A Look At Fortive (FTV) Valuation After Q4 Revenue Beat And Automation Growth Momentum

Fortive (FTV) is back in focus after fourth quarter results topped Wall Street revenue expectations. Management pointed to new product launches, targeted commercial spending, and cost discipline as key supports for the recent stock move.

See our latest analysis for Fortive.

At a share price of US$56.90, Fortive has seen a 12.94% 90 day share price return and a modest 3.53% 30 day share price return. The 1 year total shareholder return of a 5.87% decline suggests recent momentum has picked up after a softer year, helped by earnings, ongoing Industry 4.0 exposure, and consistent share repurchases.

If the latest earnings news has you looking beyond a single name, it could be a good time to scan the market for other automation beneficiaries through our 32 robotics and automation stocks.

So with Fortive trading at US$56.90, sitting at an 11% intrinsic discount and roughly a 9% gap to average analyst targets, is the recent uptick just catching up to fundamentals, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 2.1% Undervalued

Fortive's most followed narrative pegs fair value at $58.13, just above the last close of $56.90, suggesting a relatively tight valuation gap built on detailed cash flow work.

Ongoing operational excellence via the Amplified Fortive Business System and disciplined capital allocation, including targeted bolt-on acquisitions in niche software and analytics, are expected to deliver further cost productivity, improved net margins, and robust free cash flow conversion.

Read the complete narrative. Read the complete narrative.

Want to see what sits behind that fair value call? The narrative leans heavily on earnings quality, recurring revenue depth, and a richer margin profile than today. It also bakes in a higher earnings base and a premium future earnings multiple, all discounted back at 8.8% using detailed cash flow projections.

Result: Fair Value of $58.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including tariff and trade uncertainty and ongoing healthcare segment softness, that could quickly challenge even this measured undervaluation story.

Find out about the key risks to this Fortive narrative.

Another View: Market Pricing Looks Richer

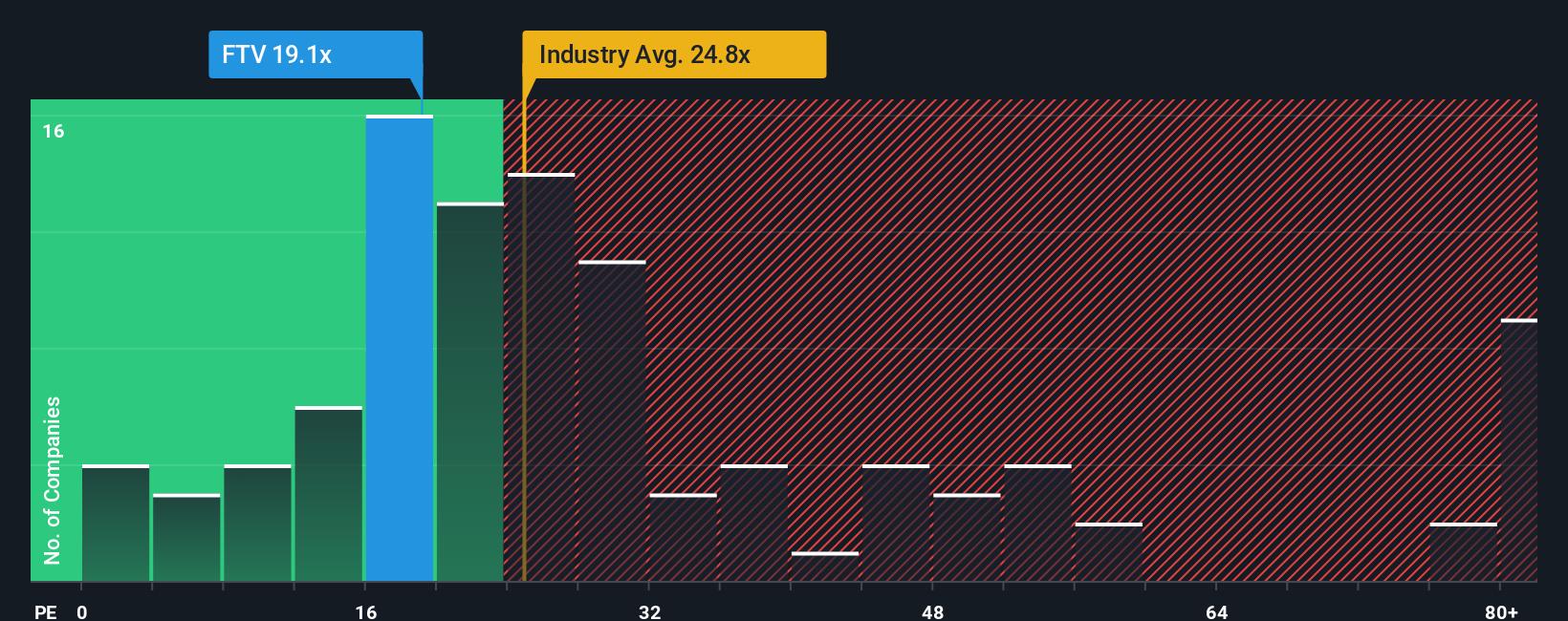

That 2.1% gap to the US$58.13 fair value leans on cash flow work, but the market is telling a different story through the P/E ratio. At 33.5x earnings, Fortive trades above the US Machinery industry at 29.9x and the peer average at 30.2x, and also above its own fair ratio of 30.2x. For you, that means less room for error if sentiment turns, so which signal do you trust more, the model or the market?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortive Narrative

If you see the numbers differently or simply prefer to test your own assumptions against the data, you can build a fresh thesis in just a few minutes: Do it your way

A great starting point for your Fortive research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If you only stop at Fortive, you could miss other opportunities sitting in plain sight, so put a few smart screeners to work for you today.

- Target potential mispricings by scanning companies that look attractively valued using our 54 high quality undervalued stocks built from detailed fundamental data.

- Prioritise resilience by checking out the 83 resilient stocks with low risk scores built around businesses with more measured risk profiles.

- Spot under followed opportunities by running our screener containing 24 high quality undiscovered gems that highlights quality names many investors may not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com