How Credit Acceptance’s Earnings Beat Amid Scrutiny At Credit Acceptance (CACC) Has Changed Its Investment Story

- Recently, Credit Acceptance Corp reported earnings that surpassed market expectations despite a difficult auto lending backdrop and ongoing legal and regulatory scrutiny of its lending and collection practices.

- This combination of resilient credit performance and heightened oversight puts a spotlight on how the company manages delinquencies, charge-offs, and funding costs under greater uncertainty.

- We’ll now examine how this earnings beat, set against ongoing regulatory scrutiny, may influence Credit Acceptance’s existing investment narrative and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Credit Acceptance Investment Narrative Recap

To own Credit Acceptance today, you need to believe its non prime auto lending model can remain profitable even as regulators and courts scrutinize how it lends and collects. The latest earnings beat supports the near term catalyst of solid credit performance, but it does not remove the biggest risk, which is that legal and regulatory outcomes could still pressure both profitability and the way the business operates.

The most relevant recent announcement is the series of amendments to the company’s asset backed and warehouse funding facilities, which adjust rates and extend maturities. In the context of this earnings beat, these funding actions matter because they directly influence funding costs, a key swing factor for returns if credit losses, competition, or regulatory driven changes to collections were to affect cash flows.

Yet beneath the earnings surprise, investors should be aware of how ongoing legal and regulatory scrutiny could still affect...

Read the full narrative on Credit Acceptance (it's free!)

Credit Acceptance's narrative projects $4.5 billion revenue and $504.0 million earnings by 2028. This requires 56.2% yearly revenue growth and about an $79.6 million earnings increase from $424.4 million today.

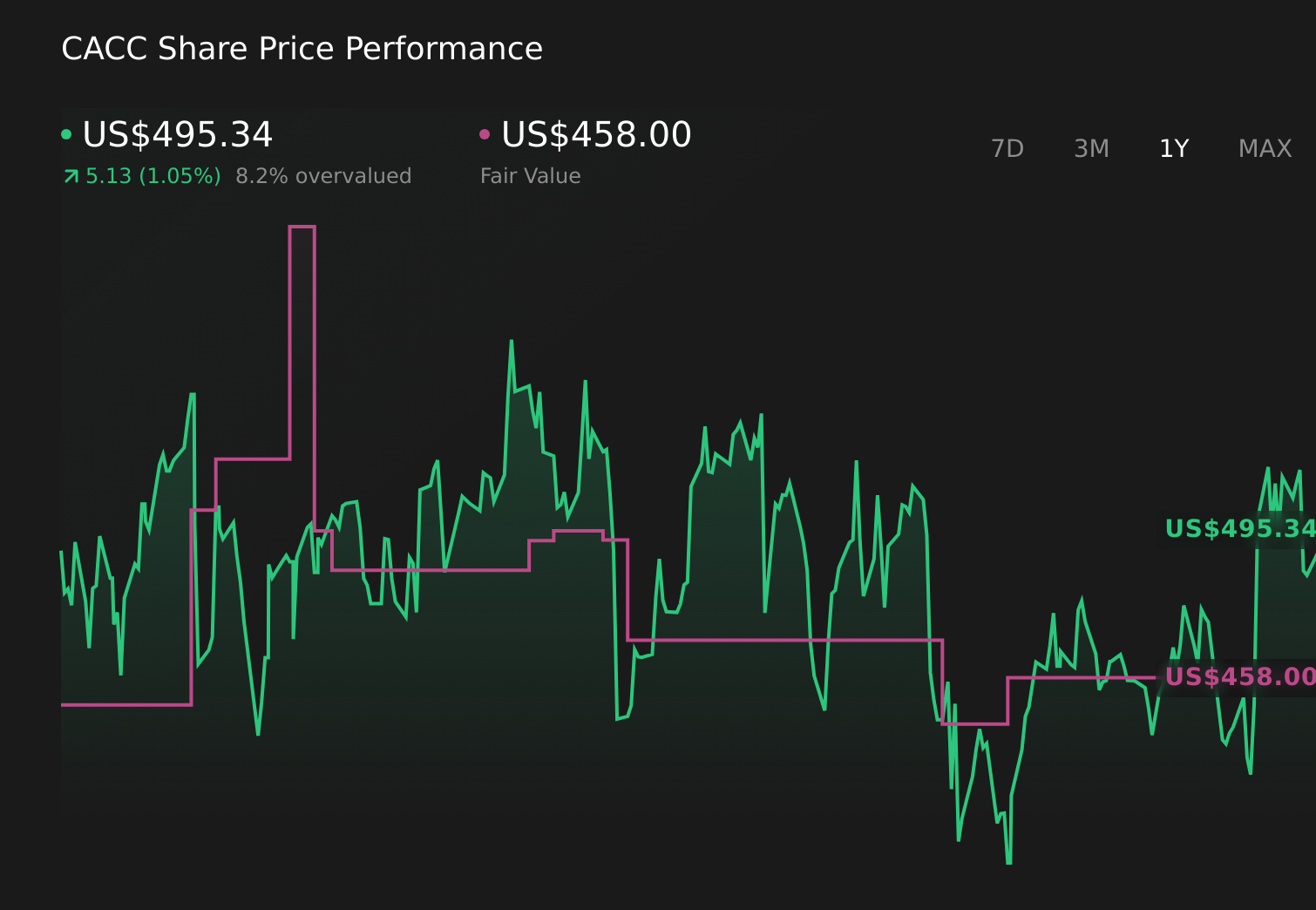

Uncover how Credit Acceptance's forecasts yield a $458.00 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Credit Acceptance cluster between US$311.83 and US$458, showing how far private views can sit apart from current pricing. Against that backdrop, the tension between resilient credit performance and ongoing regulatory and legal risk gives you a concrete reason to compare several different scenarios for the business before deciding how it might fit into your portfolio.

Explore 2 other fair value estimates on Credit Acceptance - why the stock might be worth as much as $458.00!

Form Your Own Verdict

Don't just follow the ticker - dig into the data and build a conviction that's truly your own.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The future of work is here. Discover the 33 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com