3 Undiscovered Gems In The US Market

As February begins, the United States stock market is experiencing a positive momentum with major indexes like the Dow Jones and S&P 500 showing significant gains. Against this backdrop of economic optimism, investors are increasingly looking toward small-cap stocks as potential opportunities for growth, especially as U.S. factory activity shows signs of expansion for the first time in a year. In this environment, identifying stocks that combine strong fundamentals with unique market positions can be key to uncovering undiscovered gems in the U.S. market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Cashmere Valley Bank | 30.46% | 5.25% | 1.74% | ★★★★★★ |

| Oakworth Capital | 26.12% | 15.98% | 13.01% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.65% | 41.20% | ★★★★★★ |

| Seneca Foods | 38.64% | 2.39% | -18.65% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| Pure Cycle | 5.42% | 9.36% | -2.03% | ★★★★★☆ |

| Kingstone Companies | 4.41% | 4.36% | 44.59% | ★★★★☆☆ |

| Oxford Bank | 12.42% | 14.34% | 4.14% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Spok Holdings (SPOK)

Simply Wall St Value Rating: ★★★★★★

Overview: Spok Holdings, Inc., via its subsidiary Spok, Inc., delivers healthcare communication solutions across various regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market capitalization of $282.61 million.

Operations: Spok generates revenue primarily from its Clinical Communication and Collaboration Business, amounting to $139.74 million. The company's market capitalization stands at approximately $282.61 million.

Spok Holdings, a smaller player in the wireless telecom sector, has shown impressive earnings growth of 54.6% annually over the past five years. Despite this, its recent 13% earnings growth lags behind the industry average of 36.6%. With no debt on its books for five years and trading at a discount of 19.3% below estimated fair value, Spok seems to offer an attractive proposition for investors seeking undervalued opportunities. Its free cash flow is positive, standing at US$26 million as of June 2025, indicating strong operational efficiency and potential for future expansion within its niche market segment.

- Navigate through the intricacies of Spok Holdings with our comprehensive health report here.

Examine Spok Holdings' past performance report to understand how it has performed in the past.

Ennis (EBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Ennis, Inc. is a company that produces and sells business forms and other printed products in the United States, with a market capitalization of $525.08 million.

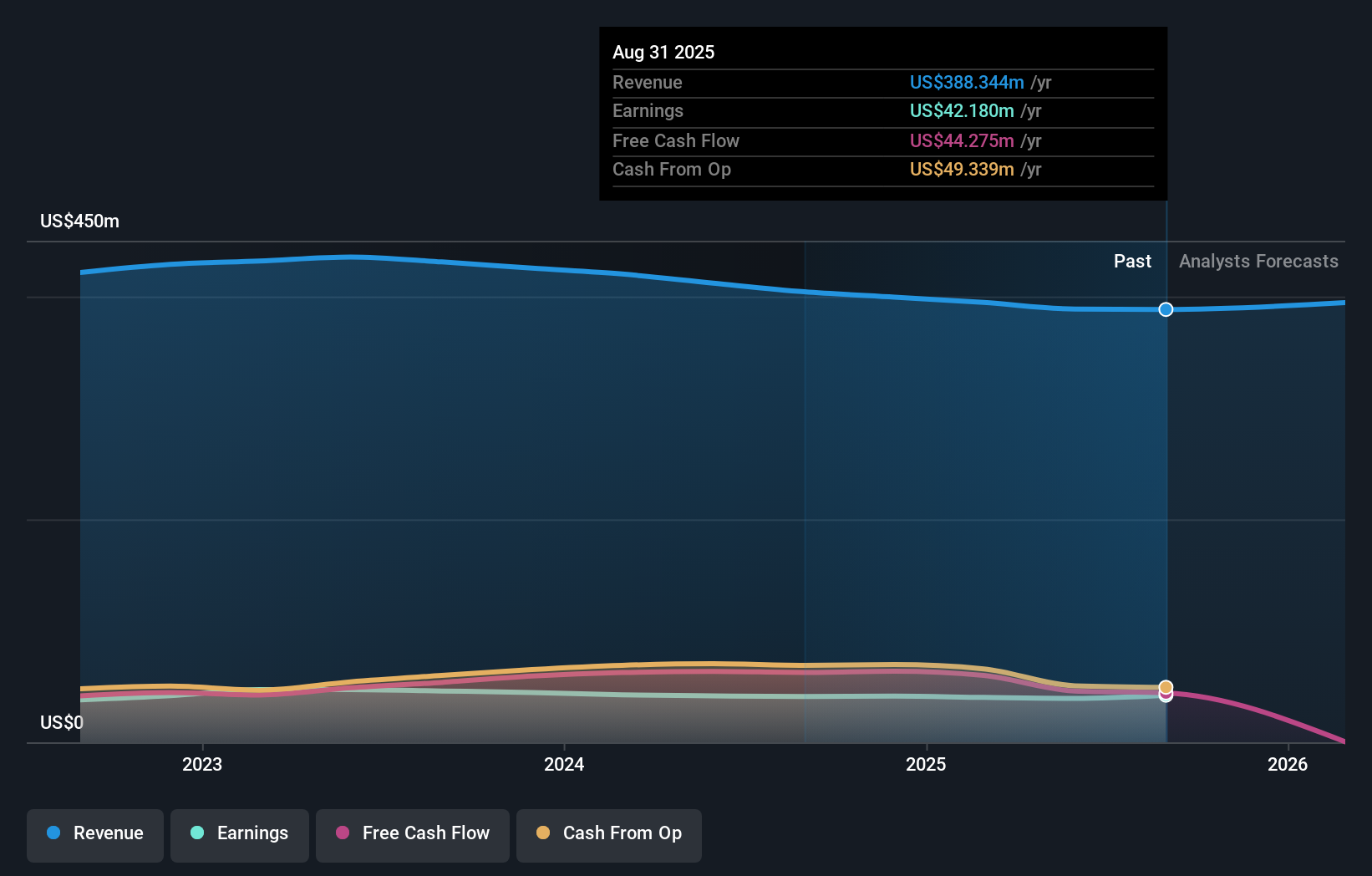

Operations: Ennis generates revenue primarily from its print segment, which accounts for $388.74 million. The company's financial performance includes a focus on managing costs to impact profitability effectively.

Ennis, a printing company with a market niche, showcases stable performance. Recent earnings for the third quarter revealed sales of US$100.17 million, slightly up from US$99.77 million last year, while net income reached US$10.83 million compared to US$10.2 million previously. Over nine months, the company reported net income of US$33.78 million against last year's US$31.2 million and repurchased 336,885 shares worth about US$5.84 million recently as part of its ongoing buyback program totaling 3,230,696 shares since inception in 2008 for roughly $54.85M so far under this initiative.

- Delve into the full analysis health report here for a deeper understanding of Ennis.

Explore historical data to track Ennis' performance over time in our Past section.

Genie Energy (GNE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genie Energy Ltd. operates through its subsidiaries to provide energy services both in the United States and internationally, with a market cap of $386.83 million.

Operations: Genie Energy generates revenue primarily from its Genie Retail Energy segment, which contributes $462.20 million, while Genie Renewables adds $21.09 million.

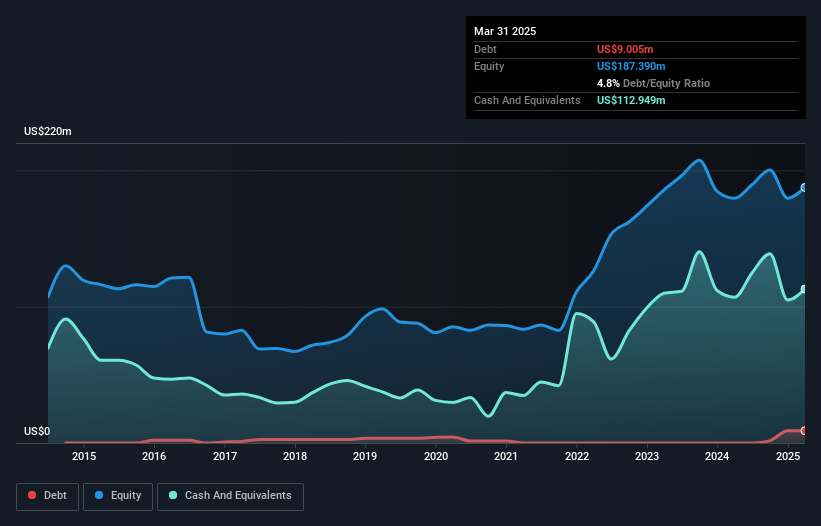

Genie Energy, a dynamic player in the energy sector, has seen its earnings surge by 118.9% over the past year, significantly outpacing the Electric Utilities industry's 8.9% growth. The company is trading at a value roughly 14% below its estimated fair market price, suggesting potential upside for investors. Despite challenges like regulatory hurdles and market concentration risks, Genie remains free cash flow positive and holds more cash than total debt, indicating financial resilience. Recently affirming a quarterly dividend of US$0.075 per share further underscores confidence in its operational stability amidst evolving energy markets.

Turning Ideas Into Actions

- Dive into all 319 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com