The Bull Case For Delta Air Lines (DAL) Could Change Following A Major Airbus Wide-Body Fleet Refresh

- Delta Air Lines recently confirmed a major order for 31 Airbus wide-body jets, converting 10 options into firm purchases and adding options for 20 more aircraft as part of its effort to modernize its international fleet and replace older long-haul planes.

- This fleet refresh focuses on newer, more fuel-efficient aircraft aimed at serving resilient premium international demand from corporate and high-income travelers, underscoring how Delta is prioritizing higher-value segments of the market.

- We’ll now examine how Delta’s decision to expand its fuel-efficient Airbus wide-body fleet could influence its existing investment narrative.

Find 56 companies with promising cash flow potential yet trading below their fair value.

Delta Air Lines Investment Narrative Recap

To own Delta today, you need to believe that premium, international and loyalty-driven revenue can offset softness in domestic main cabin demand and cost pressures. The Airbus wide-body order fits that thesis by leaning into fuel-efficient long-haul flying, but it does not materially change the key near term catalyst of margin protection or the main risk from economic uncertainty and weaker lower-fare travel.

Among recent announcements, the affirmed quarterly dividend of US$0.1875 per share stands out alongside the fleet news. Together, they highlight a management team signaling confidence in cash generation while committing sizable capital to modern aircraft. For investors focused on catalysts, this pairing raises timely questions about how Delta balances shareholder returns with higher non-fuel costs and ongoing investment in its international network.

Yet behind the focus on premium growth, investors should also be aware of rising non-fuel unit costs and what they could mean if demand...

Read the full narrative on Delta Air Lines (it's free!)

Delta Air Lines' narrative projects $68.4 billion revenue and $4.6 billion earnings by 2028. This requires 3.4% yearly revenue growth and a modest $0.1 billion earnings increase from $4.5 billion today.

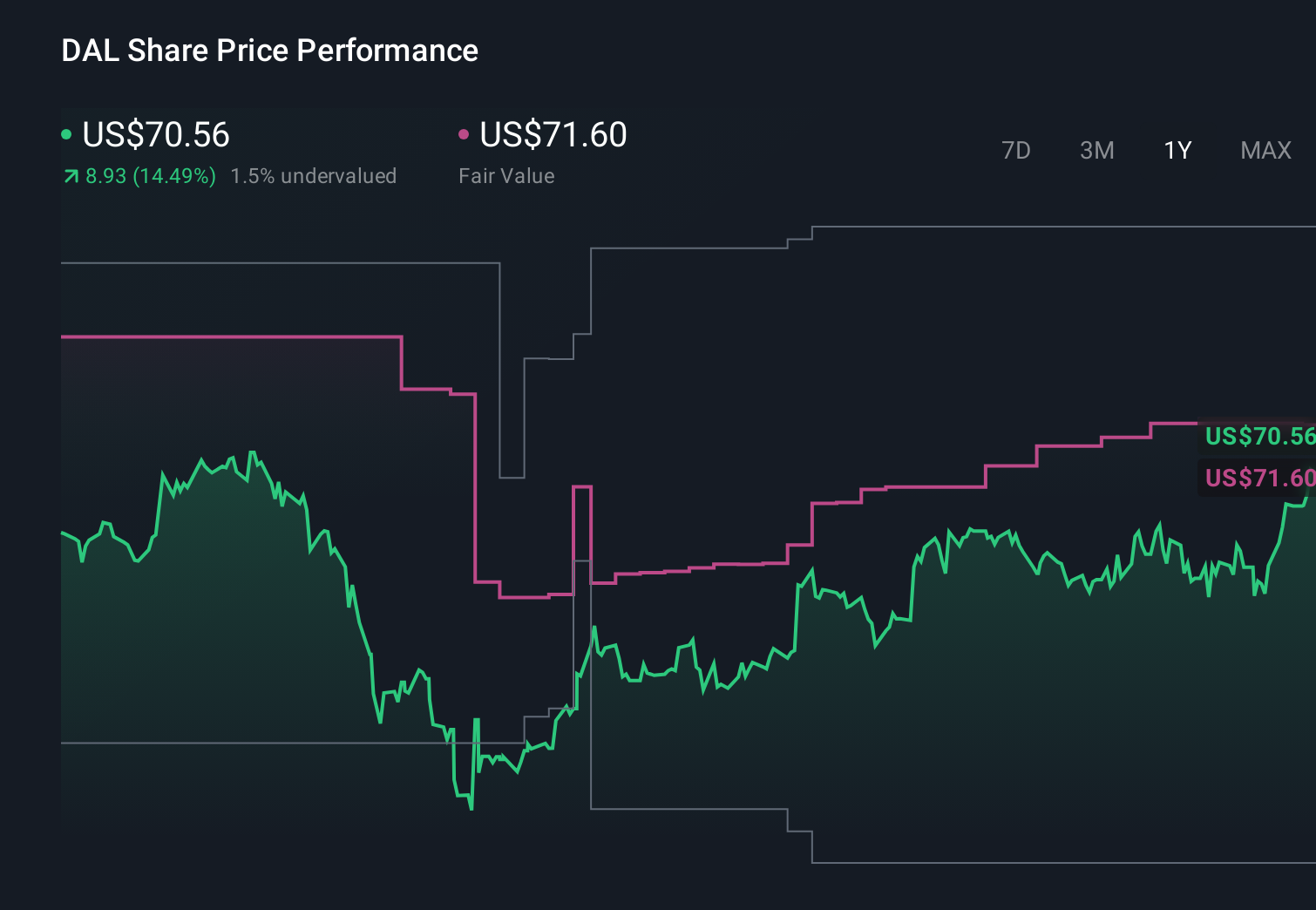

Uncover how Delta Air Lines' forecasts yield a $81.29 fair value, a 15% upside to its current price.

Exploring Other Perspectives

The most pessimistic analysts were already bracing for earnings to fall toward about US$3.2 billion by 2028 and profit margins to contract, so this new Airbus order could either challenge or reinforce those concerns, depending on how you view rising non-fuel costs and future international demand.

Explore 10 other fair value estimates on Delta Air Lines - why the stock might be worth as much as 79% more than the current price!

Decide For Yourself

Don't just follow the ticker - dig into the data and build a conviction that's truly your own.

- A great starting point for your Delta Air Lines research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

No Opportunity In Delta Air Lines?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Capitalize on the AI infrastructure supercycle with our selection of the 34 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- The future of work is here. Discover the 32 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com