Annaly Declares Q1 2026 Preferred Dividends And Signals Income Priorities

- Annaly Capital Management (NYSE:NLY) has declared quarterly preferred stock dividends for Q1 2026.

- The announcement covers multiple preferred series, with payments scheduled according to each series' terms.

- The decision directly affects preferred shareholders who rely on regular income distributions.

Annaly Capital Management is a large mortgage real estate investment trust focused on owning and financing mortgage assets. For income focused investors, preferred shares of mortgage REITs sit between common equity and debt in the capital structure, with dividends that are typically prioritized over common stock payouts. In a sector that can be sensitive to funding costs and credit conditions, dividend decisions on preferred shares often draw close attention.

For you as an investor, this Q1 2026 declaration is a fresh data point on how the Board is approaching capital allocation and income distributions for preferred holders. While it does not speak to future dividends, it helps you assess how preferred payouts are being treated right now alongside broader conditions for mortgage REITs and income oriented securities.

Stay updated on the most important news stories for Annaly Capital Management by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Annaly Capital Management.

The Q1 2026 preferred dividends provide insight into how Annaly is handling its income commitments. All four series, including the fixed to floating Series F, G and I, are paying based on three month CME Term SOFR plus a defined spread. This currently results in cash dividend rates around 8.1% to 8.9%, and 8.875% for the fixed rate Series J. For existing preferred holders, this confirms that distributions are continuing according to each security’s terms, which is a key part of the income case for mortgage REIT preferreds.

How This Fits Into The Annaly Capital Management Narrative

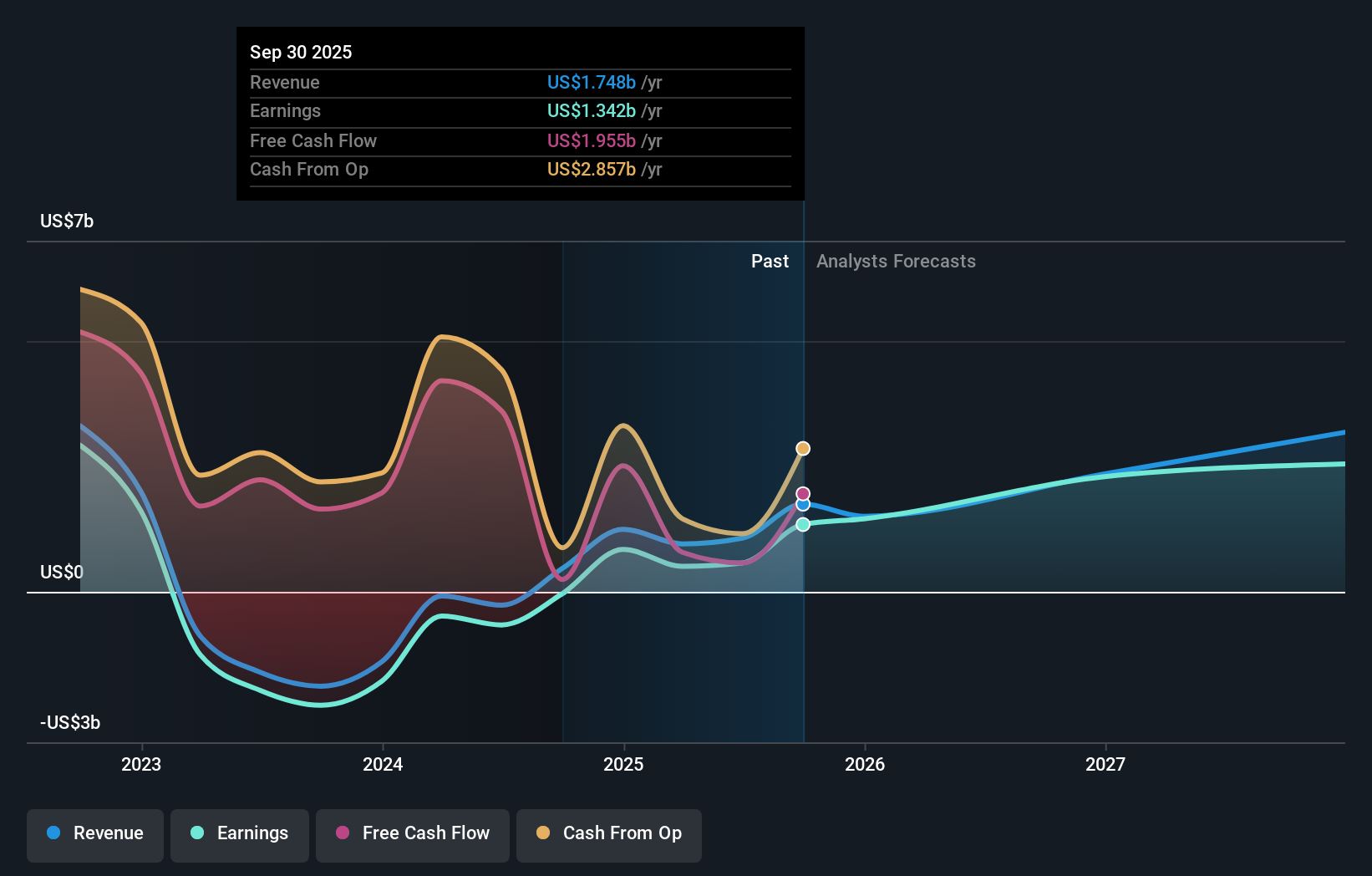

- The declaration of all scheduled preferred dividends aligns with the idea that Annaly’s agency mortgage backed securities and mortgage servicing rights portfolios are producing enough cash flow to keep income distributions on track.

- At the same time, high single digit dividend rates on the preferreds highlight the funding cost side of the story, which could pressure net interest margins that analysts expect to support earnings over time.

- The fixed to floating reset mechanics, tied to SOFR plus a spread, add an interest rate sensitivity that is not fully spelled out in the broader narrative around credit conditions and policy support.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Annaly Capital Management to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Analysts flag that debt is not well covered by operating cash flow, which can make high fixed and floating preferred payouts more demanding if conditions tighten.

- ⚠️ The overall dividend, at 12.14%, is not well covered by earnings or free cash flows, so you should pay close attention to payout sustainability rather than just the headline yield.

- 🎁 Earnings are forecast to grow 10.45% per year, which, if achieved, could support the ongoing burden of these preferred distributions over time.

- 🎁 Earnings grew by 120.6% over the past year, which gives management more room today to honor preferred commitments while working on balance sheet strength.

What To Watch Going Forward

From here, keep an eye on a few things. First, monitor how three month CME Term SOFR moves, because it feeds directly into the dividend rates on Series F, G and I and therefore Annaly’s funding costs. Second, track payout coverage, both for preferreds and the overall dividend, using earnings and cash flow rather than just reported yields. Third, watch management’s capital choices, including the lack of recent buybacks, as that can signal whether they are prioritizing income, balance sheet flexibility or growth. Comparing Annaly’s approach with other mortgage REITs such as AGNC Investment or Chimera Investment can also help you judge whether this dividend policy fits your own risk and income expectations.

To ensure you are always in the loop on how the latest news impacts the investment narrative for Annaly Capital Management, head to the community page for Annaly Capital Management to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com