A Look At Brink's (BCO) Valuation After Strong Recent Shareholder Returns

Brink's (BCO) has been drawing more attention after recent share price moves, leaving investors weighing how its cash management and security services business lines compare with its current valuation and recent return profile.

See our latest analysis for Brink's.

At a share price of $130.69, Brink's has seen a 90 day share price return of 18.86% and a 1 year total shareholder return of 41.25%, which together suggest recent momentum building on a stronger multi year outcome.

If this move in Brink's has you thinking about where else capital could work hard, it might be worth scanning 23 top founder-led companies as a fresh source of ideas.

With Brink's trading at $130.69, an indicated 59% intrinsic discount and some upside to analyst targets, the real question is whether the stock still offers value or if the market is already pricing in future growth.

Most Popular Narrative: 2.1% Undervalued

Brink's last closed at $130.69 against a most followed narrative fair value of $133.50, so the current price sits just under that modeled estimate.

The higher price target is tied directly to analysts assigning more value to Brink's earnings power, with updated P/E and margin assumptions pointing to what they view as a stronger long term earnings profile than previously modeled.

Adjustments to the discount rate suggest bullish analysts see the risk profile as more manageable than before, which supports a higher valuation on the same cash flow base.

Curious what kind of revenue mix, margin structure, and earnings ramp are baked into that $133.50 figure at an 8.23% discount rate and low future multiple assumptions? The full narrative lays out a detailed path for earnings power, share count, and long term profitability, and the numbers behind it might be very different to what the current price implies.

Result: Fair Value of $133.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could change quickly if cash usage falls faster than expected or if rising competition and tech investment needs begin to pressure margins and free cash flow.

Find out about the key risks to this Brink's narrative.

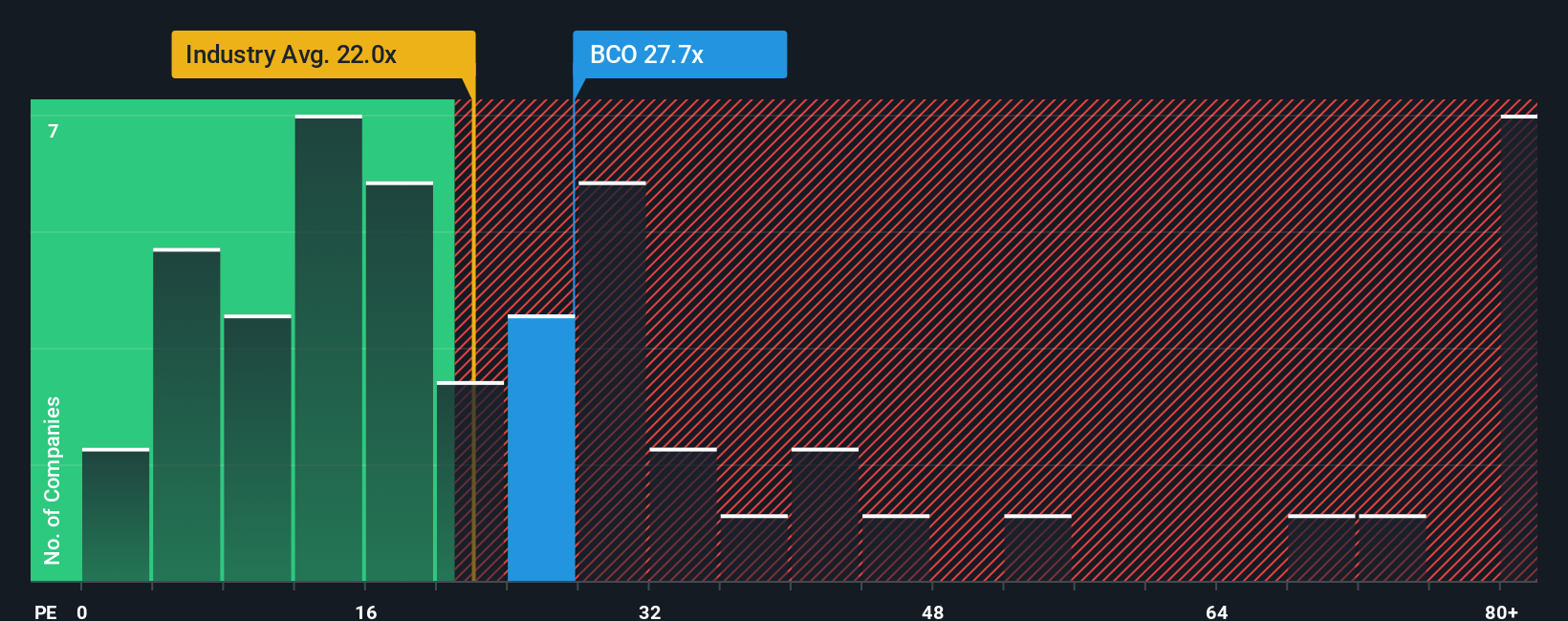

Another View: Earnings Multiple Paints A Richer Picture

While the narrative fair value of $133.50 points to Brink's looking slightly undervalued, the current P/E of 32.1x sits well above both the Commercial Services peer average of 19.5x and its own fair ratio of 55.2x. This raises the question of how much execution risk you are comfortable with at this price.

See what the numbers say about this price — find out in our valuation breakdown.

Next Steps

If this mix of upside potential and execution questions leaves you on the fence, take a closer look at the underlying data, move quickly while the facts are fresh in the market, and weigh 3 key rewards and 1 important warning sign against your own expectations.

Looking for more investment ideas?

If Brink's has sharpened your focus, do not stop here. You can widen your opportunity set in minutes by scanning a few targeted stock lists built from the same data.

- Target strong fundamentals and balance sheet resilience by running your eye over our solid balance sheet and fundamentals stocks screener (44 results) that could handle tougher conditions.

- Hunt for potential value by checking companies on our 55 high quality undervalued stocks where quality and pricing might not yet match up.

- Secure the income side of your portfolio by reviewing our 13 dividend fortresses that focus on higher yielding payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com