What Textron (TXT)'s New Buyback and Level D Simulator Milestone Means For Shareholders

- Textron Inc. announced in February 2026 that its Board authorized a new share repurchase program for up to 25,000,000 shares, with no expiration date, to offset dilution from stock-based compensation and for broader capital management uses.

- A Textron affiliate, TRU Simulation + Training, also secured FAA Level D certification for its Cessna Citation Ascend full flight simulator, underscoring the group’s push into higher-value aviation training solutions that can deepen its role across the aircraft lifecycle.

- We’ll now examine how FAA Level D certification for the Citation Ascend simulator could influence Textron’s broader investment narrative and future positioning.

The future of work is here. Discover the 33 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

Textron Investment Narrative Recap

To own Textron, you need to believe in its ability to grow earnings across aviation, defense, and industrial while keeping costs and mix under control. The most important near term catalyst remains execution in aviation and Bell, with improving operations and aftermarket demand. The new buyback authorization and Level D simulator milestone support the broader story, but do not fundamentally change the key risk around margins if product mix and Industrial volumes stay under pressure.

The fresh authorization to repurchase up to 25,000,000 shares fits into Textron’s existing pattern of buybacks, which has already reduced the share count meaningfully in recent years. For investors focused on catalysts, this matters mainly because it can amplify the effect of any improvement in earnings from programs like Denali, FLRAA, or aviation aftermarket growth, while also partly offsetting the impact if Industrial and aviation profitability remain uneven.

Yet, against these potential benefits, investors still need to watch closely for the risk that weaker Industrial demand and aviation mix could...

Read the full narrative on Textron (it's free!)

Textron's narrative projects $16.2 billion revenue and $1.1 billion earnings by 2028.

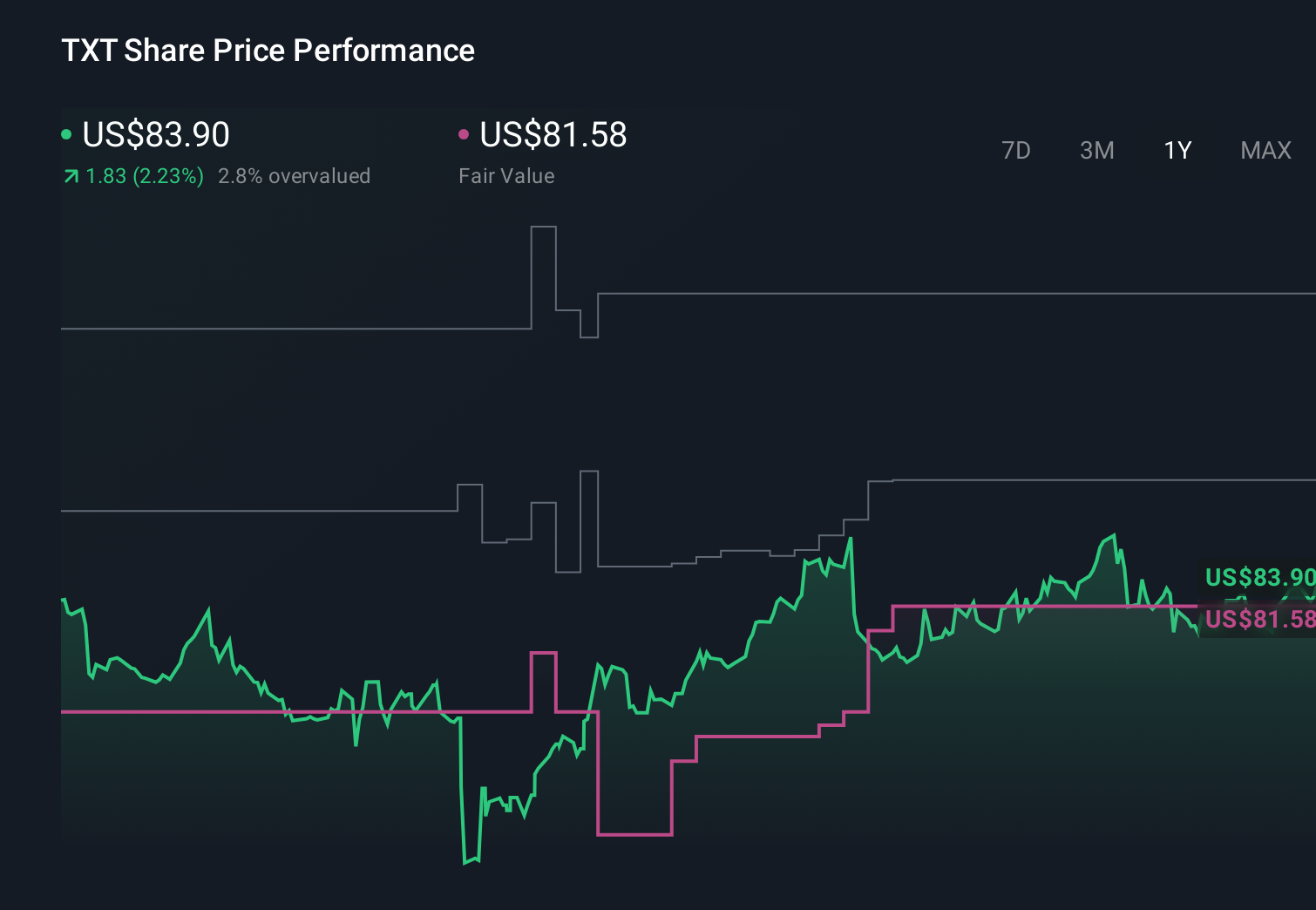

Uncover how Textron's forecasts yield a $98.41 fair value, in line with its current price.

Exploring Other Perspectives

Some of the lowest analysts see a tougher path than consensus, with revenue only reaching about US$14.7 billion and earnings around US$1.1 billion, so before this simulator news they were already assuming slower progress and more pressure from tariffs and production issues than the base case, which shows how differently you and other investors might judge Textron’s outlook once new information like this is taken into account.

Explore 5 other fair value estimates on Textron - why the stock might be worth as much as $98.41!

The Verdict Is Yours

Disagree with existing narratives? Extraordinary investment returns rarely come from following the herd, so go with your instincts.

- A great starting point for your Textron research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find 56 companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with 31 elite penny stocks that balance risk and reward.

- Invest in the nuclear renaissance through our list of 85 elite nuclear energy infrastructure plays powering the global AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com