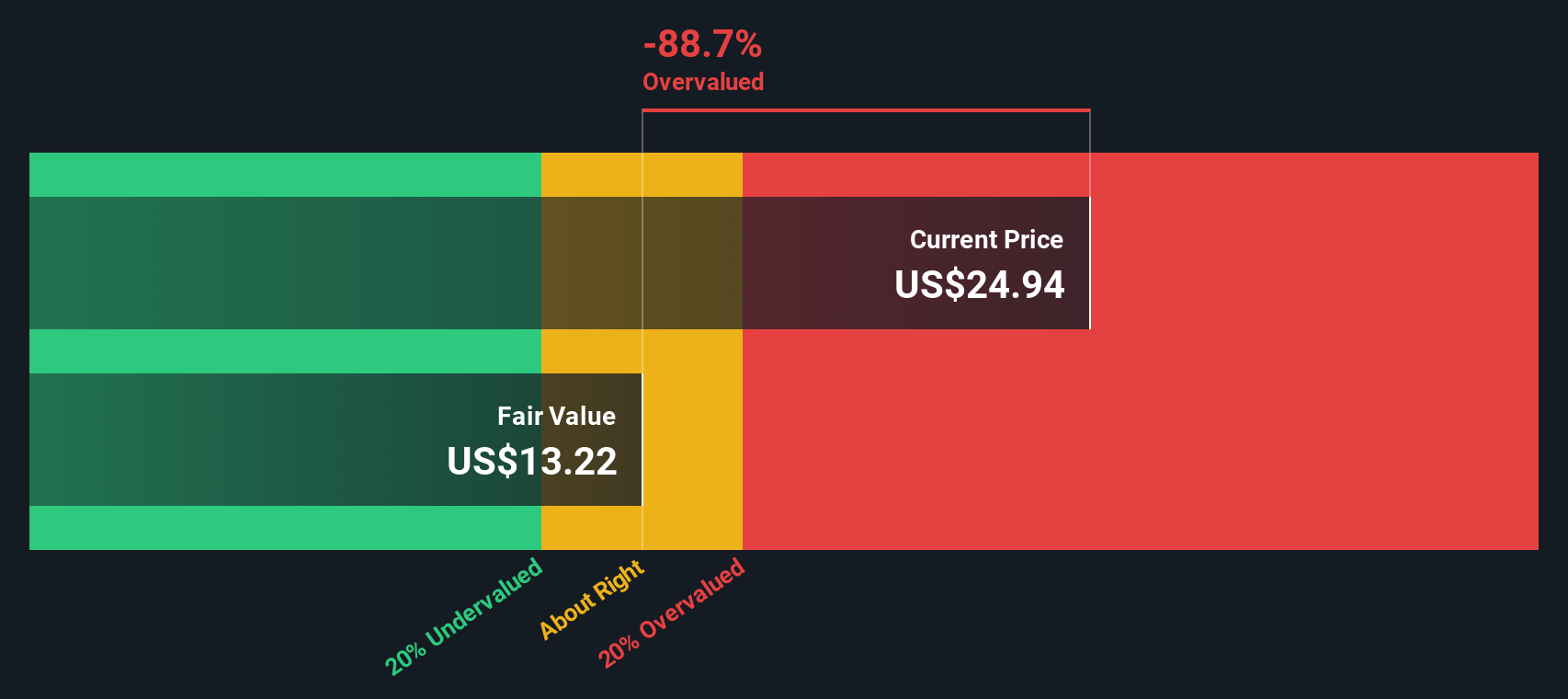

The fair value narrative pegs Photronics at $42.00 and calls that undervalued, but our DCF model tells a very different story, with a future cash flow value of $19.75 per share. Under that lens, the stock could appear expensive instead. Which approach do you consider more useful for your own thesis?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If parts of this story do not quite line up with your own view, or you prefer to test the numbers yourself, you can build a custom thesis in just a few minutes and Do it your way

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Photronics has sharpened your focus, do not stop here, use the Simply Wall St screener to spot other opportunities that could fit your style.

- Target quality at a discount by checking companies in our 53 high quality undervalued stocks that pair fundamentals with prices the screener flags as below fair value.

- Prioritise resilience by scanning our 84 resilient stocks with low risk scores that highlights businesses with fewer red flags according to our risk scoring.

- Get ahead of the crowd with the screener containing 23 high quality undiscovered gems that surfaces financially solid names which have not yet drawn as much market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com