Promising Penny Stocks To Consider In February 2026

As February begins, U.S. stock indexes have shown a strong start with the Dow Jones Industrial Average climbing by 515 points and the S&P 500 nearing a record high. While larger market trends capture headlines, investors often overlook smaller opportunities such as penny stocks, which despite their vintage name, continue to offer potential for significant returns when backed by solid financials. This article explores three promising penny stocks that combine balance sheet strength with potential growth prospects, providing investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.85 | $606.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.77 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $2.99 | $504.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.97 | $56.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Information Services Group (III) | $3.11 | $219.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Niagen Bioscience (NAGE) | $5.00 | $421.27M | ✅ 4 ⚠️ 0 View Analysis > |

| Nephros (NEPH) | $3.77 | $42.51M | ✅ 3 ⚠️ 2 View Analysis > |

| LifeVantage (LFVN) | $4.93 | $63.2M | ✅ 4 ⚠️ 4 View Analysis > |

| Lifetime Brands (LCUT) | $3.42 | $74.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Marine Petroleum Trust (MARP.S) | $4.84 | $8.84M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 346 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Commerce.com (CMRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Commerce.com, Inc. provides a software-as-a-service e-commerce platform for brands and retailers across multiple regions globally, with a market cap of $236.48 million.

Operations: The company generates $342.35 million in revenue from its Internet Information Providers segment.

Market Cap: $236.48M

Commerce.com, Inc., with a market cap of US$236.48 million, faces challenges typical of penny stocks despite generating US$342.35 million in revenue from its e-commerce platform. The company remains unprofitable but has reduced losses by 19% annually over five years and maintains a positive cash flow with a runway exceeding three years. Recent strategic partnerships, such as the expanded integration with Stripe and endorsement of Google's Universal Commerce Protocol, aim to enhance merchant offerings and global reach. However, high debt levels (net debt to equity at 40.5%) pose financial risks amidst stable weekly volatility and experienced management oversight.

- Click here and access our complete financial health analysis report to understand the dynamics of Commerce.com.

- Gain insights into Commerce.com's outlook and expected performance with our report on the company's earnings estimates.

Here Group (HERE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Here Group Limited designs and sells pop toys in China, with a market cap of $220.26 million.

Operations: The company's revenue segment consists of CN¥2.04 billion generated from the PRC market.

Market Cap: $220.26M

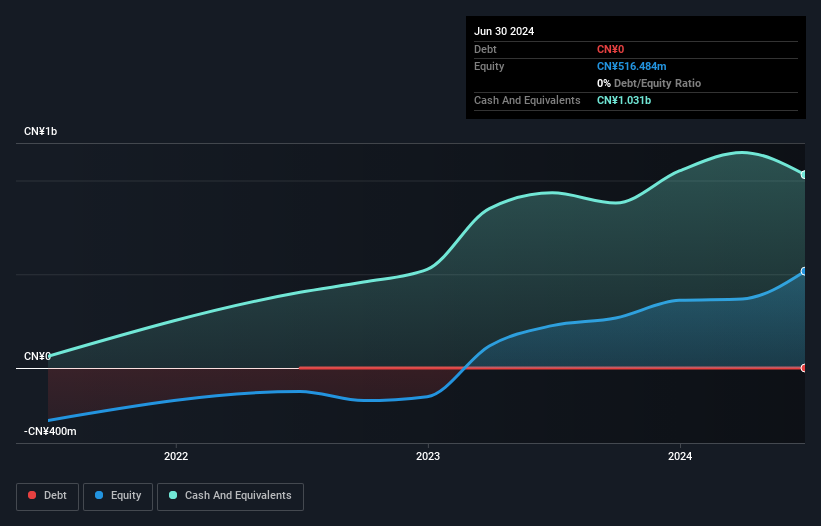

Here Group, with a market cap of $220.26 million, operates in the pop toy market in China, generating CN¥2.04 billion in revenue. Despite recent negative earnings growth and a significant one-off gain impacting results, the company shows financial resilience with its net profit margin improving to 12.3% from last year's 10.7%. The debt is well covered by operating cash flow and it maintains more cash than total debt, ensuring short-term assets exceed liabilities significantly. Trading at 69.6% below estimated fair value and supported by an experienced management team, Here Group projects revenues between RMB 750 million to RMB 800 million for fiscal 2026 amidst declining earnings forecasts over the next three years.

- Click here to discover the nuances of Here Group with our detailed analytical financial health report.

- Gain insights into Here Group's future direction by reviewing our growth report.

loanDepot (LDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans, with a market cap of approximately $683.54 million.

Operations: The company's revenue is primarily generated from the originating, financing, and selling of mortgage loans, amounting to $1.10 billion.

Market Cap: $683.54M

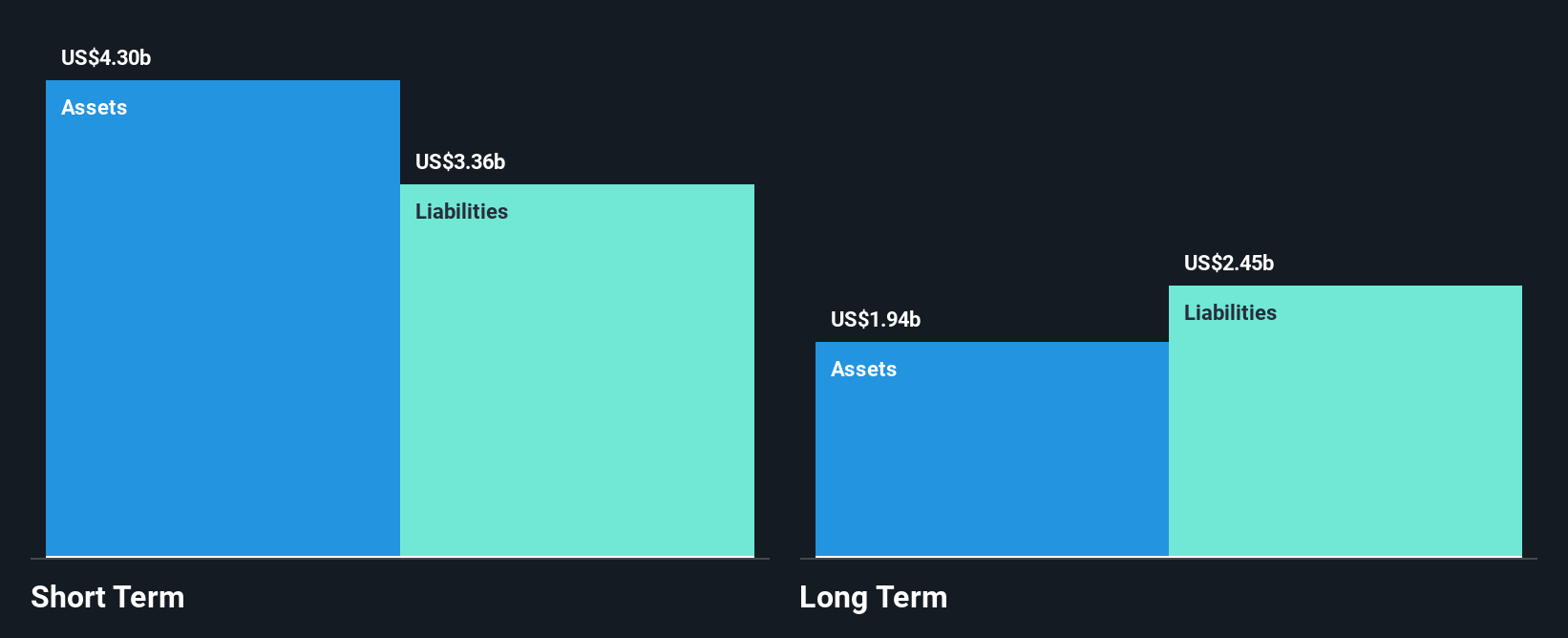

loanDepot, Inc., with a market cap of US$683.54 million, operates in the residential mortgage sector. Despite being unprofitable and facing increased debt levels over five years, it maintains a strong cash position with short-term assets of US$4.3 billion exceeding both short and long-term liabilities. The company is trading at good value compared to peers and has not experienced significant insider selling recently. While its share price is highly volatile, loanDepot benefits from an experienced management team and board, alongside a positive free cash flow that provides a runway for over three years despite ongoing losses.

- Get an in-depth perspective on loanDepot's performance by reading our balance sheet health report here.

- Examine loanDepot's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Click here to access our complete index of 346 US Penny Stocks.

- Interested In Other Possibilities? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com