Assessing RPC (RES) Valuation After Earnings Miss And Securities Investigation News

RPC (RES) is back on traders' radar after its fourth quarter and full year 2025 results, which included a miss on non GAAP earnings and weakness in Support Services, were followed by a securities law investigation.

See our latest analysis for RPC.

At a share price of $5.82, RPC has seen short term share price strength, with a 1 day share price return of 3.37% and a 90 day share price return of 9.60%. Longer term performance has been softer, with a 1 year total shareholder return decline of 1.85% and a 3 year total shareholder return decline of 30.26%. This suggests recent momentum is rebuilding after a tougher few years, especially as the market digests weaker Support Services results, ongoing share repurchases and management’s comments about pursuing acquisitions in less capital intensive service lines.

If recent results have you reassessing energy related ideas, it could be a good moment to broaden your search and check out 23 top founder-led companies as a fresh source of ideas.

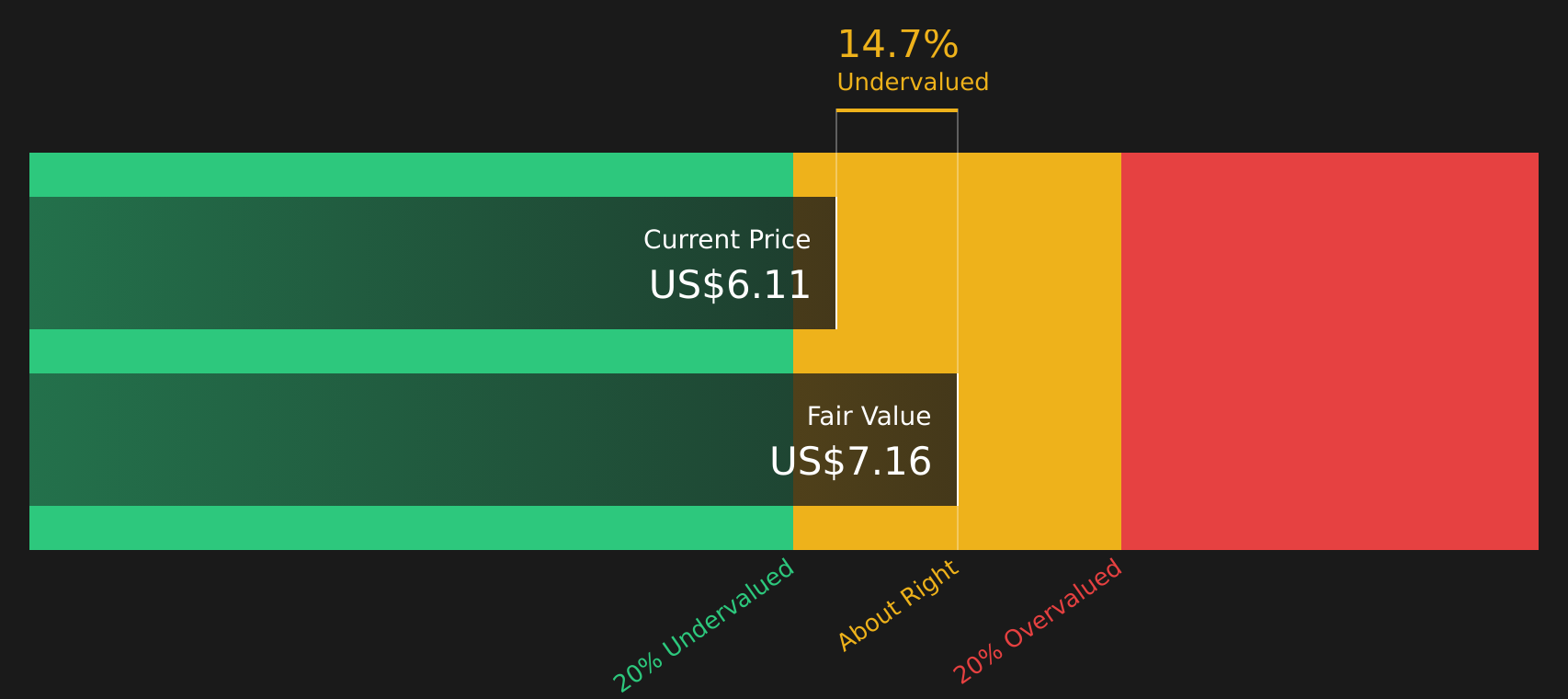

With earnings under pressure, an investigation under way and the stock trading around a 19% implied discount to intrinsic value, you have to ask: is RPC quietly undervalued here, or is the market already pricing in its next chapter?

Most Popular Narrative: 2.9% Overvalued

RPC’s most followed narrative pegs fair value at $5.66, slightly below the last close of $5.82. This sets up a tight valuation debate.

Continued investment in natural gas powered pressure pumping equipment and other efficient, cleaner service lines directly addresses future demand for environmentally friendlier drilling solutions, positioning RPC to benefit from long term client preference for lower emission and high efficiency operations, which can support pricing and market share gains and lift net margins.

Curious what kind of revenue path, margin profile and future earnings multiple are baked into that fair value? The narrative leans on specific growth rates, a higher profitability run rate and a premium P/E to justify today’s modest premium. The full story joins these pieces into a single, tightly argued valuation case.

The narrative uses a 7.50% discount rate to bring those future cash flows back to today, and the small 2.9% premium to fair value leaves limited room for error in those assumptions. Result: Fair Value of $5.66 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that tight valuation leaves little cushion if pricing pressure in pressure pumping and wireline persists, or if higher capital spending keeps free cash flow under strain.

Find out about the key risks to this RPC narrative.

Another Angle: DCF Says Undervalued

While the most popular narrative calls RPC roughly fairly priced around $5.66, our DCF model paints a different picture. Based on that calculation, the stock trades about 19% below an estimated future cash flow value of $7.15, which points to a potential valuation gap. This raises the question of whether the market is being too cautious or whether optimistic cash flow assumptions are driving the valuation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RPC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 54 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RPC Narrative

If you see the numbers differently or prefer to lean on your own work, you can test your assumptions, shape the story and Do it your way in just a few minutes.

A great starting point for your RPC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If RPC has sparked your thinking, do not stop here. Use the screener to hunt for other setups that could suit your goals just as well.

- Target dependable cash generators by checking out 13 dividend fortresses that may help anchor your portfolio when sentiment swings.

- Pursue value focused opportunities using 54 high quality undervalued stocks to spot companies where the market price sits below fundamentals based fair value estimates.

- Get ahead of the crowd by scanning our screener containing 24 high quality undiscovered gems and see which lesser known names still fly under most investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com